Many option traders are just taking bets on volatility when they are buying calls and puts.

It’s a common mistake that many traders make when buying options for directional trading, but these strategies just get eaten alive by time decay, or theta and implied volatility. [The two main pricing components of an option].

There are four of the best options income generating strategies that I use, designed to take advantage of these pitfalls

Are you tired of losing money while stocks go sideways?

These strategies are designed to generate profits even in sideways markets.

If correctly used, any of these four option income strategies can provide your trading portfolio with high probability trades almost every time.

And it’s one of my favorite strategies for high volatility market environments like we are in now…

Credit Strategies

A credit spread option is when a trader takes two or more options and together, sells the total premium they produce to generate income.

Now I know this may sound confusing, but let me explain the concept of how to write an options contract.

Instead of buying puts or calls, you will actually want to trade 2 more more contracts for a net credit.

So, if you were to take a bullish bet on the markets, you could either buy a call, or sell a put spread.

A credit spread involves selling a high-premium option while purchasing a low-premium option in the same stock and option type.

What are my four favorite credit trading strategies?

Favorite short credit strategies:

- Covered Calls

- Credit Spreads

- Iron Condors Spreads

- Credit Puts

Let’s take a look at how each one of these can generate you different types of returns on your trades.

Credit Spreads

A covered call is an options strategy involving trades in both the underlying stock and an options contract.

The trader buys or owns the underlying stock or asset.

They will then sell call options (the right to purchase the underlying asset, or shares of it) and then wait for the options contract to be exercised or to expire.

For a covered call, the call that is sold is typically out of the money (OTM), when an option’s strike price is higher than the market price of the underlying asset.

This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option.

How to create a Covered Call:

- Purchase stock in lots of 100

- Sell 1 OTM option contract for every 100 shares owned

- Wait for call to expire worthless

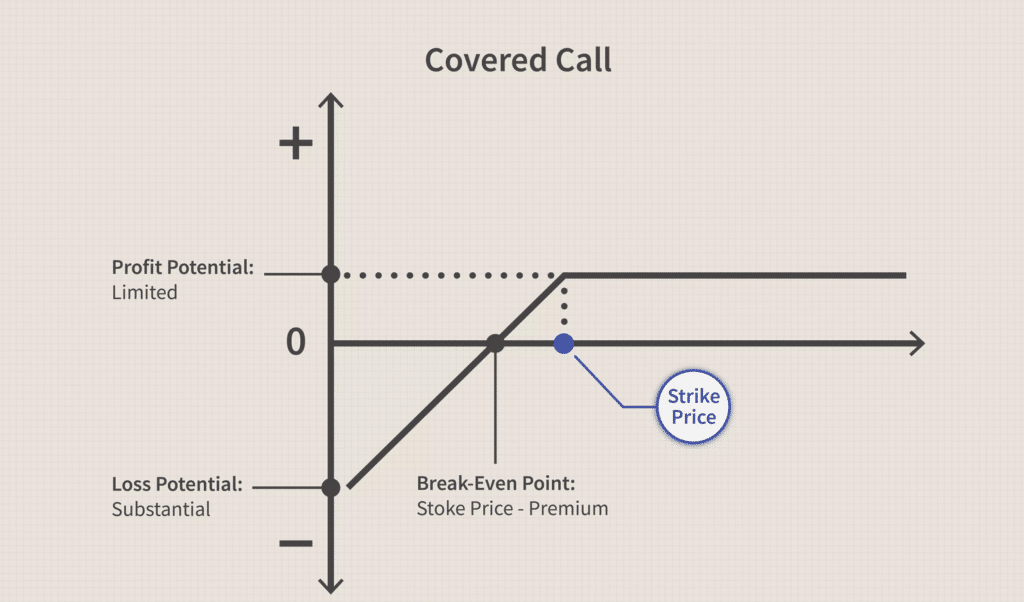

Here is a sample risk profile of this trade

As you can see, by selling an OTM option, you are actually able to generate income on your trade if you are expecting a stock to stay in a range over the life of the option.

And this strategy looks a lot like a credit put strategy many traders use.

But what if you don’t like the idea that you could have a substantial possible loss if the stock dropped?

Well, that’s where a Credit spread strategy would come into action.

The Credit Spread Strategy

Let’s take for example, you wanted to go long the markets and use put credit spreads, you would want to sell a higher premium put contract, and buy a lower premium put contract for protection to the downside.

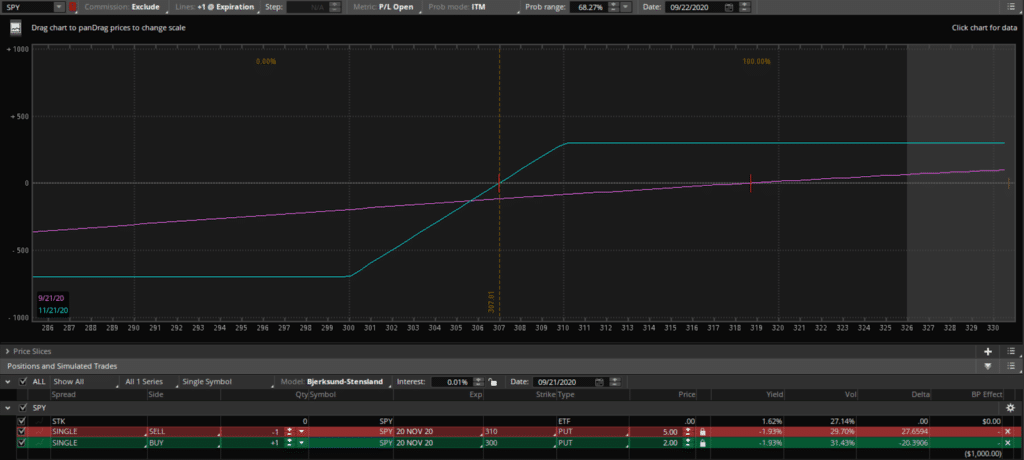

And in order to do this with the SPY trading at $330, you would need to sell a $310 put at $5.00 and buy a lower $300 put at $2.00

In other words:

Sell : SPY 20 Nov 20 $310 Put @ $5.00

Buy : SPY 20 Nov 20 $300 Put @ $2.00

Simultaneously, I am buying an out of the money (OTM) put option and writing (selling) an OTM put option with a higher strike. Since the higher strike is closer to being in the money (ITM) it sells for more money. Combining these trades I collect a credit of 3.00 (or $300). The option I am selling would bring in a credit of $500 but I have to use the credit to pay the $200 for the second option.

Since you are simultaneously buying and selling two Out of the Money (OTM) contracts, this might sound strange at first.

Take a look at the risk profile of this trade.

Source: Thinkorswim

The risk parameters of this trade are

Max Profit : $300

Max Loss : $700

Breakeven : $307

The graph above does a good job of visualizing the trade. The x-axis is the price of the SPY on expiration. The y-axis is the profit based on the possible outcomes of the final SPY price.

As a reminder, option pricing is the price of one share, but every contract is quoted in a multiple of 100 shares. So when the price of the option says $3.00, it means that you will actually collect $300 per single trade.

Wrapping Up

Now, do you see the power of trading a credit spread instead of a debit spread?

I hope so!

There are many benefits of trading this type of strategy, like the ability to generate steady income, trading with the odds like a casino in your favor, and making money if the markets go up, down, or sideways.

Personally, I find this strategy so liberating and stress-free to not have to constantly worry about the direction of the markets every time I want to trade.

And when trading credit spreads, you often can build a strategy where you can only lose in the case of a drastic or extremely large move in the underlying stock price.

So, are you ready to take the leap and start generating a second income for yourself in as little as 1 month?

0 Comments