Up, down, or sideways… you can put yourself in a position to win no matter what the market does…

…that is if you know how to apply the right options strategy.

Now you might be skeptical when you hear things like “I made money going long a stock when its price dropped.

But with options, it is actually possible!

Let me show you the power of them and what you can do to make money…even when the stock doesn’t move!

Options Profit Planner

While trading I always try to pick the best strategy for the job at hand…

And if I wanted to go ‘long’ a stock, I wouldn’t simply buy a call…

Insteads – sometime it’s best to select from naked put options when looking for the most bang for your buck.

And if you’re looking for a more conservative trading strategy – a trader could place a credit put spread to get long these markets as well.

Why’s that?

Credit Spreads involve selling a high-premium option while purchasing a low-premium option in the same class or of the same security, resulting in a credit to the trader’s account.

While most options traders are focused on debit spreads, this gives traders a unique advantage when trading credit spreads.

Let me explain…

The Short Put and Credit Put Spread

Let’s take a look at an example of a credit spread on AAL to place the long/neutral biased trade.

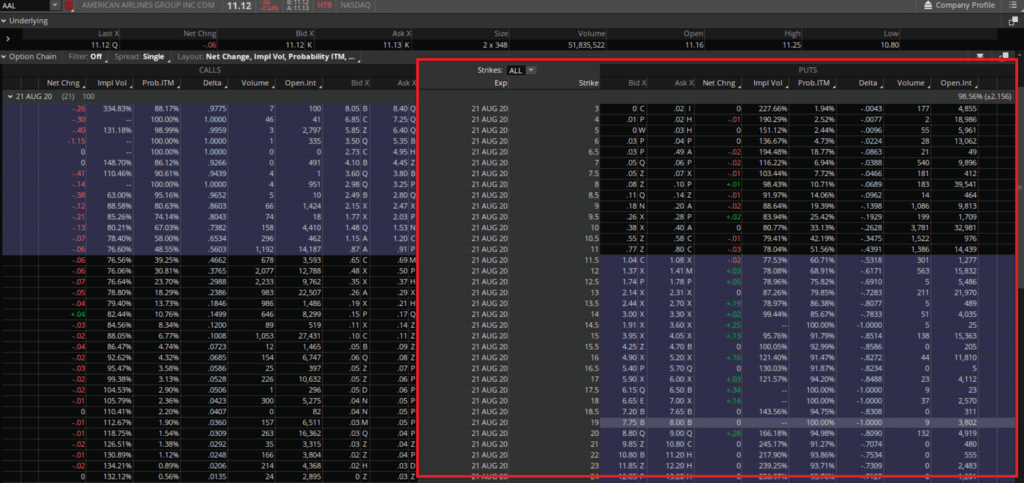

First, when trading a put credit spread you will want to focus on the right-hand side of the options chain.

Source: Thinkorswim

Next…the right side of the options chain is where the put contracts are listed in this option chain.

And to complete a short put or short put spread, you would look to simultaneously sell a higher priced strike and sell a lower priced strike

Now…there are two strategies you can choose from – the short put or credit put spread.

The Short Put

First, let’s start off with an analysis of the short put strategy to trade AAL on.

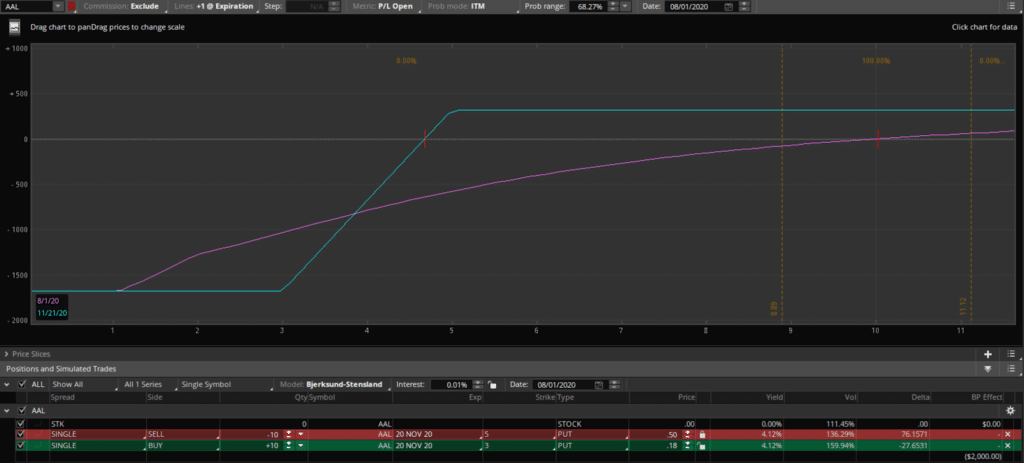

Here is a sample risk diagram of a short put.

Source: Thinkorswim

As you can see, there is a huge range where you can generate profits in this trade.

And when trading this strategy there is a risk of losses if the stock goes to 0, but it’s technically a limited loss.

Plus if the stock is to sell off to $5, I am comfortable with owning the stock for a long time down at these levels.

That’s a 50% discount from where the stock is currently trading at!

Now… let’s look at a credit put spread.

Credit Put Spread

When trading a Credit Put Spread, you want to combine 1 long put option and 1 short put option.

Let’s take a look at a sample trade…

Source: Thinkorswim

Immediately you can see that the downside risk is capped instead of unlimited… which might be a lot more comfortable for new traders.

And that’s ok if you prefer this protection because there’s still a huge profit zone in this strategy.

But unfortunately the trade off is nearly 50% less profits on this trade.

Why Did I Chose This Trade

I choose to use credit spreads over debit spreads because I get paid upfront to execute the trade.

What does this look like on a chart?

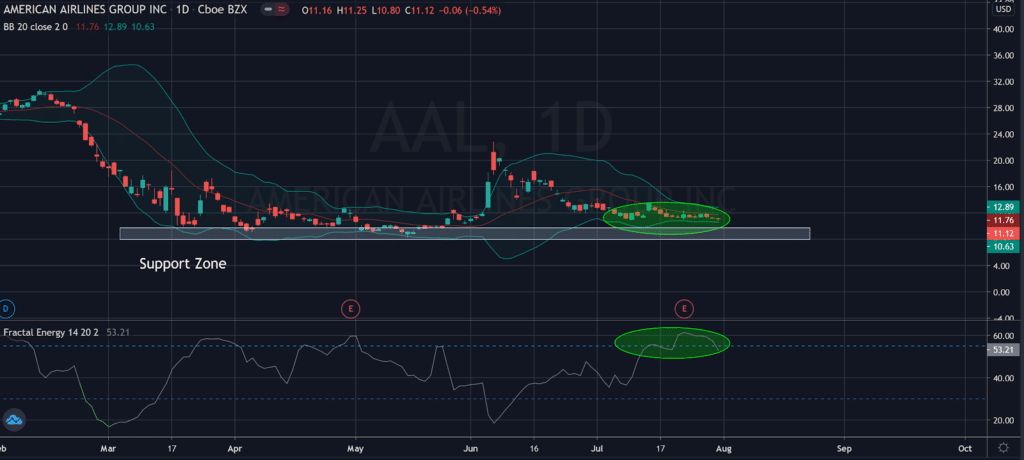

Source: Thinkorswim

As a technical trader I like to structure my trades around patterns and psychological levels to give me the best shot of a winning trade.

In this example, I believe the banks will be bailed out and continue to trade higher in the short term.

Reviewing the trade:

- The stock is trading at support created the selloff in Marchin

- The stocks are trading under the lower bollinger band levels and at support levels

- The Fractal Energy Indicator is trading below above threshold signaling the stock is charged for a move

Wrapping up

Here at Options Profit Planner, I utilize an options trading style focused around credit trading to generate income for my business.

Since trading is a business I always focus on the money coming in and the money going out.

Now I bet you are wondering what credit trading is…

Credit Spreads involve selling a high-premium option while purchasing a low-premium option in the same class or of the same security, resulting in a credit to the trader’s account.

Credit spreads give unique advantages to traders when trading credit spreads, with the most important being that you are paid upfront to place a trade!

And as a business owner, I want to make sure I know how much money I have coming in and out each and every month.

Since running a trading account is actually a business and not a trip to the casino!

To learn more about credit spread trading and have trades like this alerted to you …

0 Comments