Do you feel like the markets are sometimes just a rat race?

Buy the rally, sell the rally… who knows what’s happening anymore!

And it becomes confusing when markets turn over… leaving you in a trade gone bad…when you were just bragging about how you perfectly timed the market move.

But you’re not alone…many traders are feeling like this, unable to peg any market trend or direction… leaving them with a bag of nothing and a bunch of losing trades at the end of the day.

I’m going to let you into a secret…my proprietary options trading strategy doesn’t pick losing trades.

That’s right!… My trading team at Options Profit Planner have successfully navigated these markets—going UNDEFEATED OVER THE LAST 8 MONTHS!

It’s so powerful, some say that I have unlocked the inner-workings of the markets!

And you know what?

Today I’m going to be talking to you about what is exactly I’m doing to have such a high trade win rate.

And how you can steal a page out of my playbook, and start churning consistent profits with my fractal energy.

First, A Little About Me

Did you know that studies show that the average millionaire has at least 7 sources of income?

It’s true! And since we can’t possibly be at every business at the same time, the key is finding ways to make passive income.

Like every other millionaire, I have several sources of income; from running a trading business, to managing active real estate portfolios, there are many ways I make steady income.

And to make it even busier, I am a husband and a father. So the time I allocate to anything must be worth it!

Which is why I make sure what I do has low-risk profit streams!

I can’t afford to be glued to my computer screen, chasing a recent biotech high-flyer stock for 250% gains. That works great for some, but not wealth builders like me.

So that is why I created my passive income-generating algorithm for trading stocks. It’s a reflection of myself and my business style that aims to collect profits consistently across any market condition.

And what I wanted to achieve is a business in the stock market and getting paid to trade.

This means I want to be the “house”, and unlike many traders, I will focus on credit strategies instead of debit strategies!

Without waiting anymore time… let’s talk about Options Profit Planner and how it can turn your trading business around in as little as 1 week!

Options Profit Planner

When it comes to trading, it’s actually more about psychology than mathematical models that attempt to use computers to reverse-engineer the stock market..

The financial markets are just a way to express the value of a company through the greed or fear of the investor.

If an investor feels safe, they are willing to put risk-on and buy stock.. This in turn drives greed in the chase of profits.

Alternatively, if investors are uncertain about the future, they will stop buying stock or begin selling the stock they own…all due to fear of the future and the desire to have risk-off.

But simply reviewing a stock chart doesn’t tell the entire picture… you need tools that help you decipher exactly what is happening in the stock market!

This is where chart patterns, technical analysis, and fractal energy comes into action.

And it’s easy to go overboard with indicators, creating an “indicator soup” strategy. Trust me…this never works and most new traders fail to understand this!

Which means I only use a handful of indicators to power the system behind Options Profit Planner

These two indicators are:

- Fractal Energy

- Bollinger Bands

That’s it! There’s no reason to make it any more complicated!

And I execute all my trades in the options markets because I want to get paid to trade instead of paying the markets.

How does a trader achieve this? By leveraging credit option trading strategies that stock the odds of winning in your favor.

What Is Fractal Energy

Fractal Energy is the cornerstone indicator of Options Profit Planner and its power is used to pinpoint key market reversals.

The power of fractals allows me to determine the strength of trends and how much “life” is remaining in a stock’s movement.

There are 2 main components of Fractal Energy:

- Fractal Pattern

- Energy

And when you use the power of this indicator you will be able to successfully determine the strength or weakness of trends on any stock.

By using Fractal Energy Indicator, Options Profit Planner has been able to predict this move down and this bounce almost perfectly!

And the way to predict larger market movements is to reference a longer time frame to understand what the major trends are doing.

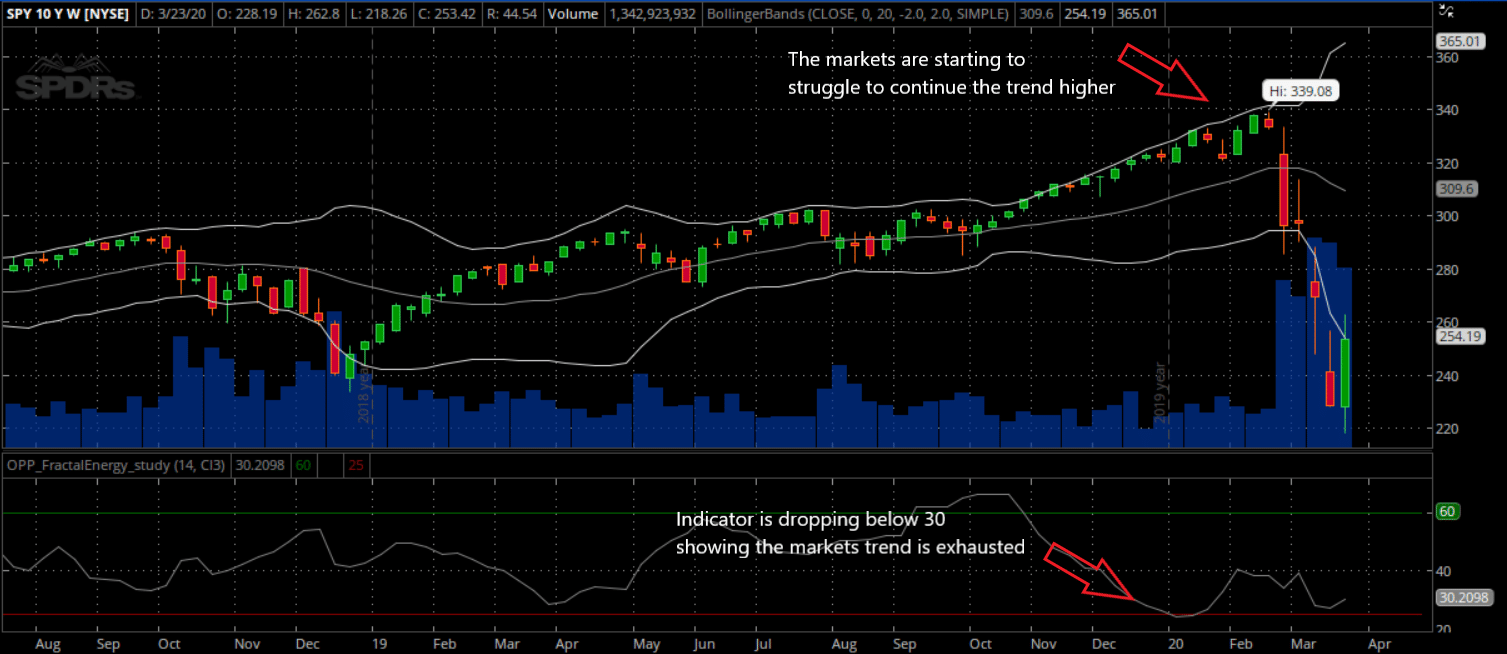

Let’s take a look at SPY’s with the Fractal Energy plotted…

Source: Thinkorswim

Here is how this breaks down…

Breaking down what Fractals said about the markets at all time highs:

- The Fractal Energy indicator dropped to new lows, below the lower threshold value of 30

- Markets struggled to continue trend higher, showing weakness in the stock

And the same indicator can alert you to when a stock is exhausted and about to make a bottom too!

Let’s take a look at how Fractal Energy can spot market bottoms.

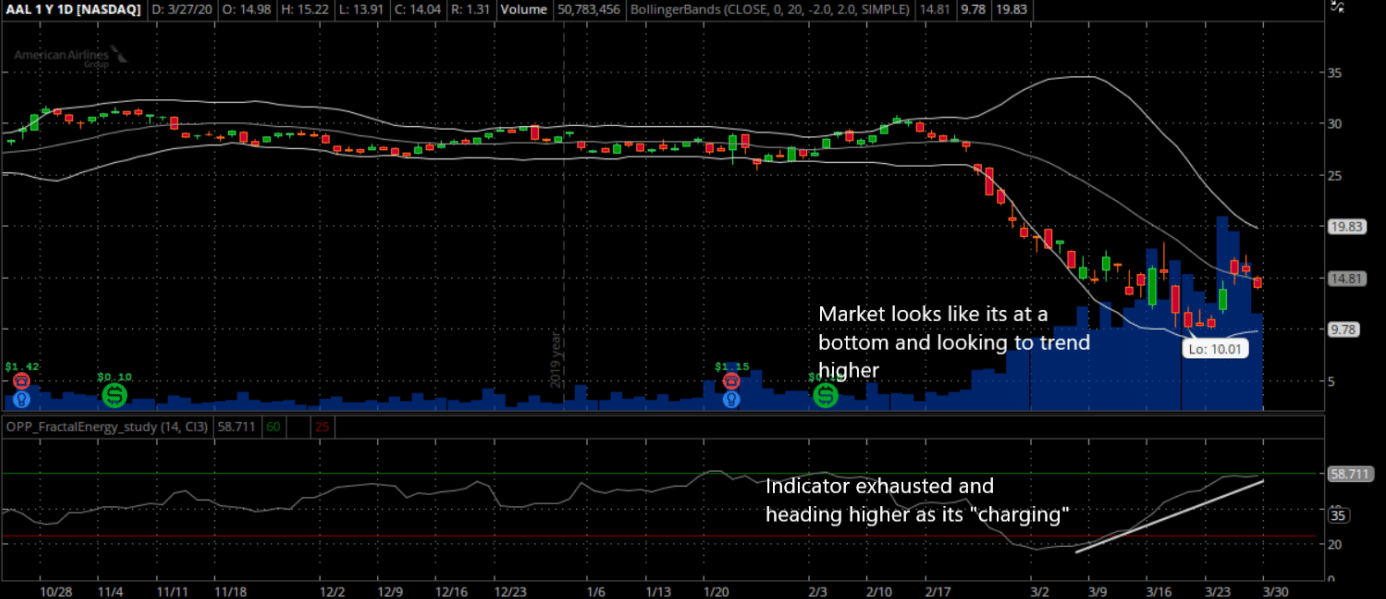

Source: Thinkorswim

In this example, AAL is starting to put in a bottoming pattern at the lower bollinger bands and the Fractal Energy is starting to “charge up” as it climbs back from its low of 20’s to its highs of 50’s.

Key points from analyzing the stock chart:

- The daily bars appear that they are ready to bounce back from the sell-off\

- Higher lows looking to form to confirm uptrend

- If low istested, it must hold to give a “double bottom” pattern

- The Fractal Energy is getting “charged up” showing the stock is ready to trend again

Now that you know the direction of the markets, one of the best ways to trade this is by selling options!

A Credit Trading Strategy

Before we dig into an example trade, let’s review my favorite credit trading strategy, the short put, and how to utilize this tool to achieve steady and consistent income.

For instance, if you’d like to buy a stock at a lower price than it’s currently offered on the market, while getting paid to wait until it drops, then you should consider a short put strategy.

What Is a Short Put?

A short put, or naked put, involves selling a put option for immediate credit. Meaning, you are paid upfront for placing this trade!

And there are two outcomes… you either get paid to own the stock or you get paid to place the trade.

Either way, you’ll be paid to take this position!

This means if you want to own AAPL 40% below the current market price, you can sell puts on this stock that are 40% out of the money and collect the premium!

Then if AAPL trades down to, or below your strike price, you will own the stock at that price for it to trade higher! That’s a win-win in my books!

So how does this work when trading?

Trade Breakdown

So let’s take a look at a sample trade on AAL recently.

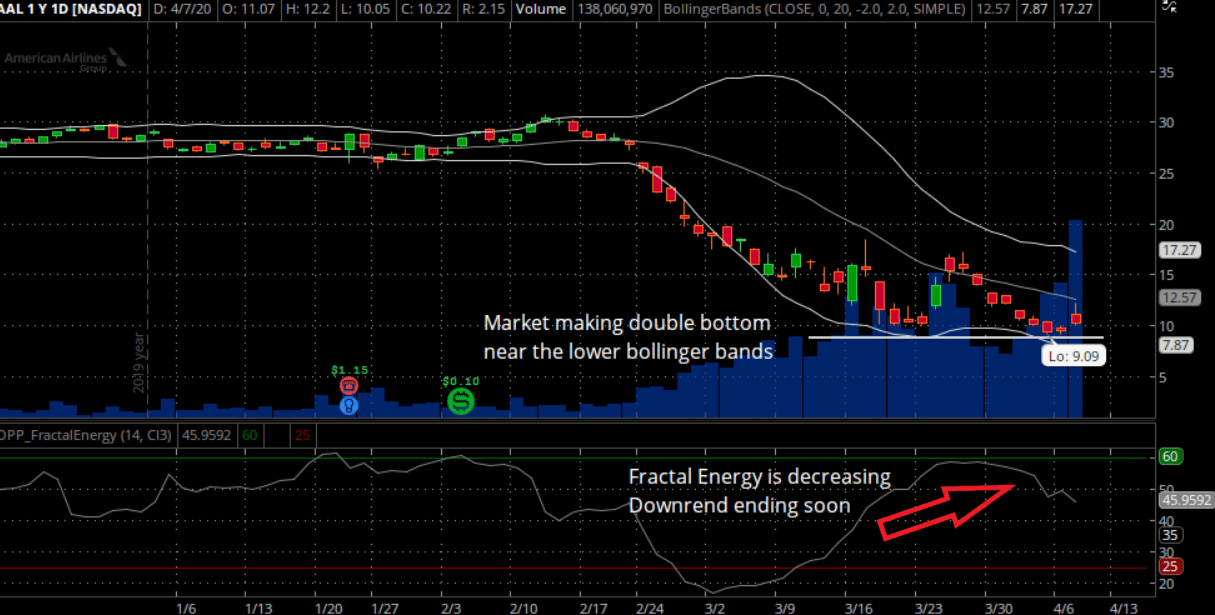

By looking at the Fractal Energy, it seems that AAL should be trending higher as energy builds.

Source:Thinkorswim

From the chart it seems AAL is going to finally rally at the double bottom and at the lower bollinger band.

Source: Thinkorswim

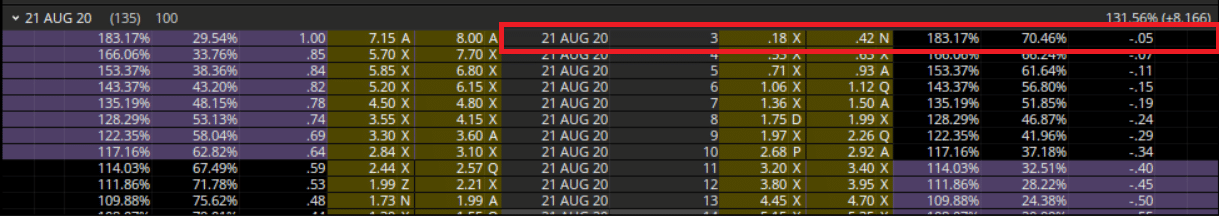

By selling 1x Aug ’20 $3 put for $1.00 – a trader can get the long stock and collect income if the contract rallies. The trader can also get assigned stock if the market falls below this level.

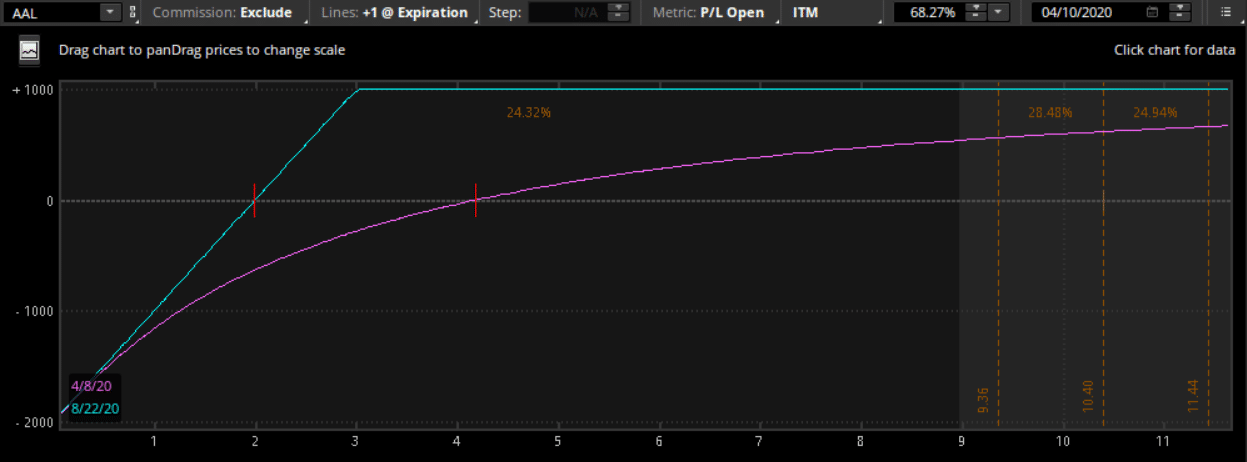

And here’s the risk profile for this stock.

Source: Thinkorswim

Wrapping up

As you can see, there are many advantages to trading a short options strategy instead of buying premium.

Let’s take a look at some of the pros and cons of selling options.

Pros to selling options

Smooth Return Stream

Selling options is one of the most reliable and stable sources of returns in the markets.

Premium selling strategies tend to have extremely high win rates and are a great way to grow trading capital over time.

Winners Mentality

Most traders tend to feel better when they are winning rather than losing. This makes sense that traders would benefit from a system that has them winning a high percentage of trades.

This boosts confidence and leads to less “second guessing” the trade. This confidence tends to lead to smaller losses compared with traders who are buying “lotto tickets”.

Cons to selling options

No “Grand Slam” trades

Selling options tends to be “singles and doubles” type of trading. The knowledge that a big grand slam is right around the corner keeps traders coming back to their screens every day, waiting for that huge opportunity in the markets.

Unfortunately, option sellers won’t have this rush of excitement like hitting it big at the casino.

Potential of large losses

Another huge negative is the potential for large losses. While this is a remote possibility, it does still exist depending on the underlying security traded.

Traders can mitigate their risk to large losses by trading credit spreads rather than naked options. This is the “best of both worlds” as the trader can play the house odds while maintaining a controlled and limited risk profile for their account.

Final Words

To summarize, premium selling is known to generate a wildly profitable and extremely smooth equity curve.

But it has many benefits that are associated with a strategy like this one.

Some key benefits are:

- There is the risk of an occasional loss with selling a naked put, but this is mitigated with the use of credit spreads.

- Get paid upfront to take your trade

- The return of a premium selling options book is that of a mean reversion stock trading system, with a large number of small wins with the occasional larger-loss trade.

- Selling Naked Puts is one of my favorite strategies since it allows me to purchase stocks at a discount and get paid doing so!

Want more proof that selling options is the only way to consistently make money?

Then stop what you’re doing and watch this.

0 Comments