There are not many traders out there who have stable returns…

You see, most stock traders actually have “fat tail” returns

What this means is that traders hit big winners and take big losers…

I’ve never really understood how someone can pay the bills with inconsistent returns like that

This is a strategy that I’ve nearly perfected.

I’ve been landing win after win, and not having any loser*

Not too shabby if you ask me, since I just started offering to teach traders my strategy this year!

And I’ve recently took off yet another trade with nearly 100% returns*

Want to learn more?

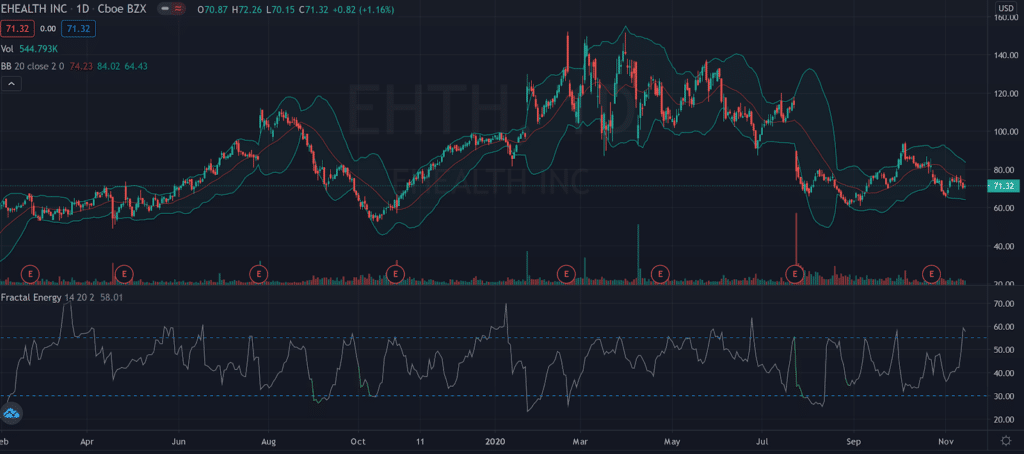

Fractal Energy And Credit Spreads

Fractal Energy and Credit Spreads is the cornerstone of Energy Trader

And I use this combo of indicators to land me win after win each week*

You see, I’ve been able to identify what the internals of a stock is doing and how it’s going to move in the near term

So even though this chart doesn’t make much sense, but it’s what gives me the upper hand when it comes to trading credit spreads

What I see from looking at this chart is nothing short of dollar signs.

But let me break it down further:

- The stock is trading near a major support level, I don’t see it getting below $50

- The Fractal Energy is saying the stock is exhausted and the fractals are charting up slowly

- Stock is trading at the lower Bollinger Band, as more supporting evidence of the price not falling

- The options market let me trade sub $40 strike options

So what did I do?

My members received this alert when I sold that spread:

EHTH: I sold the Jan ’21 $40/35 put spread for $.90. EHTH finished the week at $88.65.

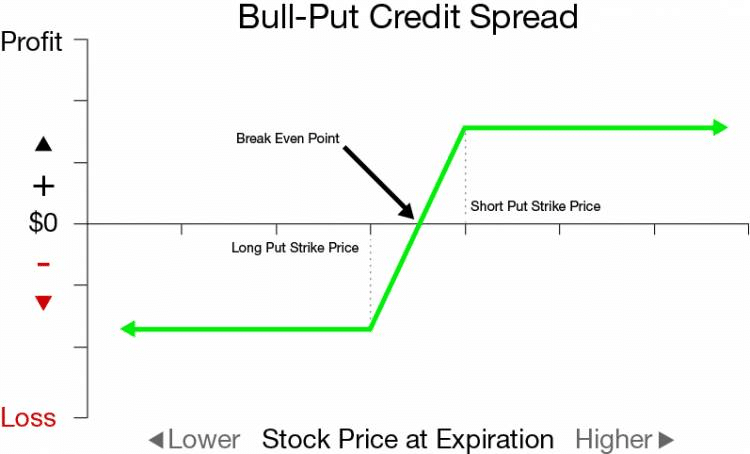

Not sure what a credit put spread is?

This is a sample payout diagram of how this strategy works and how I profit on this trade

[Want to learn more? Stay tuned for my strategy corner, where I break down this strategy in further detail]

But for option traders – sideways is a direction that turns credit spreads into a profitable trade

So as time progressed, and the stock actually dropped a little bit as well, my profits continued to click higher!

And now that time has passed, these options will be expiring worthless…

Meaning, I get to keep 100% of my profits on this trade!

And I’ve been doing this on stocks all week long, locking in great returns trade after trade

Now, what stocks are these?

Keep an eye out for the weekly watchlist coming soon, and if you want actionable trade alerts, be sure to sign up to Options Profit Planner now!

Only members will get the trade alert when I actually place the trade.

You don’t want to miss out on this unique trading strategy

*Results presented are not typical and may vary from person to person. Please see our full disclaimer here: ragingbull.com/disclaimer

0 Comments