My favorite options strategy is built on generating cash flow.

And if I can collect income…and define my risk…

Well…that’s what I call a sound business.

It’s like the insurance business…profitable but not exactly sexy.

Sure, you might argue that I will never have a 1000% winner, or…

To coin the late Ace Hood, “wake up in a new Bugatti” will probably not be in my future anytime soon.

But that’s ok!

I am more than happy to take the slow road to profits instead of the roller-coaster that many traders face each day.

And one way that I do this is by trading credit spreads and generating income from my options positions instead of spending money on bets.

So let me show you one strategy which I apply to generate returns of 100% in as little as a few days to weeks!

Options Profit Planner

It’s all in the name – I like to plan for profits using the options markets!

And that doesn’t mean going around and buying lotto tickets on random stock.

Instead, I take the slow and steady wins the race approach to my investing and trading strategy. Focusing on quality stocks that I feel comfortable holding for the longer term if things don’t work out as I plan.

And when trading an option selling strategy, this can always be a possibility, especially when I am dealing with Naked Puts.

So let’s go a little more in depth with

- How this strategy works

- Why I choose to trade Naked Puts and not Naked Calls

- How to offset the loss of being assigned stock with selling Covered Calls

What Are Options

Options are a financial instrument that gives investors the right, but not the obligation to purchase a security, at a specific price and date in the future.

And for this right the investor will pay a cost, or premium, at which the seller feels is a fair value to exchange these contracts.

Now let’s take a look at price obligations…

Price Obligations

An obligation on selling put options is if the price falls below your strike, you will be required to own that stock (at the strike price), as the sample trade above.

Let’s take a look at a quick example…

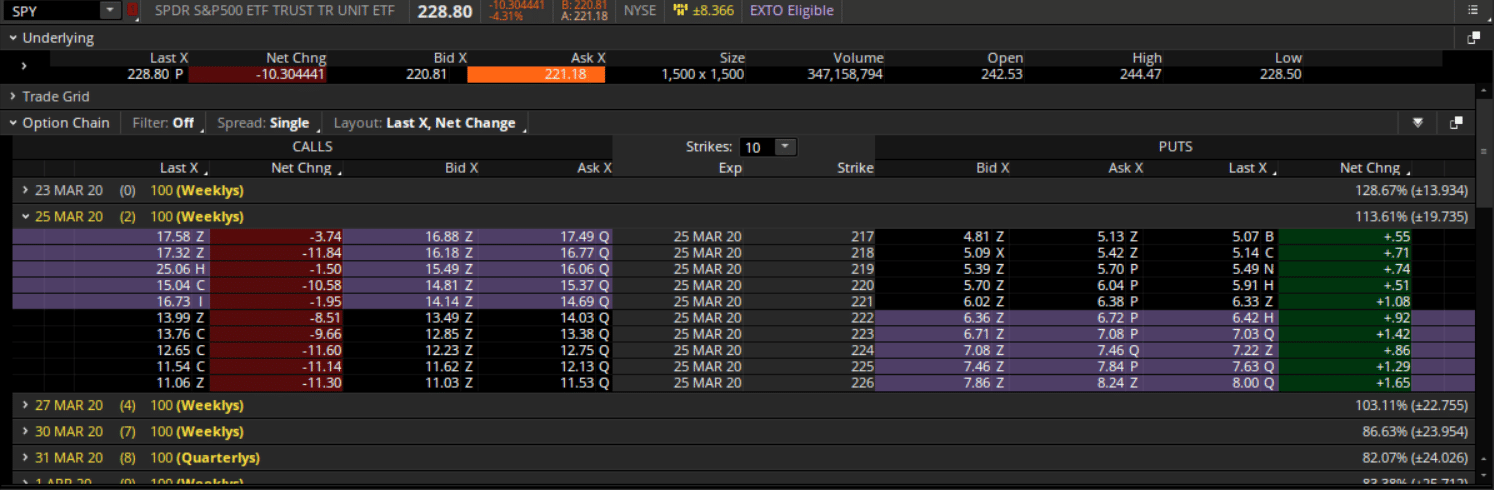

Source: Thinkorswim

Each option contract has an associated strike price at which buyers and sellers agree upon buying and selling stocks.

The value of the contract is what the markets are pricing the options at and are subject to change based on the supply and demand on that stock or option contract.

Options Expiration

Every option has a time and price associated with them and adjusts in price based on a number of underlying factors.

One of the factors is time decay, and it is based on how much time is left on the options. Typically, the value of a weekly call option is cheaper than that of a monthly all option.

For example, a weekly option that is expiring on Friday of this week has 5 days of time value added to the options price.

Theta is the value of time in the options contract, and the longer the amount of time, the more time value an option will have.

The Strategy

Let’s assume that the trade we are about to take is a Short Put on AAL that expires next month.

In general, we know that the 52-week lows tend to be extremely strong areas of support for a stock.

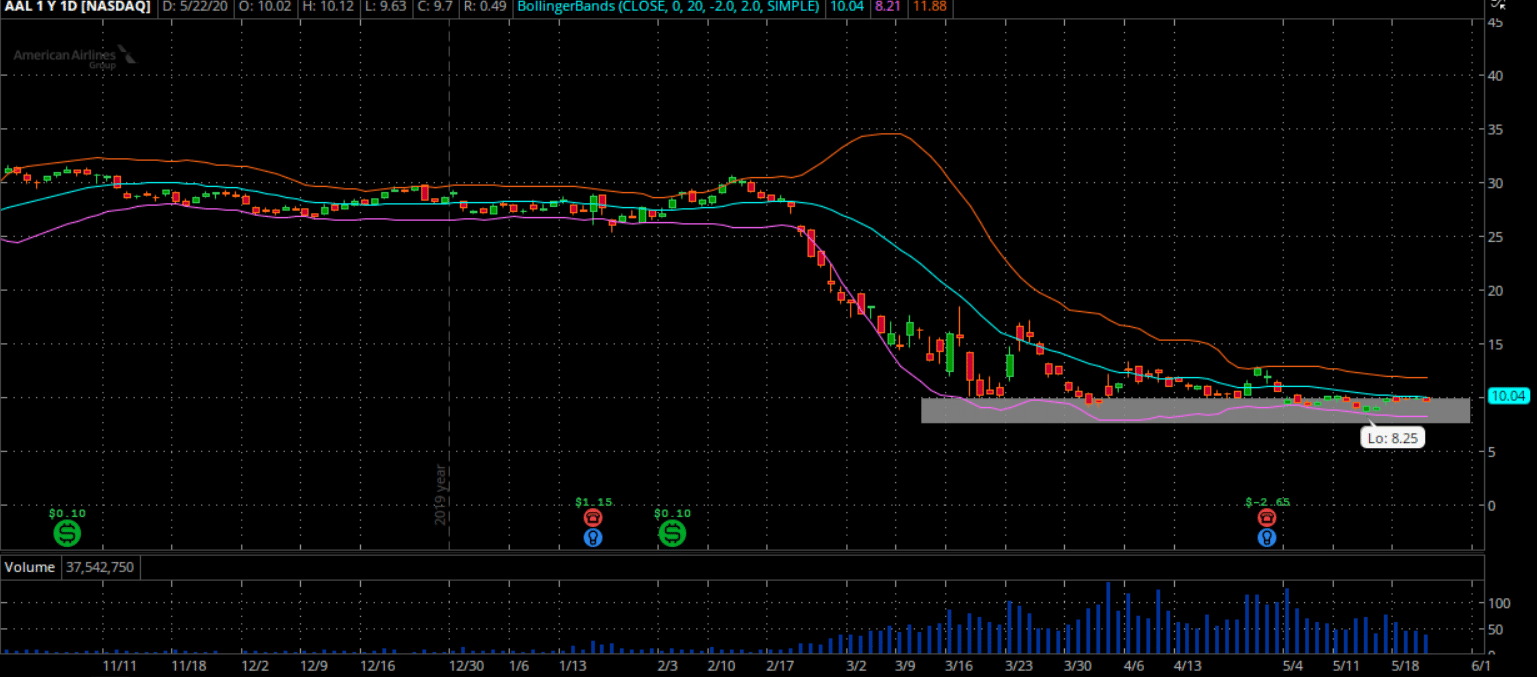

Source: Thinkorswim

And looking at AAL, it appears to be acting in the same way.

The stock had experienced an aggressive selloff from the CoronaVirus and has found a bottom somewhere around the $8-$10 range.

So it seems like it would be ok to sell an expensive put option far out of the money (OTM) at $3 for two reasons.

- Its extremely overpriced due to market fears

- I wouldn’t mind owning stock for a lifetime at $3 / share on a popular airline company.

The Trade

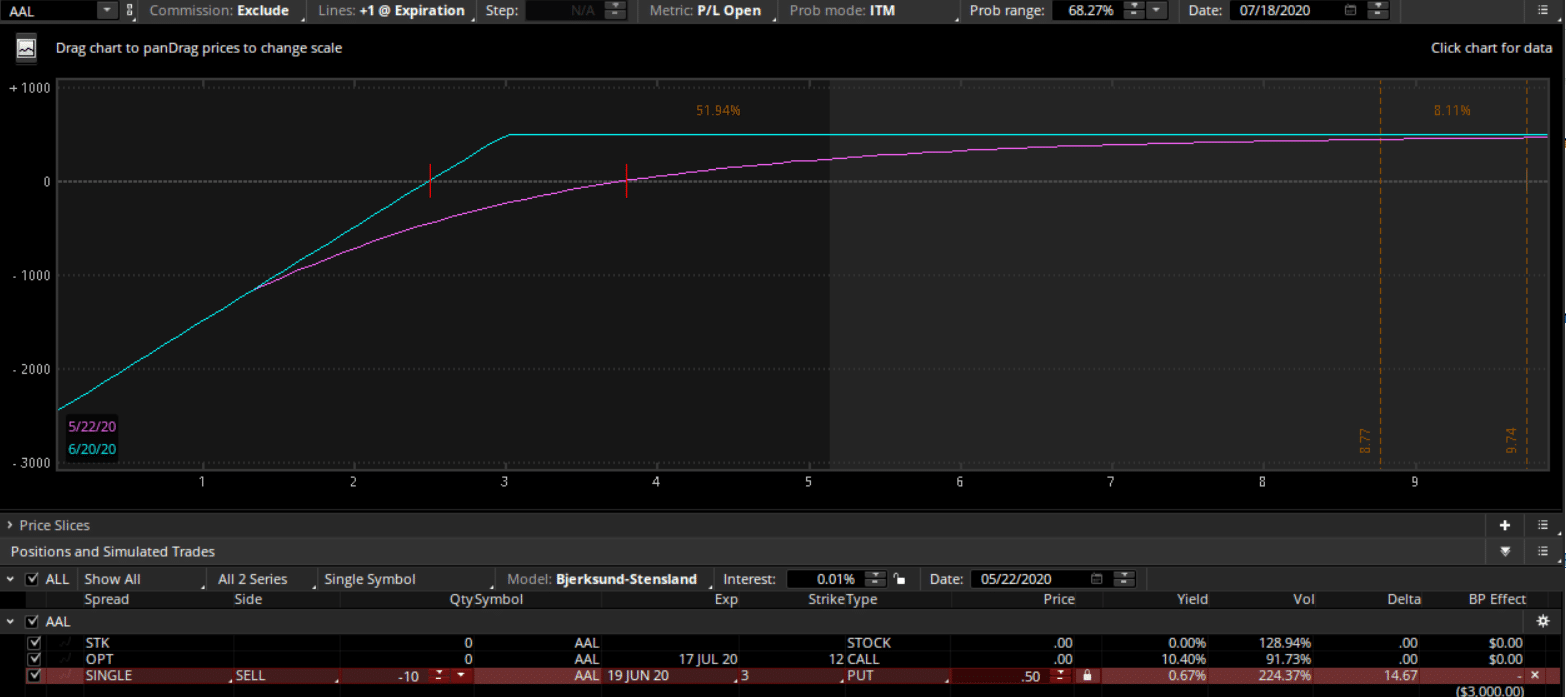

And this is the trade that I could place on AAL when it was trading near its lows.

Source: Thinkorswim

- AAL: I sold the July ’20 $3 put for $.50

And this option is currently trading around $0.03 per contract.

Meaning… in just a few more days I will be able to capitalize on a 100% gain on this trade!

It’s that simple of a trade! By only using 1 option I am able to place a great position on AAL and return 100% of my capital in a few short weeks!

This trade is aiming to capitalize on the extended markets along with the increase of implied volatility in the markets when trading near its lows.

But I am sure you are asking… why would I want to sell puts that far out of the money?

Well because I feel confident that if AAL was to get down to that price I would like to own the stock.

And by selling puts you can get paid upfront for telling the markets you would like to own stock at that price.

What do I want to happen?

- The market to rally

- The market to continue to sell off and I get to own AAL at a great price

Wrapping up

So here is a quick breakdown of the pros and cons of trading Naked Puts that should give you a better indication of what an options selling strategy can do for you!

Pros:

- Huge returns of 75% to 100%

- House odds in your favor of over 60%

- Ability to purchase stock at a significant discount

- Can win in a up, down, or sideways market

Cons:

- Limited upside gains

0 Comments