Have you ever found yourself in a situation where you are closing out a trade only to wish that you made a little more money?

I am sure you have… and I know that I’ve been there before!

Don’t get me wrong, there are times when it is an absolute necessity to protect your profits and your account and not be greedy.

And in my opinion, traders never went bankrupt getting paid for their trades.

But every now and then, maybe you need a little extra juice in your cup and need to squeeze out a bit more profits.

Now, in my opinion, there is really only one choice traders can take besides blindly doubling up their position.

And I’m talking about rolling out your position to increase both time and profits of a trade, potentially.

In fact, I just did this earlier in the week to nearly double my profits on my options trade.*

Want to check out how I did it?

Increasing Profits

Increasing comes can be achieved in a couple different ways…

By doubling up your position, or by rolling out your trade

And honestly, doubling up your position is just crazy.

So instead, I choose to roll out my trade to a further date and increase my profits as well

And sometimes as an options trader, you need to stay nimble and on your toes at all times to keep your strategy in a position to generate income.

How does this work?

What is a rollout?

A rollout strategy involves simultaneously closing one of the options contracts and opening a different contract of the same class.

This new contract can be a further-dated expiration (rolled out) or a higher/lower strike (rolled up/down).

[ Stay tuned, there is more to come in my cornerstone educational material that is launching soon! ]

Adding Time To The Play Clock

Now, let’s talk about the choices you have in front of you

The main choices an options trader has:

- Take the trade off, and try to capture as little loss as possible

- Adding new positions (spreading your position) to take risk off the table

- Turn it into a new position to change your spread

- Adding new positions to create a new trade, adding risk to your trade, but adding profits

- Adding time to your position, typically adding both risks and profits to your trade

I want to focus on the last point, adding time to your trade and increasing your profits

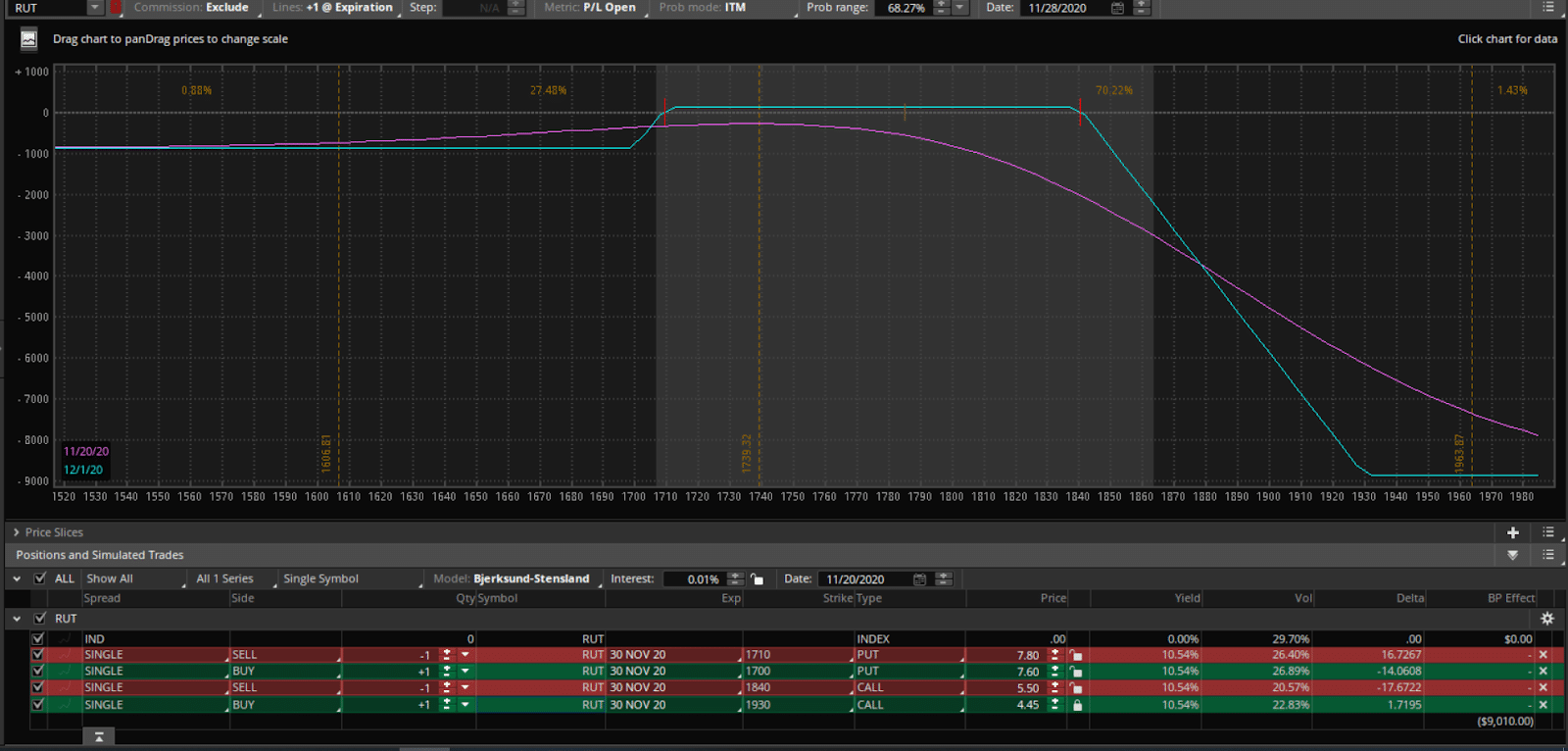

Let’s take my RUT 20 Nov ’20 $1710/1700/1930/1840 that I targeted at $1.25 to sell

You see, if the RUT stays right here, I am going to be making near $1.12 out of the $1.25 on my trade, or approximately 90% ROI.

But, even though the 90% ROI is awesome returns, I just need more total profits.

So this is how I would roll the contract out to double my profits and keep the same ROI percentage.

The Rollout

So, here is what I did to ‘roll out’ my trade

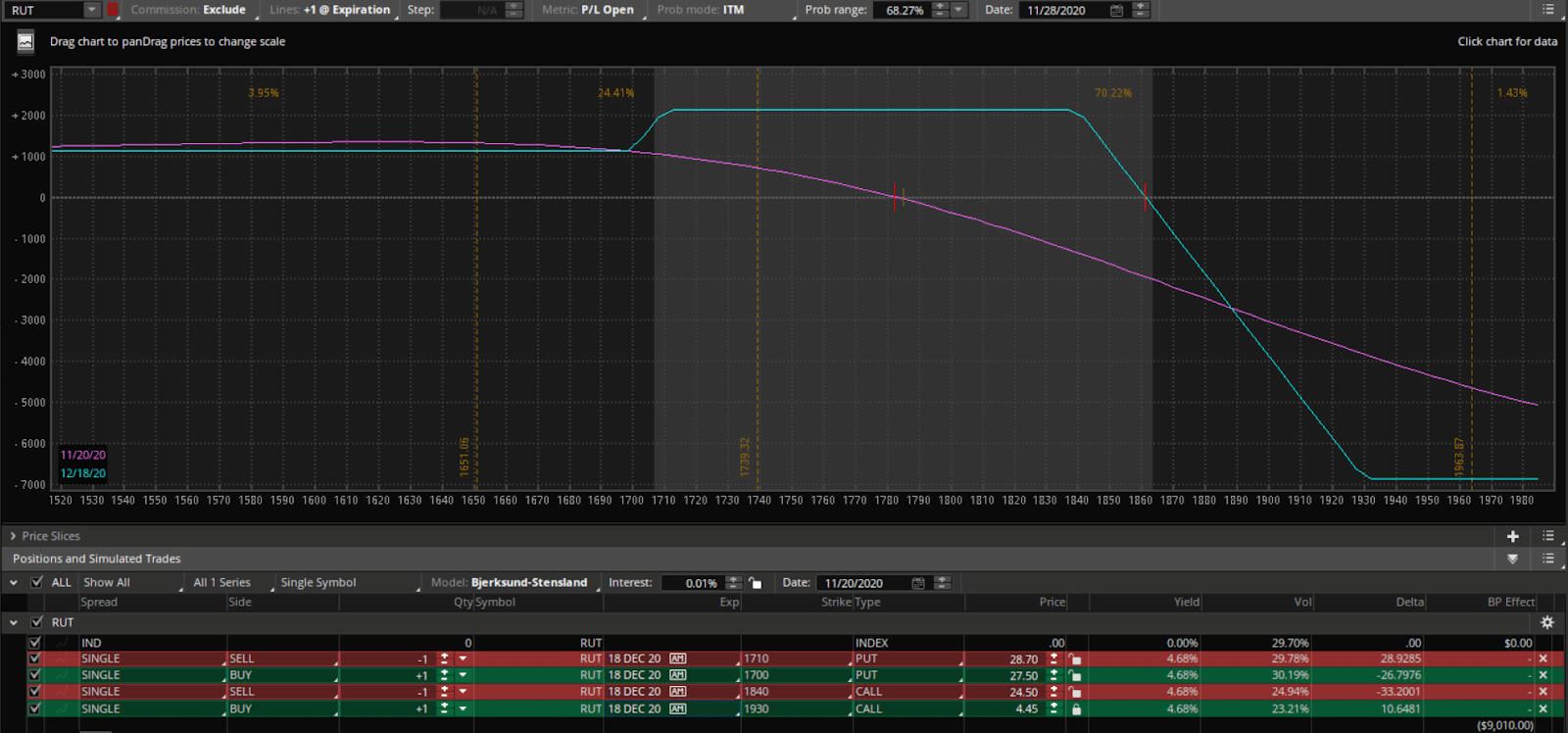

I simply closed out of my Nov20 trades, and opened up the same position for 18DEC20

And by doing this, I increased my returns exponentially!

I took $125 max profits up to $2125!

That’s an insane amount of increased profits just by adding an extra month to the options!

And the kicker… I actually take less risk on this trade for making more money!

Talk about a win-win all around

And why did I feel this confident in my trade rollout?

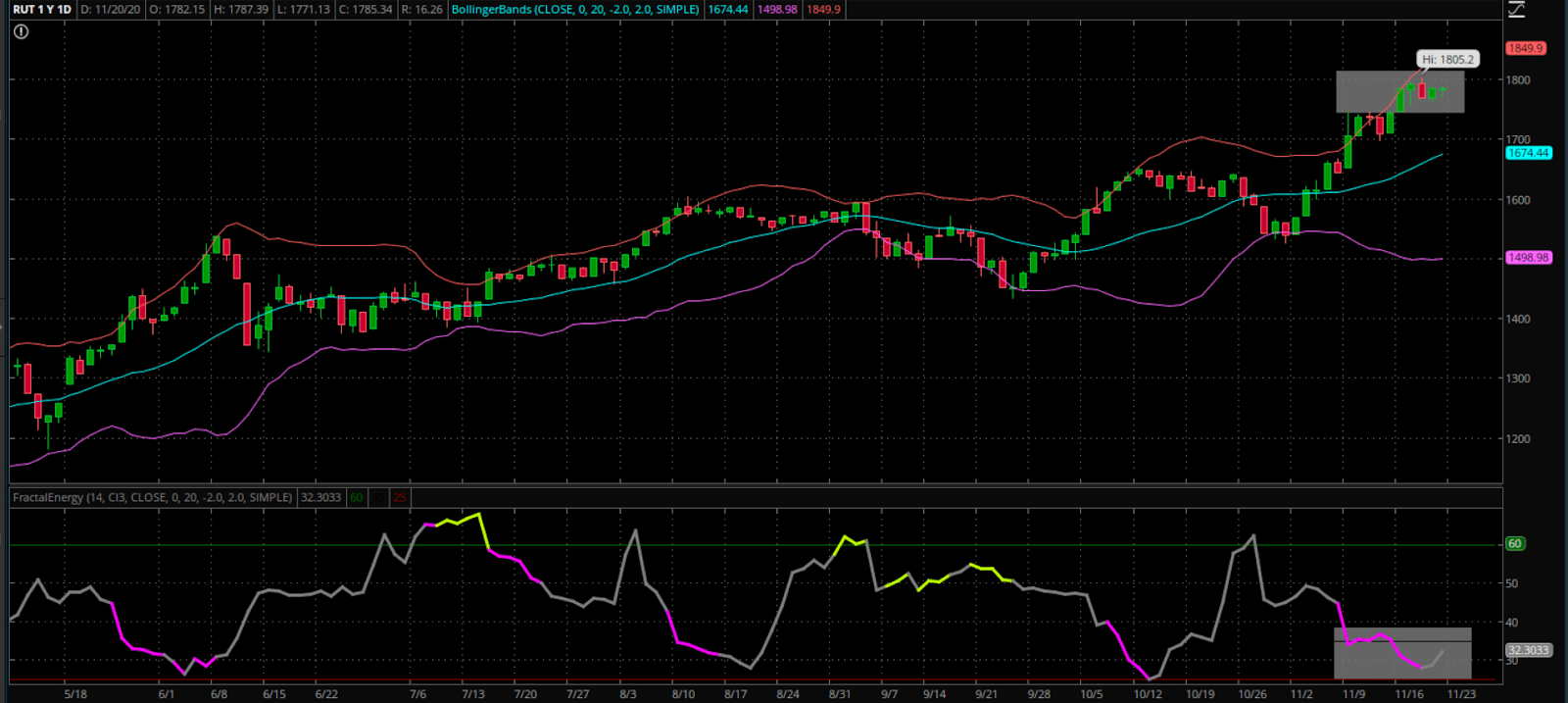

Well, by taking a look at the RUT chart, and noticing that the Fractal Energy is exhausted and the stock is trading above it’s upper resistance levels.

This means that there is a high likelihood that the RUT will either drop or trade sideways for the better part of the rest of the month and into next month as well.

Want to see what I actually did with this trade?

[ Check out my full, in-depth RUT trade recap video, right here ]

Now, I know you’re scratching your head about how this all works, and I know I would be too if it was my first rollout on a complex trading strategy

Which is why I created a complete and in-depth and comprehensive options training course.

This will get you up to speed and comfortable with trading options at a higher level in as little time as possible

But if you’re already comfortable with these types of strategies…

Don’t miss out on my next options trade that I am setting up this weekend to generate more income

And if you hurry and sign up now, members will be receiving a detailed guide to selling options next week on Sunday evening.

So what are you waiting for, sign up here to see my next trade

Don’t miss your chance to generate additional income week-over-week and month-over-month by using credit spreads

Click here to sign up now and join my team in Energy Trader

0 Comments