These are challenging markets to trade…

And it’s very rare you’ll hear me say it’s time to take a short break and sit out on the sidelines — no, now’s not the time for me to take a back seat.

You see, stocks typically trade with a lot of emotion, from exuberance during new highs to sadness and fear during lows.

It’s in times like these, with the markets zig zagging all over, I can find some of the best opportunities to trade.

Now – if you ask traders what they are watching, many times they just trade what’s given to them on the news channels.

Sure, this could be a strategy… but I sure don’t want to be trading like this because there’s no edge.

Instead, I focus on income-generation and consistent returns on my trades

You see, no matter if stocks are in an uptrend, downtrend, or stuck in a range, I have a strategy that works for me in each market.

And there are two tips that you should always keep in mind when markets with high volatility.

Two Tips To Safely Trade These Markets

First things first, I don’t want to try to “predict” the markets whenever I place a trade setup.

Instead, I want to see a direction that will most likely land my strategy to max profits.

Which means that when trading credit spreads, a stock can go up, down, or sideways and I can win on my position.

Tip #1 : Don’t Be Afraid Of Credit Call Spreads

Before I place a trade, I want to reference my technical indicators to give me a heads up to what the buyers and sellers are thinking about the stock.

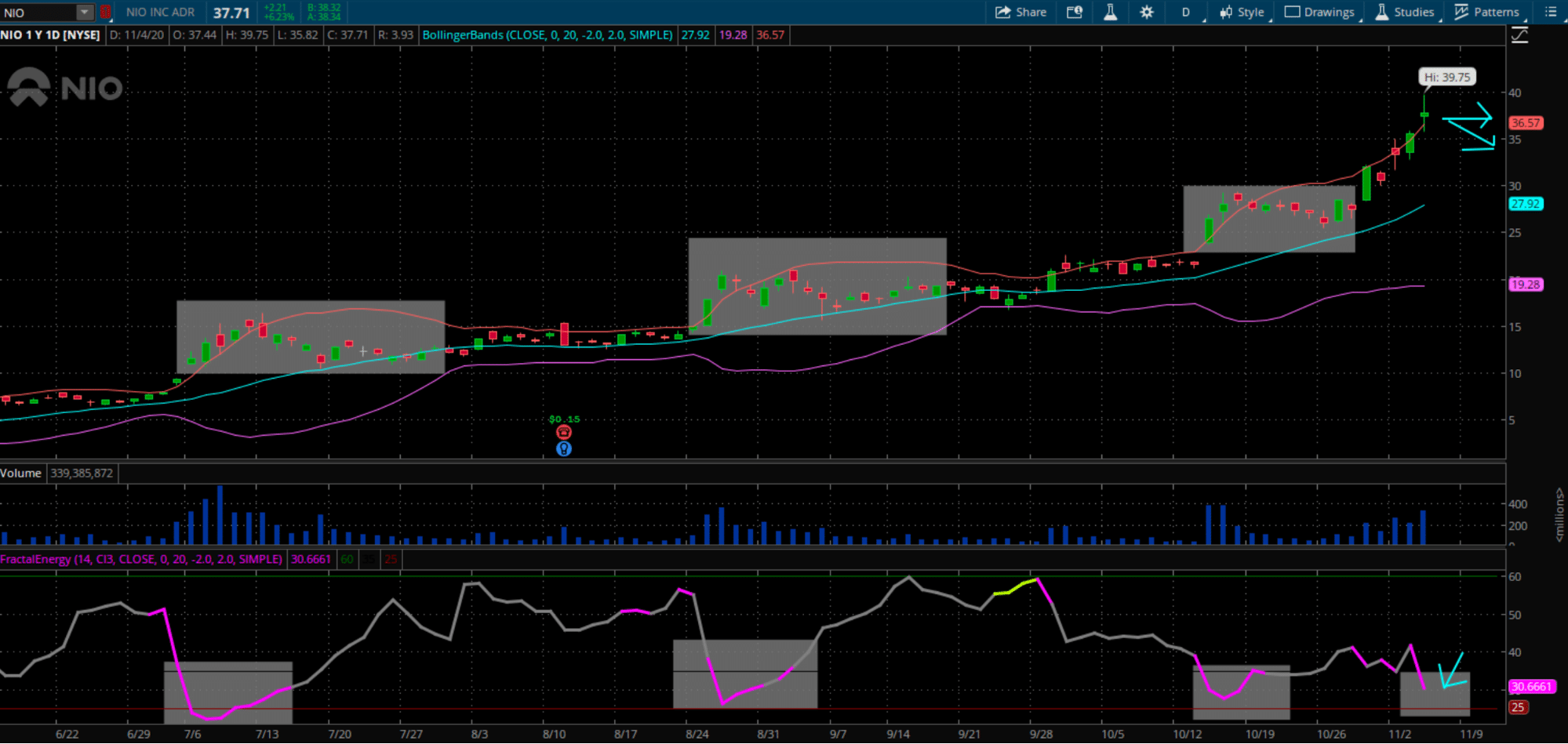

And one stock that I’ve seen buyers piling into lately that has energy that is exhausted is NIO.

Let’s take a look…

The stock has been off to a strong start all year

And keeps ripping higher.

But you see, stocks don’t go up in a straight line… instead they go up then rest, then go up again

And that’s exactly what Fractal Energy has highlighted for NIO during each “pause” period.

You see, just because Fractals signal that a stock is “exhausted” doesn’t mean it’s going to be dropping 10%.

In fact, a stock could go sideways for a period of time while it builds up energy that it needs to trade higher

Now, this is how I would trade it..

- Use credit call spread to generate a stream of income instead of betting on a direction.

- My target is $30, over the course of 2-3 weeks

- Sell credit spread and target a 80% ROI on my trade

Trading Tip: Instead of buying puts that are usually juiced up from buyers trying to short the stock or hedgers looking to protect their profits…look to sell credit call spreads to generate income from collecting the credit of the options.

Tip #2 : Trade Popular Contracts Only

Liquidity is king

And liquidity is a measure of how easy it is to get in and out of a position, at a market-fair price.

One example of liquidity is real estate investments compared to cash holdings.

A real estate investment is usually a slow transaction and can tie your assets up for a longer period of time.

Cash investments are usually a fast transaction, meaning that you can easily buy and sell goods or services with it.

So how do you know what is liquid vs illiquid?

One measure of liquidity that I like to use is the volume and open interest of the options

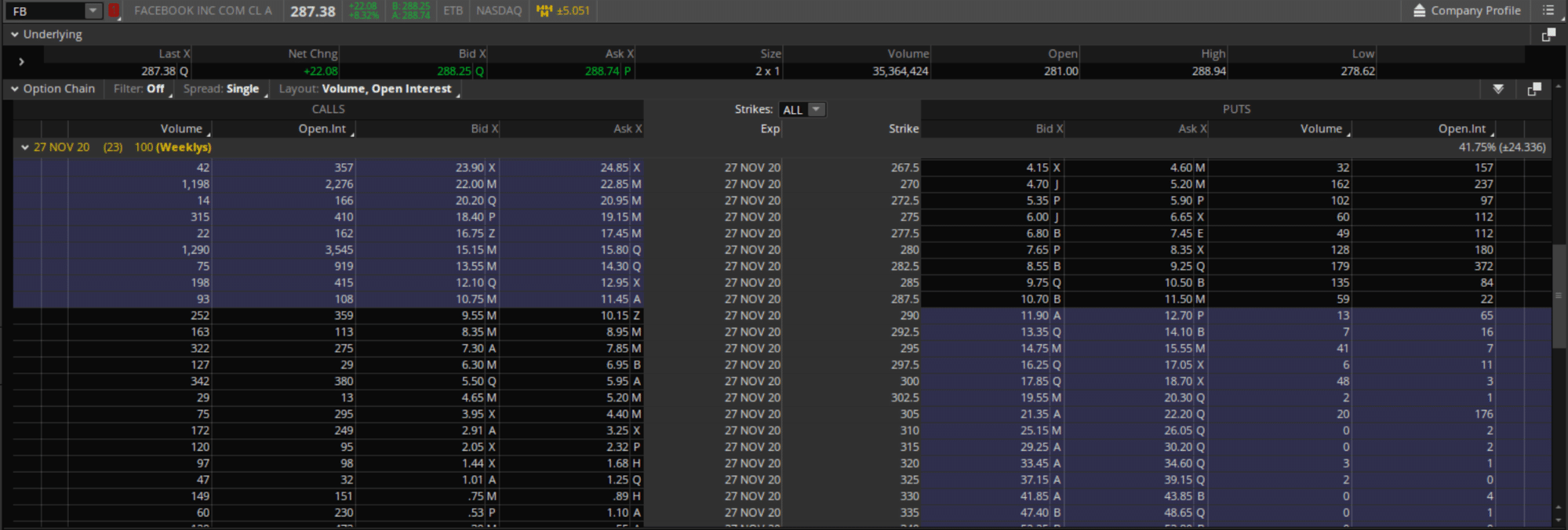

Here is an example of an illiquid options chain:

Source: Thinkorswim

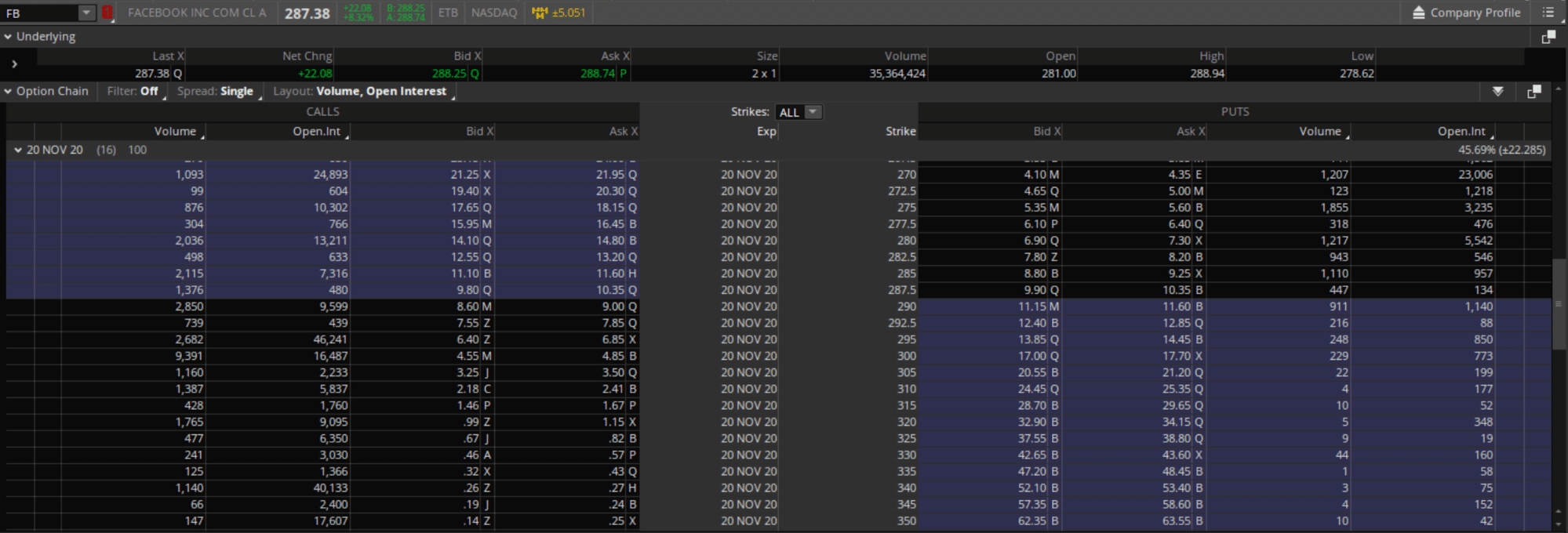

And to compare, here is an example of a liquid options chain on the same instrument

Source: Thinkorswim

And by quickly looking at the volume vs open interest, you can see how the monthly options have far more volatility than the weeklies do.

Learn How I Am Trading Fractal Energy

I am expecting to see some fantastic trading opportunities coming from the volatility around the elections.

And now that I’ve got a few stocks on my watchlist, I will be looking at the options markets to find juiced-up contracts to sell

You see, I don’t want to be the sucker and bet into this election…

Some recent trades include a 84% win on American Airlines (AAL), a 91% gain on OneMain (OMF), and huge 95% gain in NMI Holdings (NMIH)*

Ready to learn how I generate profits on a weekly and monthly basis?

Click here to sign up for Options Profit Planner today

0 Comments