Are you struggling to find a trading system that fits your trading style?

Maybe you have tried many strategies… only to lose money on them?

It’s the struggle of new traders and a theme I hear all the time from everyone I speak with.

But it doesn’t have to be that way!

You see… I created Options Profit Planner as a way to trade the stock market in a way that made sense for my busy schedule

Now let me show you how I combine technical and fundamental research in order to find the best trades.

Options Profit Planner

It’s really surprising how many traders overlook the fundamentals of a stock when placing their trades.

Their rationale is that price action dictates how they trade. And that might be true for a stock trader…

But what if you are selling naked puts and then you are assigned on a stock that you end up having to hold for 5 years in order to make a decent ROI?

Wouldn’t you want to make sure your money is safe and you are owning a high quality stock?

I know I would…

So, what do I do?

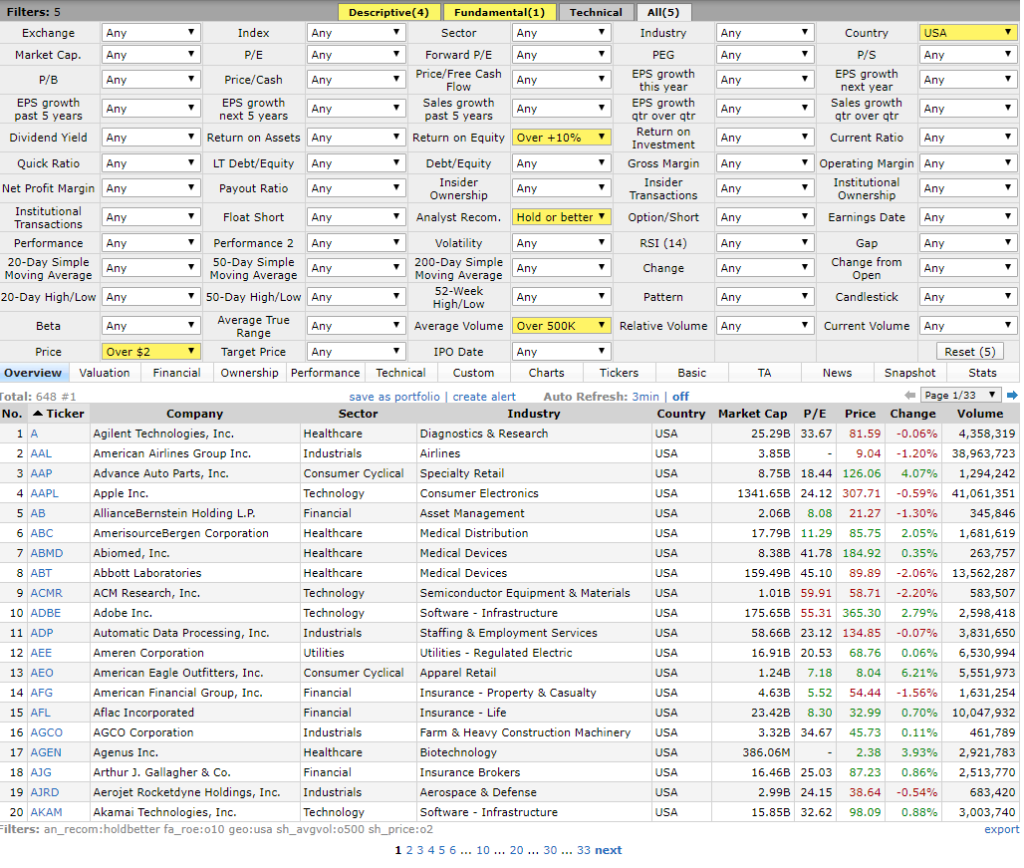

I use a fundamental filter to narrow down the list of stocks to trade on. As an example here are just a few of the many criteria I look for in stock before taking a position.

Example criteria for a high quality stock:

- Us-Based only

- Volume > 500k

- ROE > 10%

- Over $2

- All positive analyst reviews (hold or better)

Source: FinViz

Here is an example of the screener that I use, and right away we were able to narrow down the list of stock from 10k down to about 600 just from these simple criteria.

And the more you add, the further this gets narrowed down and could eventually give you the exact trade you could place.

Now that we have the fundamentals covered, let’s take a look at the price action and technical patterns to filter down the list of stocks to a single trade.

Next…

Technicals

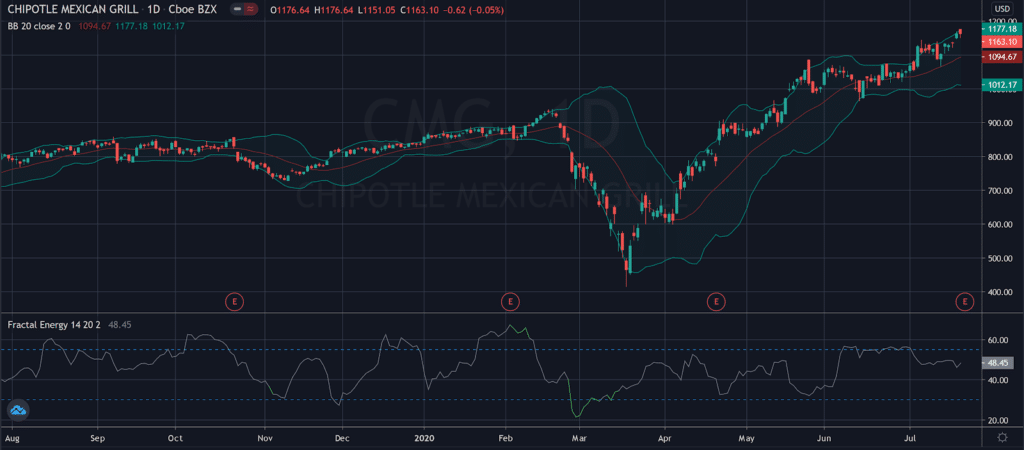

The technicals of Options Profit Planner are based around two critical indicators, the Fractal Energy and Bollinger Bands.

Let’s dive in and take a look at each of these indicators and how they help to navigate the markets.

What are Bollinger Bands

Bollinger Bands were developed by John Bollinger as a price envelope designed to define the upper and lower price range levels of a stock.

Bollinger Band Indicator consists of a middle Simple Moving Average (SMA) along with an upper and lower offset band.

Because the distance between the bands is based on statistics, such as a standard deviation, they adjust to volatility swings in the underlying price.

How do you read them?

Bollinger Bands help to determine whether prices are high or low on a relative basis, and according to these calculations, price should fall within range 95% of the time!

Let’s take a look at an example chart:

Source: Tradingview

You may have noticed right away that price tends to fall inside the Bollinger Band nearly every single trading day with very few actually making it outside the two bands.

And if the price did trade outside of the bands, the stock made sure to rebound quickly to get back inside of it.

How this indicator works:

- When Bollinger Bands tighten, there is a high likelihood that price will have a sharp move

- When the bands separate by an unusually large amount, this is showing a significant increase in volatility or a gap in stock price.

- The stock price can exceed and even hug or ride the band price for extended periods of time.

- Price has the tendency to bounce within the bands’ envelope, touching one band and moving back towards the other.

- You can use the middle SMA or opposite band as target prices and exits for your trading

- If prices move outside of the band, it’s expected to see a trend continuation until the price moves back inside the band.

What Is Fractal Energy

Fractal Energy is the cornerstone indicator of Options Profit Planner and its power is used to pinpoint key market reversals.

The power of fractals allows me to determine the strength of trends and how much “life” is remaining in a stock’s movement.

There are 2 main components of Fractal Energy:

- Fractal Pattern

- Energy

And when you use the power of this indicator you will be able to successfully determine the strength or weakness of trends on any stock.

Let’s take a look at how this works…

Credit Strategy

In order to generate steady income for my business, I make sure that I focus on becoming the casino instead of the gambler.

This means that I am looking at taking short options positions instead of long trades.

Why?

Because most options expire worthless and this behaviour makes selling options work like running an insurance company.

Since options are risk insurance for option buyers, the option seller holds the responsibility of the “insurance provider”.

And for this risk the option seller will charge a premium (the credit on the option) for this risk that they collect up front when they sell those options.

3 of my favorite strategies are:

- Naked Put

- Credit Put Spread

- Credit Call Spread

So let’s take a look at each and see how they are trading strategies that can generate income as the casino instead of spending money like the gambler.

Naked Puts

The Naked Put Strategy is a go to strategy for many options sellers since it has the advantage of owning a stock if the trade goes bad.

What is a Naked Put?

A naked put, or short put, is typically traded when a trader assumes that the underlying security will rise between the time of execution and the expiration date of the option.

The trader will execute this strategy by selling a put option with no corresponding short position in their account.

Since there is no additional position, this is considered an uncovered trade, meaning that the trader would be required to own stock if the buyer should exercise their right to the option the seller is holding.

A put option is designed to create a profit for a trader who correctly forecasts the price of the security will fall substantially, past the breakeven!

But as a put seller, you actually collect revenue on this trade if the option rises, falls, or goes sideways.

Takeaways:

- A naked put is an option strategy that involves selling put options.

- When put options are sold, the seller benefits as the underlying security goes up, down, or sideways in price.

- Naked refers to an uncovered position, meaning one that has no underlying security associated with it.

- The risk of a naked put position is that if the price of the underlying security falls, then the option seller may have to buy the stock away from the put-option buyer.

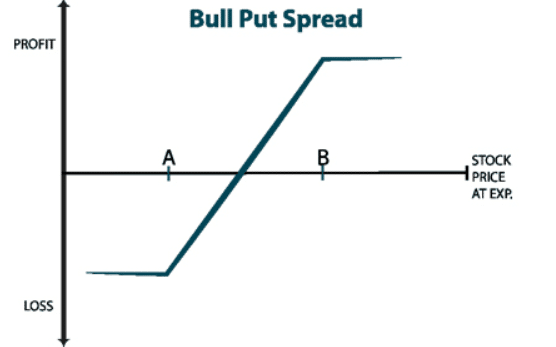

Credit Put Spread

A credit put spread is a type of credit option strategy that is used when a trader expects an increase in the value of an asset.

The credit put spread is equivalent to going long the stock, except there is no unlimited risk potential.

The credit put spread is placed by simultaneously purchasing a put option at a higher strike price and selling a put option at a lower strike price in the same expiration month.

This is considered a limited-risk trade since the selling of the put option is covered by the purchasing of a lower-strike put option.

Risk parameters of a Credit Call Spread are:

- Max Gains : Net premium received

- Max Loss : High strike – Low strike – Net premium received

- Breakeven : short put strike – net credit received

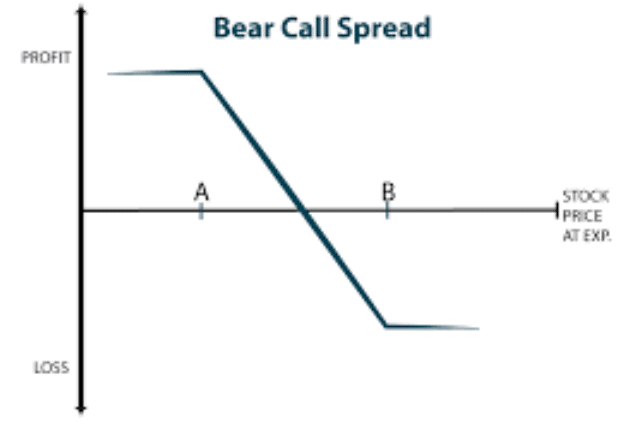

Credit Call Spread

A credit call spread is a type of credit option strategy that is used when a trader expects a decrease in the value of an asset.

The credit call spread is equivalent to going short the stock, except there is no unlimited risk potential.

The credit call spread is placed by simultaneously purchasing a call option at a higher strike price and selling a call option at a lower strike price in the same expiration month.

This is considered a limited-risk trade since the selling of the call option is covered by the purchasing of a higher-strike call option.

Risk parameters of a Credit Call Spread are:

- Max Gains : Net premium received

- Max Loss : High strike – Low strike – Net premium received

- Breakeven : short call strike + net credit received

Wrapping up

To summarize, premium selling is known to generate a wildly profitable and extremely smooth equity curve.

- There is the risk of an occasional large loss, but this is mitigated with the use of credit spreads instead of naked options.

- The return of a premium selling options book is that of a mean reversion stock trading system, with a large number of small wins with the occasional ‘fat tail’ trade.

- Selling Naked Puts is one of my favorite strategies since it allows me to purchase stocks at a discount and get paid doing so!

Want more proof that selling options is the one way to put positions in a position to gain?

Then check out this exclusive training workshop I put together.

You’ll learn the options strategy I use to generate cash flow.

0 Comments