I can’t even count the number of times I heard people saying to buy high flying technology stocks in the last week

But I’m always skeptical when excitement for stocks is that high from a retail traders point of view

This usually means that traders are chasing price and will be left holding the bag at the end

Now even though I might not be buying immediately there will be a time coming soon where I will want to be involved in this stock

And the name of the game is timing the markets… and by using this proprietary set of indicators, you get a huge edge against the rest of the traders out there

Just by adding these two indicators to your trading toolbox you will never look at a stock the same again.

Ready to learn more about how fractals can change your trading?

How To Use Fractal Energy In Your Trading

Fractal Energy is a complex indicator that mimics the dynamics found throughout nature, from the pattern found in a pinecone to the shoreline patterns carved out by the ocean.

These patterns can also be applied to the stock market and trading to find stocks that are both ready for a trend or about to consolidate or reverse direction

But first – What are fractals?

The power of fractals allows me to determine the strength of trends and how much “life” is remaining in a stock’s movement.

There are 2 main components of Fractal Energy:

- Markets Fractal Pattern

- The Internal Energy

By combining those two different components you create a single indicator that is able to successfully determine the strength or weakness of a trend on any stock.

But first, what are Bollinger Bands

Bollinger Bands

Bollinger Bands act as a price envelope designed to define the upper and lower price range levels of a stock.

Bollinger Band Indicator consists of a middle Simple Moving Average (SMA) along with an upper and lower offset band. Because the distance between the bands is based on statistics, such as a standard deviation, they adjust to volatility swings in the underlying price.

How do you read them?

Bollinger Bands help to determine whether prices are high or low on a relative basis, and according to these calculations, price should fall within range 95% of the time!

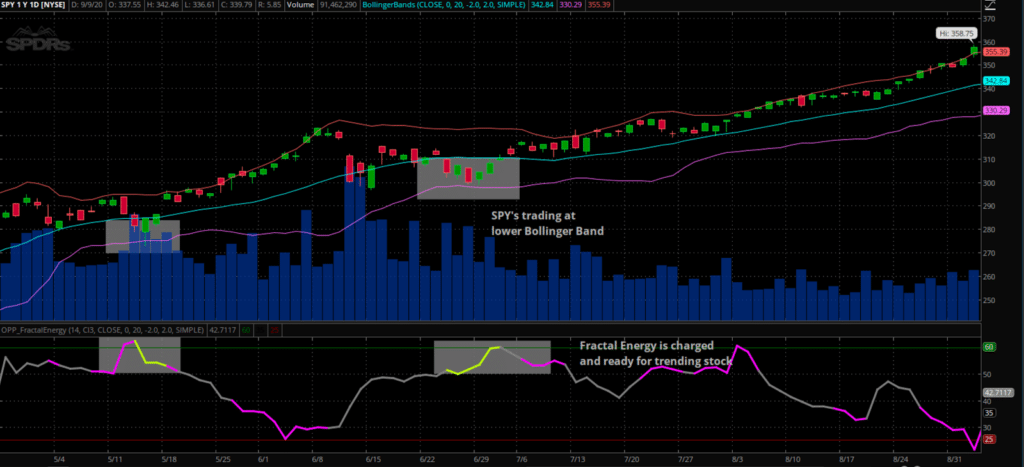

Just take a look at how the Fractal Energy combined with Bollinger Bands was able to determine the momentum higher as the SPY’s continued to make all time highs

Source: Thinkorswim

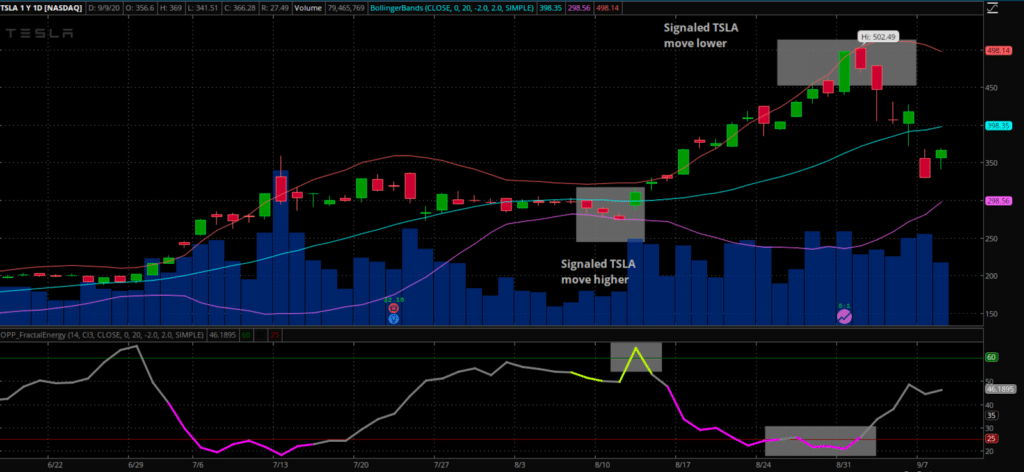

And recently this same indicator said something about TSLA that warned of the recent collapse

Now let’s take a look at the stock pattern I saw that warned of this move lower

Source: Thinkorswim

In this chart you can see that Fractal Energy and Bollinger Bands predicted both directions of the TSLA move

How would you trade this lower?

With the use of a Credit Call Spread trading strategy to put the house odds in my favor

And what does this mean for today?

Well as we continue to monitor both the Bollinger Bands and the Fractal Energy, we can see that there’s a buy signal coming up soon.

As the Fractal Energy continues to charge up and the Bollinger Bands climb higher (or the stock sells off a little further) then we will see a buy setup in TSLA for possibly another huge trading opportunity

And how would I take advantage of this move?

I would make sure to use a Credit Put Spread to capture the move higher.

The Odds Are Stacked In Our Favor

Option sellers take maximum advantage of the option time decay theory, commonly known as Theta Decay.

OTM options lose value quickly and become worthless at expiration.

We can take advantage and be the house with odds in our favor on every trade

Don’t forget that an option buyer needs to be right about direction and time!

Remember traders, there are many ways to make money in this market and selling options is one of my absolute favorite go-to strategies.

Key Points:

- Credit Spreads can profit if the stock goes down, stays the same, or goes up depending on a Call or Put Spread

- Limited risk compared to Naked Puts and Naked Calls

- Puts the house odds in your favor compared to buying Options or Stocks

- Allows you to get paid to take risk unlike stocks

And you see, when it comes to placing a trade, you need to have the stock selected, with a price range identified,an indicator to show you strength of the stock, and an options strategy to tie it all together.

Fractals, Bollinger Bands, and Credit Spreads are the cornerstone of Options Profit Planner

When it comes to placing a trade, I always make sure there’s an edge by leveraging the power of the internal energy of a stock and pattern.

And I always make sure that I utilize a strategy of selling options or spreads to focus on generating a steady flow of income for my trading business.

But what’s extremely important to remember is that there is a strategy for both going long and short stocks that are available to you.

Plus Credit Spreads give unique advantages to traders over debit spreads, with the most important being that you are paid upfront to place a trade!

0 Comments