A lot has been said about the market’s volatility over the last five weeks.

Make no mistake about it, what we’re experiencing during the COVID-19 pandemic is unprecedented.

So instead of telling you my opinions where we go next. I want to talk to you about strategies.

Because the strategies you select in this market will determine whether you make money, lose it, or just break-even.

I discovered the best approach to trading these markets has been with options.

Which strategies am I referring to, and how did I get my start creating passive income with options?

How It Started

I realized early in my career that I was looking for something different… a way to achieve financial freedom while being able to support my family.

Like many entrepreneurs, I had the drive to start and grow a successful business at a very young age.

And like most entrepreneurs when they first start out, I immediately had to face failure.

But that’s ok! I took it as a time to learn and to grow so when I was to start my next business I had the skills to succeed.

First, as I started my next business, I had to quickly find ways to increase cash flows in order to pay the bills and keep the doors open every day.

Like other companies, owning a trading business comes with the same set of requirements.

To generate cash flows and earn profits!

Which is why I decided to trade options for income instead of paying to speculate on stocks like I would at a casino.

Why do I trade options instead of stock?

Options give me two distinctive advantages over trading stocks

- Dictate what price you will pay for a company

- Get paid upfront to take a trade

And that’s exactly what I need in a business!

It’s important to remember that options give me the ability as a business owner to name the price I buy inventory (stocks) and at what price I want to pay (the strike price) for that inventory!

Now… in order to understand how this works… let’s take a closer look at options.

What Is An Option?

Definition: Options are financial instruments(derivatives) and are based on the value of underlying stocks. An options contract offers the buyer the opportunity to buy or sell the underlying asset.

There are two types of options:

- Call Options – Allow the buyer to buy the asset at a specific price on a specific date.

- Put Options – Allows the buyer to sell the asset at a specific price on a specific date.

All option contracts all have specific expiration dates by which the trader must exercise their option.

There are two types of option traders, a buyer and a seller.

- Option Holder has the right to buy or sell the underlying asset at a specific price.

- Option Writer is obligated to buy (or sell) the underlying asset if the contracts are assigned.

Call and put options are the two foundations to a wide range of strategies designed for hedging, income, or speculation.

The two ways options are traded:

- Option buying – speculation and hedging

- Option selling – income generation

And since we are looking to run a successful business we are going to want to focus on option selling strategies only.

But first…let’s take a look at why buying options won’t work for income generation.

The Problem With Buying Options

Here is a hypothetical example of a trade we can place.

After looking at the Fractal Energy of AAPL, a trader is bullish on this stock and wants to take a long trade at $248.

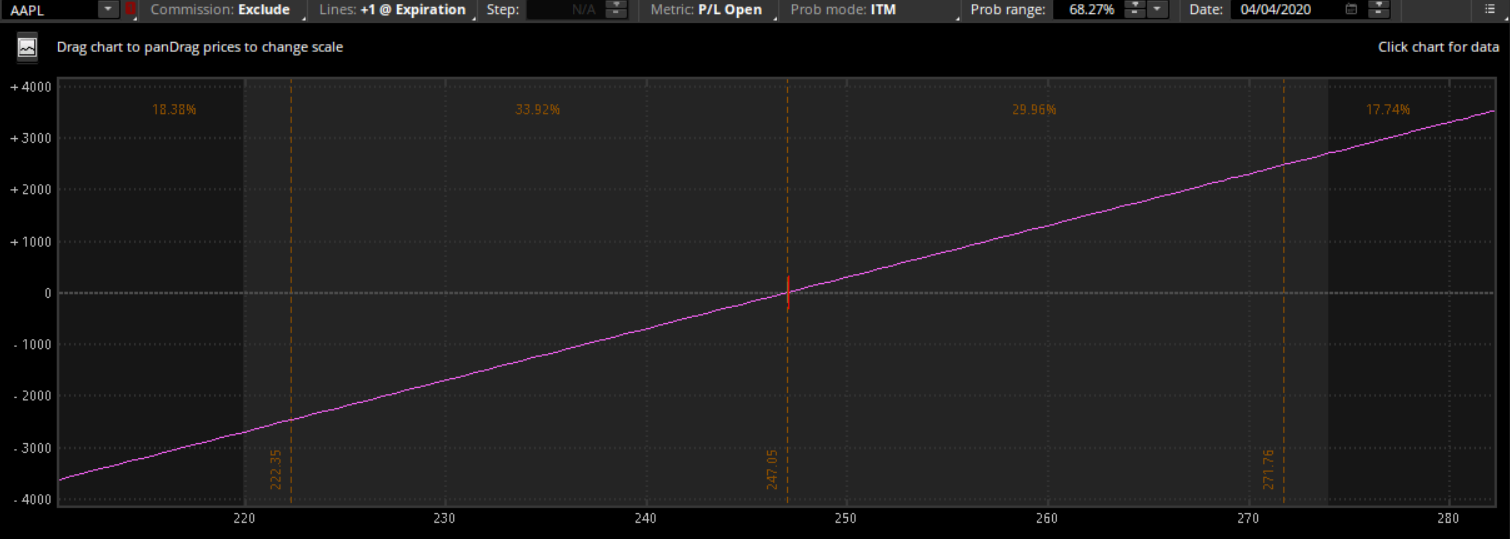

Here’s is the chart on AAPL:

Source: Thinkorswim

At this point the trader has only a few choices they can make on how to trade AAPL.

They can do one of two things…

Choice 1: Buy the stock

Choice 2: Buy the call option

Let’s break down each possible trade that can be made and see what issues they have in common with each other.

Buying The Stock

Trader has to purchase 100 shares of Apple at $248 per share.

By doing so, this will tie up approximately $24,800 in buying power on that single trade!

And when you buy stock, you have unlimited profit and severe loss possible on the trade.

When a trader buys a stock, they are actually taking more risk than they think they are.

Source: Thinkorswim

Now let’s take a look at long call options…

Buying The Call Option

A trader wants to purchase 100 shares of AAPL using options.

He would purchase 1 at-the-money call option, which gives the trader exposure to 100 shares.

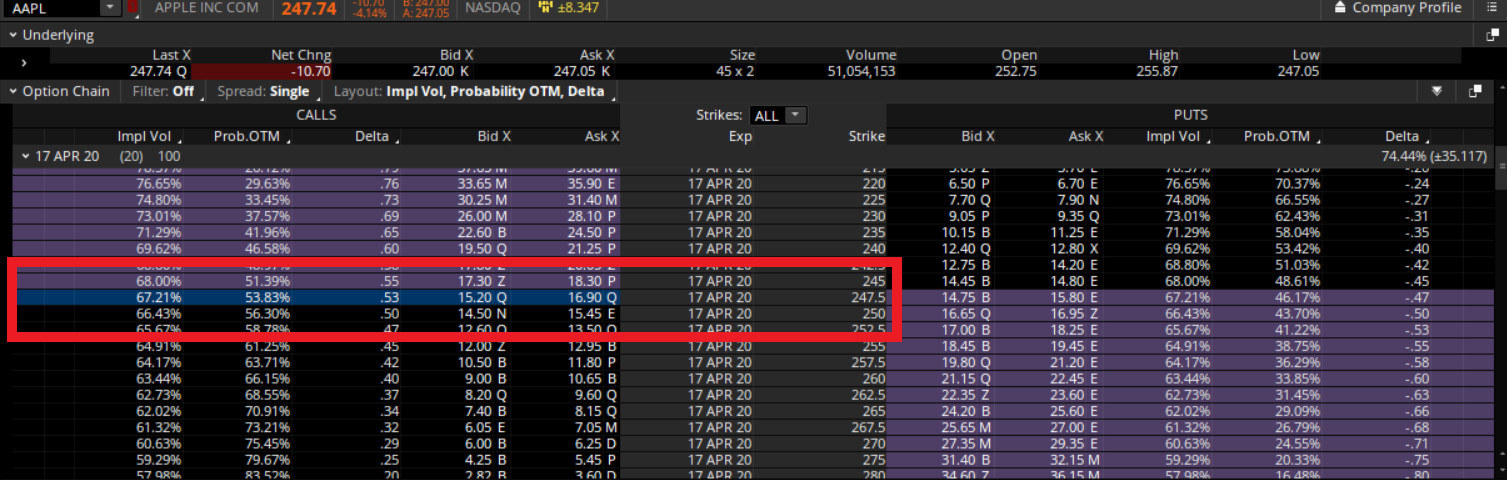

Source: Thinkorswim

Source: Thinkorswim

The trader would purchase 1 AAPL 17 APR 20 Call @ 16.90 which would cost the trader $1,690.

For a long call:

Profit: Unlimited

Risk: Cost of stock option

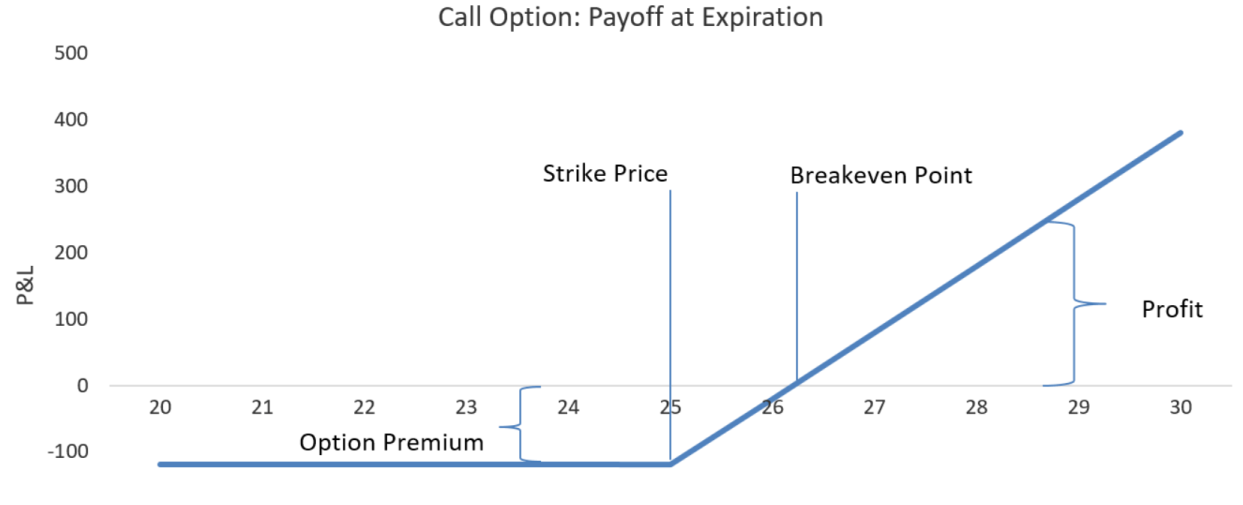

Here is the payout diagram for a long call option.

Source: Thinkorswim

Source: Thinkorswim

How does this work?

Basically… in order for a trader to profit on a call option, the stock needs to go in the correct direction and beyond the breakeven point before you make any money.

And if you get the direction right, but miss-calculate the amount it will move up by, you will still lose money!

What is the solution?

Buying options is an uphill battle and the premiums to establish a position make turning profits extremely difficult.

That’s why we turn to selling options to put the house odds in our favor.

Selling Options – Be The Casino, Not The Gambler

As a trader, selling options allows a trader to take on the roll of a casino owner.

A casino, or the house, has a small but well-defined edge in the markets. The long term goal is to make a steady stream of income for their business.

And one thing they realize is possible and accept is that they will sometimes take losses, both small and large.

Like any tool traders may use, there is a time and place to sell options. A trader must maintain a solid understanding of current news and understand that market events may significantly impact a stocks price.

When selling options is correctly utilized, this is a sophisticated way of entering into equity trades or generating income for your portfolio.

So let’s take a look at how to gain long exposure when selling put options.

Naked Puts

Naked puts, or a short puts, is another way to trade a stock if you anticipate a rise in price.

This strategy allows a trader to collect income if the stock trades up, down, or sideways prior to the expiration of the options contract.

One of the key benefits of trading this strategy is that it allows a trader to get paid upfront to place this trade.

And if the stock stays above the breakeven prior to expiration, the trader could keep all of the premium collected on this option.

The naked put is one of the go-to strategies for professional traders when it comes to selling options.

This is because it allows a trader to take ownership of the underlying stock at a desired price and date.

And due to stock ownership possibilities, this theoretically keeps the amount of losses an option trader has compared to trading stock equal to one another.

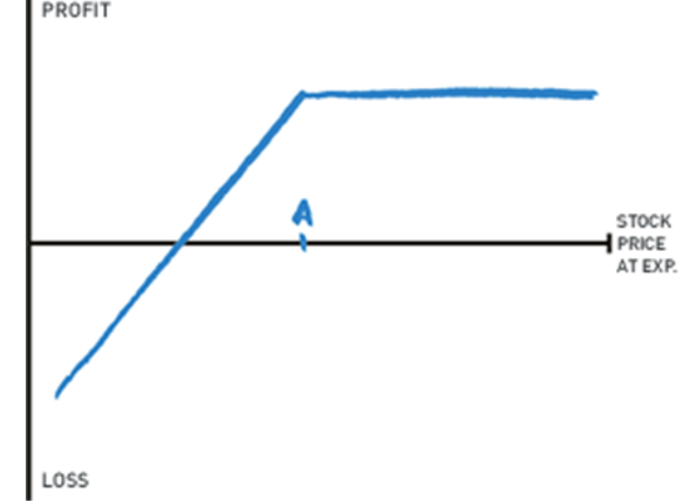

Here is the risk diagram that is associated with a short put.

Even though the chart looks like unlimited losses, the value of the asset going to $0 is the theoretical max loss.

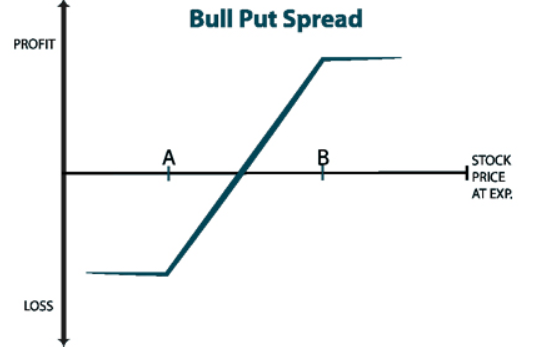

Bull Put Spread

An alternative to the naked put is a spread trade called the bull put spread.

The main advantage to a credit spread is the reduced risk of losses compared with the naked put trade.

Like a short put, a bull put spread is used when the trader expects a rise in the price of an asset, but doesn’t want to assume theoretically unlimited losses to their position.

The spread is placed by simultaneously purchasing a put option at a lower strike price and selling a put option at a higher strike price, in the same stock and expiration date.

This is considered a limited-risk trade since the sale of the put option is covered by the purchasing of the put option.

Final Words

To summarize, premium selling is known to generate a wildly profitable and extremely smooth equity curve for a trading business.

- There is the risk of an occasional large loss, but this is mitigated with the use of credit spreads instead of naked options.

- The return of a premium selling options book is that of a mean reversion stock trading system, with a large number of small wins with the occasional ‘fat tail’ trade.

- Selling Naked Puts is one of my favorite strategies since it allows me to purchase stocks at a discount and get paid doing so!

Want more proof that selling options is the only way to consistently make money?

My trading account has gone undefeated – even through this recent market collapse! It’s unbelievable that it has seen no losing trades throughout this turbulent market.

So… are you looking to get trade ideas that only require 15 minutes per week to trade for yourself?

0 Comments