I’ve never heard of a trader who wanted to make less money

If you are a trader the chances are you want to increase or replace your current income

And that is what I aim to do for every trade I take

You see… I want to be the casino with the house odds in my favor

Which is why I turn to different credit spreads every time I trade

And one way to own a stock and boost your income is to use a covered call strategy

By using this strategy I return 90%+ on almost every trade

But before you run out and trade this strategy, you need to hear these two tips

Let me explain…

The Covered Calls

This strategy is an options strategy involving trades in both the underlying stock and options contracts.

So, what is the purpose of a Covered Call Strategy?

To generate income on top of owning a stock

And as an income-generating focused trader, I am always in the hunt for the perfect covered call opportunity.

How To Create A Covered Call

Creating a covered call is a straightforward process once you understand the basics of options, and it’s done in 3 basic steps.

The 3 Steps To Creating A Covered Call:

- Purchase or already own a stock that you have an interest in owning for a period of time. Be sure to purchase stocks in only lots of 100 shares.

- Sell 1 call contract for every 100 shares of stock you own. For example, if you own 500 shares of AMD, you will want to sell 5 contracts.

- Wait for the call to be exercised or to expire worthless. If the call expires worthless then you will keep the premium and also keep the original shares of the stock you own.

Risks Of A Covered Call Strategy

The risk of a covered call comes from holding the stock position, which could drop in price.

Your maximum loss comes from the stock going to zero, but that is the same risk any stock trader that is unhedged would have.

The Formula:

Maximum Loss Per Share = Stock Entry Price – Option Premium Received

Unfortunately, there is a trade off to generating income with this strategy. Your profits are capped to the price of the options contract you sold.

The Formula:

Maximum Profit = ( Strike Price – Stock Entry Price) + Option Premium Received

Quick Example

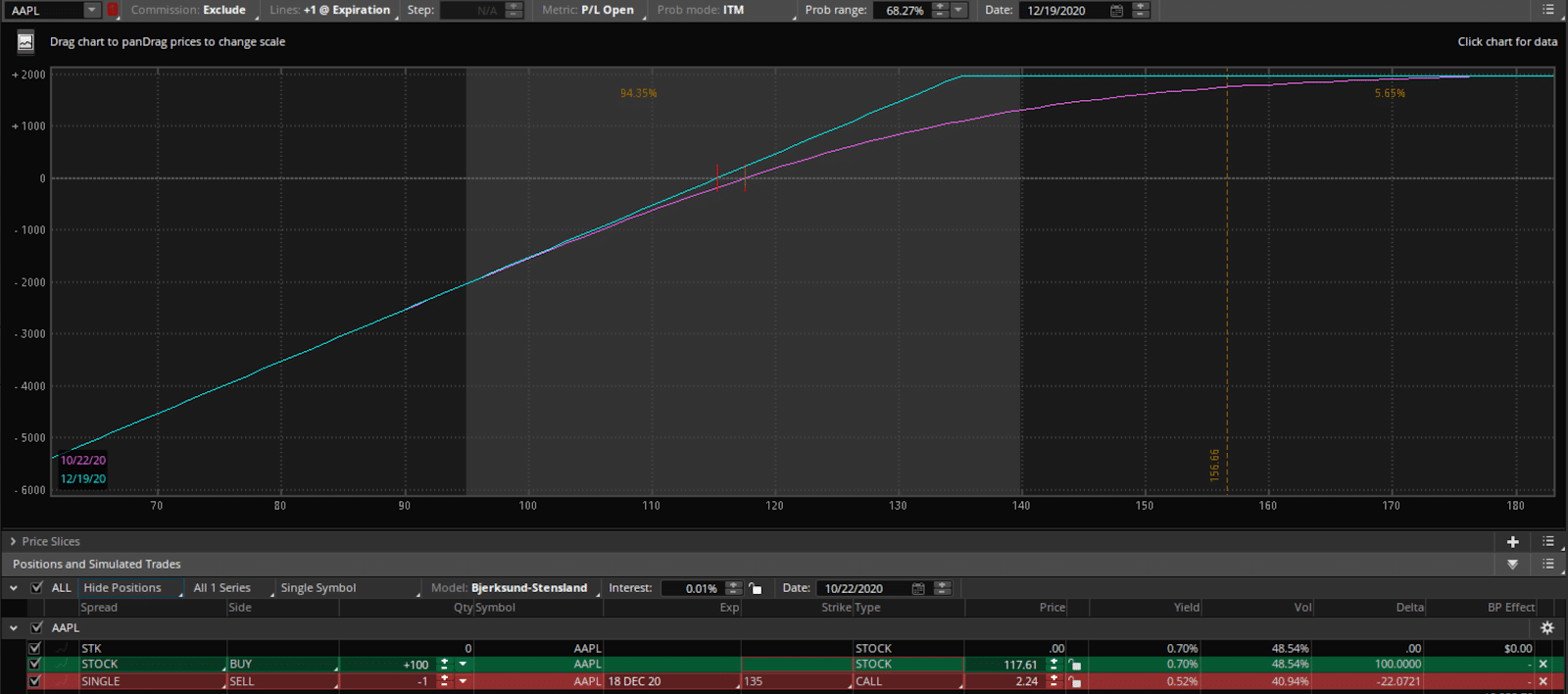

Here is a quick example of how I would use a Covered Call spread on my trading

Source: Thinkorswim

You might think this is a short put at first glance, but it’s not.

This strategy mimics the short put and allows a trader who owns a stock a way to generate income.

The possible outcomes:

- If the stock falls, you keep the credit from the call option and maintain ownership of the stock

- If the stock rises, you keep the credit from the call option and can either close your position out or let it exercise to deliver your shares

My ideal outcome is actually to let the stock fall or stay within a specific range.

Why?

If the stock does this you can keep your stock and generate a considerable amount of income just by selling out the calls.

And if you maintain a covered call trading strategy, you could sell out calls almost every month on a single stock and generate trading income by simply owning the stock.

Final Thoughts On The Covered Call Option Strategy

The main goal of the covered call is to collect income via options premium by selling calls against a stock that you currently own.

If the stock moves in any direction but not greater than the strike price, you are able to collect the premium and maintain your stock position.

Traders should factor in commission on this trade, and if the commissions are greater than your option you are selling, you might want to consider selecting a different option to sell.

0 Comments