A Safer Way To Buy The Dip?

Sure buying calls outright defines your risk.

However, when you think about what you need to happen in order to make money on calls, I believe call buyers can be at a statistical disadvantage.

Think about it like this…

When you purchase a call, you:

- Are working against time

- Susceptible to drops in implied volatility

- Need the stock to move to your favor… and depending

So what’s the alternative?

For me, it’s selling spreads.

In other words, I’m betting where a stock won’t go, rather than where it will. I believe this actually helps me stack the odds to my favor.

How?

Well, let’s just consider the bull put spread.

This strategy allows me to collect premium and remain bullish. Both my downside and upside are capped here.

However, the odds of winning can be higher than buying calls outright.

You see, when I use the bull put spread…

- The stock doesn’t necessarily have to go to a specific level

- Time is working in my favor

- If implied volatility drops, I stand to benefit

I also stand to gain in three different scenarios.

- If the stock trades sideways

- If the stock falls a little

- If the stock runs higher

The best part is there are “suckers” to take advantage of. For example, I’ve noticed there are plenty of traders who just go as far out as they can just to find a cheaper options price.

What they don’t understand is when they go so far out, the odds of the stock moving in the direction they thought it would are slim.

How do I find these trades?

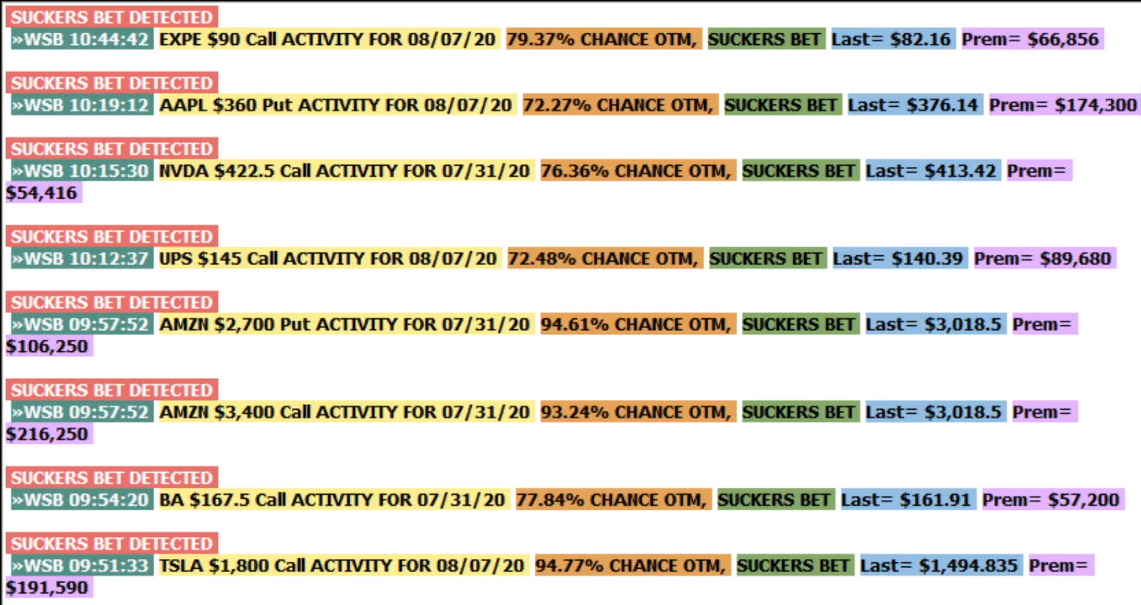

Well, I have a “sucker bet scanner”.

It lets me know the low odds bets I can take advantage of.

For example, take a look at this trade in Amazon (AMZN). Someone purchased the $2700 puts expiring this Friday, when the stock was trading at $3,018.5.

![]()

In other words, they’re looking for AMZN to suffer a massive drop after earnings.

However, they don’t realize if AMZN doesn’t drop significantly, those options will lose a lot of the time premium and most likely expire worthless.

I don’t try to trade earnings announcements, but if one was bullish on AMZN, they could look to sell the $2700 puts and buy the $2600 puts.

So if AMZN even drops a little or rallies, the trade would stand to gain.

Of course, there are other “sucker bets” out there, but I believe traders need to learn the strategy to take advantage of them.

I put together this eBook to help traders learn how to utilize this strategy. I believe it’s easier to understand than all the other guides or eBooks because you’ll learn the basics…

As well as get a feel of how they actually work through real-money case studies.

0 Comments