One thing that excites me the most about selling options is being able to generate income on demand

Yes trader, you heard me right.

On. Demand. Paid upfront!

This means… If I want to make money, I simply need to execute another credit spread.

Now, I don’t want to blindly sell every stock I see of a watchlist – that’s just nuts!

But I do want to sell as many of my A+ setups as possible

You see, unlike spending money on options, credit spreads allow me to generate income by taking advantage of two options pricing calculation

Theta and Vega, or the time decay of an option and volatility of a stock

And the juicer the options, the more money I can make in the same amount of timeSo, this week, I’m on the hunt to find some of my favorite setups in hopes to take advantage of a shorter trading week and land me some faster paydays.

Energy Trader – Watchlist

Traders, when it comes to finding stocks… you just need to stop looking at the same 5 stocks on repeat.

Sure, there’s a slight advantage to knowing the stocks that you love to trade…

But more often than not you are actually doing yourself a disservice by holding out on what the rest of the market can offer

And one way that I find stocks to trade outside of my usual grab bag assortment, is my utilizing my Fractal Energy Scanner to help me narrow down my ideas.

And two scanners I typically use are geared towards finding exactly what I want to see

I scan and search for

- The perfect fractal energy setup (Thinkorswim)

- Stocks that are of high value for a long-term investment (Finviz)

You see, I don’t necessarily use each scanner for every trade, but these tools help to give me confidence in my decision and why I chose a stock to trade.

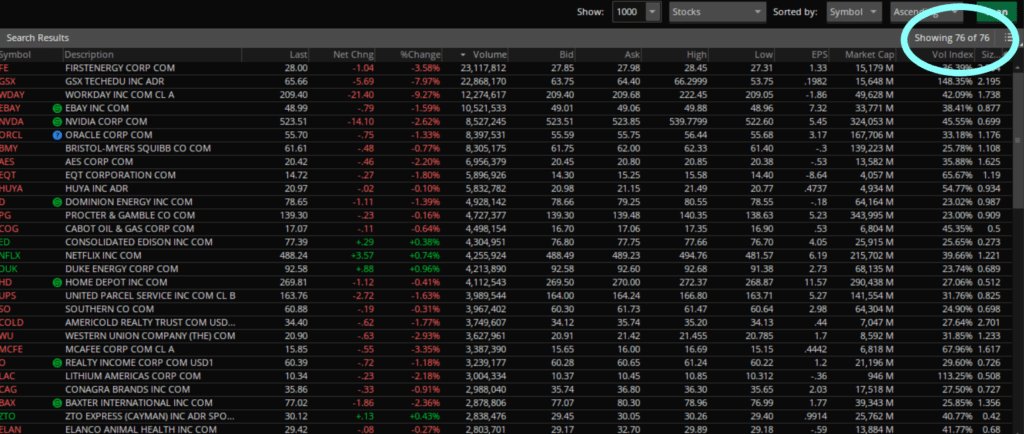

Check this out… by using a scanner, instead of scanning almost 30K …. Or THIRTY THOUSAND stocks…

A scanner gives me the ability to only focus on only the “best of the best” and look at a stock universe of no more than 100 names on average.

In this case, I am only looking at 76 names that are setting up for my A+ setup next week

Now I don’t want to take every one of them, but instead get together a list of the “best of the best” to trade on

Here’s what I found for the week ahead…

DUKE ENERGY (NYSE: DUK)

Fundamental review:

- Duke Energy (NYSE:DUK) owns and operates a utility infrastructure with 7.7 million retail energy customers and 1.6 million natural gas customers in six states.

- DUK outperformed the S&P 500 meaningfully in the 2008-09 Great Recession.

- One thing to keep in mind is how DUK will be impacted from the change in presidency, as a focus is going to be placed on green energy and companies that provide clean alternatives to gas and oil.

Technical review:

- Recently had earnings on 11/5, which appear to have somewhat mixed impact on the stock. DUK missed earnings, but it appears the stock has traded sideways from this announcement.

- Technically, DUK is sitting on a strong level of support that stretches as far back as Feb 2020

- I am looking an old traders saying, Past resistance = future support to hold true

- DUK is currently holding its technical level from the Bollinger Bands, acting as support since Nov 2

- Fractal Energy is holding steady at 52.74

- FE supports there is a lot of energy building in DUK, and a breakout in either direction could come as soon as this week

Source:Thinkorswim

HOME DEPOT (NYSE: HD)

Fundamental review:

- Consumers’ appetite for home improvement continued in the third quarter, as they spent money on an aspect of life that’s brought comfort during the pandemic: their homes.

- Home Depot and Lowe’s customers have taken on DIY projects and paid for home renovations, such as converting garages into home offices and gyms and sprucing up the yard to make it a relaxing escape during a challenging year.

- Both retailers saw a noticeable bump in sales and a shift online in the third quarter.

Technical review:

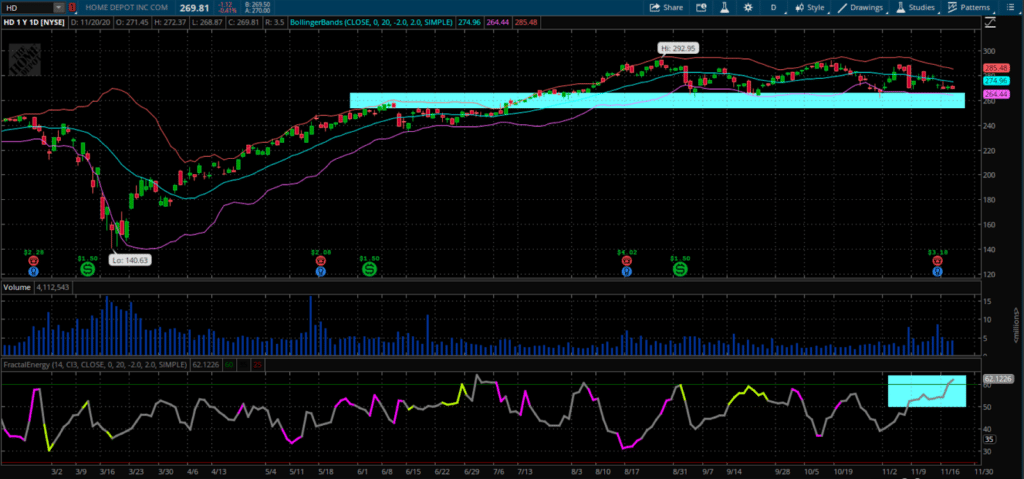

- Home Depot is in a strong uptrend, since the stimulus package was announced in March 2020

- Currently, HD is sitting on multi-month support

- Past resistance = future support is holding true, as HD has been holding onto the $260 / share level since August 2020

- HD has held its technical support level, the lower Bollinger Band, the prior 3 times it traded at it

- Fractals are screaming higher, with a value of 62.12 reported, the second strongest all year, with the highest value recorded at 64.12 on 7/6, where the stock ran nearly 20% higher afterwards

Source: Thinkorswim

STITCH FIX (NASDAQ: SFIX)

Fundamental review:

- Stitch Fix is an online apparel company

- It uses recommendation algorithms and data science to personalize clothing items based on size, budget and style.

- Stitch Fix generated more than $1 billion in sales during 2018 and reported 3.4 million customers in June 2020.

- As the pandemic continues, customers are still setting sales records for online purchases, even though malls and stores are starting to re-open

Technical review:

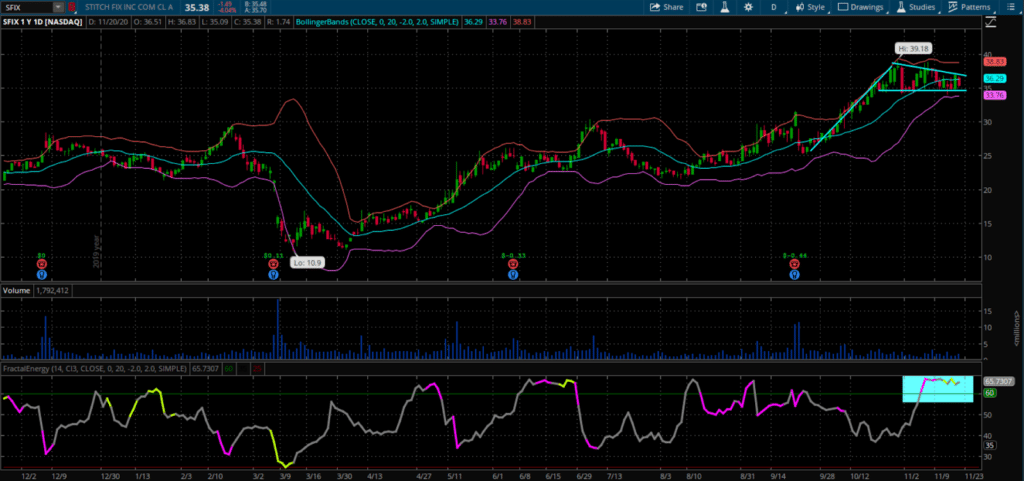

- SFIX is forming a Bullish Pennant near all-time highs

- Stitch Fix is trading into the lower Bollinger Band, which can act as a technical level of support for a stock

- Fractal Energy is charged near all time highs.

- Previous four largest FE charges resulted in a 50%, 30%, 35%, and 50% respectively

Source: Thinkorswim

Wrapping Up

There are plenty of Fractal Energy Trades out there, and I want to teach you how to find them.

That’s why I created Energy Trader, so you can learn how I identify my scalable and reliable pattern to attack the market.

Now, this is just my watchlist for the week ahead

And if my pattern sets up perfectly, I will be taking these trades.

But only my subscribers will receive exclusive access to this information.

To stay up to date with my weekly research and receive actionable trade alerts when I place my trades, sign up to my Energy Trader subscription today.

Remember, once I decide to trade these stocks I will not be sending this information out to anyone other than the subscribers of Energy Trader

So before missing your chance at learning how to trade one of these stocks utilizing my special indicators – sign up here before it’s too late.

0 Comments