Do you hate buying stock just to watch it go against you the minute you execute your trade?

Or maybe you buy stock but it feels like you are catching a falling knife when the stock is in a nosedive

So what are you to do as a trader?

Well, one solution is to trade options instead of stocks by purchasing calls to get long exposure.

But if you get it wrong, you will lose all of your money!

And there is always a strategy to make money with options no matter what the markets are doing

So I’m going to walk you through two option strategies that I believe are viable for these market conditions.

If you master them you can soon start putting them to work and make steady casino-like profits

Options Profit Planner

At Options Profit Planner, there is one thing that I make sure of before placing any trade

That is to know that the odds of winning are stacked in my favor

And buying stocks and options just don’t give me those odds, which is why I stick to credit trading strategies

Credit trading strategies give traders a unique opportunity to generate income from the sale of option spreads instead of placing bets on a stock’s movement.

This means a trader could generate profits if a stock went up, down, or sideways !

So… if you are trading options, it is a must to learn how to trade credit spreads to generate income.

But one of my favorites (besides credit trading) is that a trader can adjust their risk parameters to meet their needs for trading the markets.

Two examples would be limiting losses to the downside, and being able to capitalize in a sideways market. Both are not achievable by trading stocks themselves.

Next… let’s take a look at this in more detail.

The Strategy

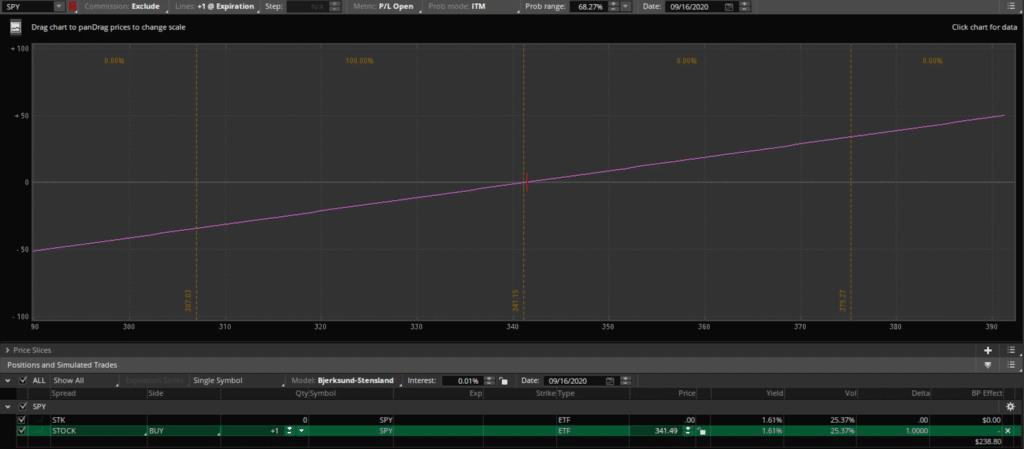

First, let’s review the risks associated with trading a stock…

Remember, if you are long a stock, this is assumed to have unlimited gains and unlimited losses associated with it.

Here is a stock risk diagram for your reference.

Source: Thinkorswim

So, as you can see above, there are significant risks associated with trading long stocks directly.

And with the markets moving with high periods of volatility, this unlimited downside risk is not suitable for everyone

So what’s the solutions?

Well there are a few choices for a trader to make when seeking an alternative for a long stock.

These choices are:

- Trade a Naked Put

- Trade a Credit Put Spread

Let’s take a look at how each one of these trades can offset losses when trying to get long a stock in these types of markets.

The Naked Put

A Naked Put can be a great way for an options trader to help generate income while maintaining a similar risk profile of a long stock

The benefit is the trader is paid upfront to carry risk in this stock and can make money if the stock goes in any direction.

For a Naked Put to be effective, a trader would typically sell a put that is out-of-the-money (OTM) to give them the best likelihood of expiring with no value left

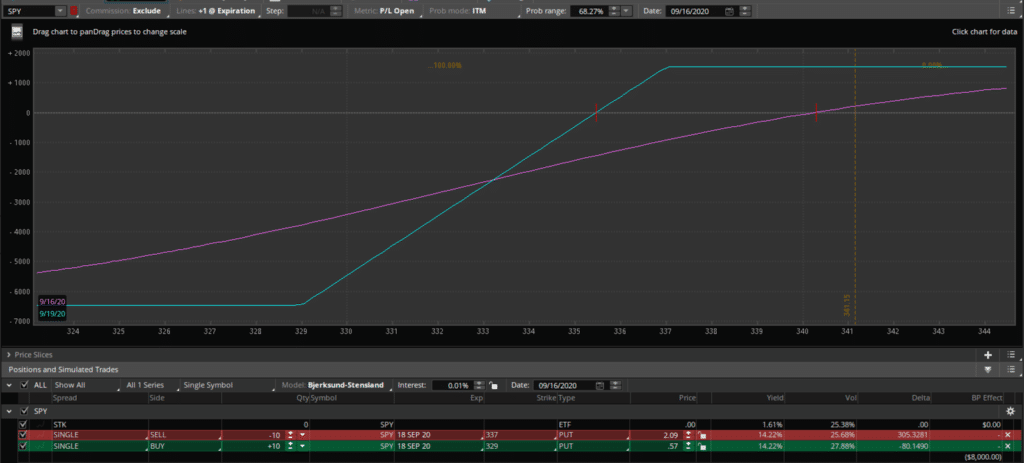

Here is an example of the Naked Put option strategy

Source: Thinkorswim

But we can take this trade one step further and protect the downside risk as well by using a strategy called a Credit Put Spread

The Credit Put Spread

A credit spread is a directional strategy that requires a trader to buy an option that is at a nearby strike and sell an option that is at a further strike. Both in the same month and on the same stock.

This can be a highly advantageous choice instead of going long the stock directly….especially during extreme periods of high volatility like we are in now.

The credit put spread is a fantastic trading strategy that allows traders to take advantage of a sideways, bullish, or slightly bearish market environment. With proper strike selection you can vary how much income you will receive for the trade.

Here is an example of this for the SPY

Source: Thinkorswim

As you can see the risk profile looks very similar to the Naked Put from above except it has a limited downside risk with the trade.

And these strategies are two of my favorite to trade

So…Why is this such a favorite trade of mine?

Well for three reasons:

- Allows you to trade without the capital required of owning stock

- Has a limited loss to an unfavorable downside move

- Allows me to collect income for the trade if it moves downward, upward, or even stays the same price.

Putting It All Together

Trading credit spreads is a great way to generate income and eliminate many risks associated with trading a long stock position.

Let’s take a look at some pros and cons to trading credit spreads and naked puts.

Pros:

- House odds in favor of seller (60% or more)

- Possibly 100% ROI on the trade

- Limited downside risk for credit put spread

- Can win in up, down, and sideways markets

- Lower capital requirements vs owning stocks

Cons:

- Limited upside gains

It’s easy to see how the pros of trading this strategy significantly out-weight the cons!

0 Comments