Are you tired of bleeding money trading options?

Do you want a 67% chance to make money?

Want that competitive edge in the markets?

Look no further than the Options Profit Planner!

Today, we are going to take a closer look at what exactly an option is and how they are used to achieve our targeted goals.

So crack your knuckles and buckle in so you can be a master and leverage the power of this simple options strategy.

There’s no better time than now to kick it into high gear!

However, you need to ask yourself two questions and remain focused on them.

The WHY and the HOW…

Why do we place these strategic options bets?

How do you actually implement and make money off the setup?

If you lose track of the thought process behind this strategy… you’re better off just going to a casino with your hard-earned money.

Remember how I told you I like to purchase market property at or below market value while being paid for doing it?

That also applies to trading… and when I tell you about all the innerworkings of one of my favorite strategies to use to consistently rake in profits in the options market…

… you’ll be kicking yourself wondering why you haven’t been using it… because it actually could improve your odds of success.

So what’s the strategy I’m referring to?

It’s all about the cash flows, or the “Rent”…

Rent payments are the way we make those Benjamin’s on that market property.

To start, how do you purchase a stock below market value?

Let’s take a closer look at the options markets to find our answers.

For example:

Stock A is currently trading for $30/share.

Hold on… but I told you that I like to buy cheap stock, so $25/share sounds more like my price…

I can do this by selling out of the money options!

If I want to own a stock, I choose to sell a naked put.

Don’t be confused with the hit TV Show, “Naked and Afraid”… There is nothing to be afraid of when you follow these easy steps to successfully trading naked puts.

Now you’re probably thinking… what are options and puts?

Let’s understand more about options first.

All options have many variables that impact price, but there are only two main criteria that we should focus on.

The two main criteria are:

1) A price obligation

2) The time to expiration

Price Obligations

An obligation on selling put options is if the price falls below your strike, you will be required to own that stock (at the strike price).

Let’s take a look at a quick example.

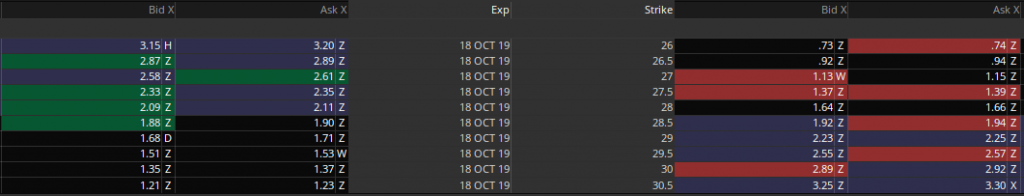

The options available to trade for 18 OCT 19 are listed here. It’s standard practice to list options with calls on the left and puts on the right side of the grid.

With this stock trading at 28.25, selling the 26 strike will give you stock that is about 7% cheaper than its current trade price, and you will be paid for the trade.

More on this to come but let’s take a quick look at a sample options chain to learn about the second criteria, option expiration.

Option Expiration

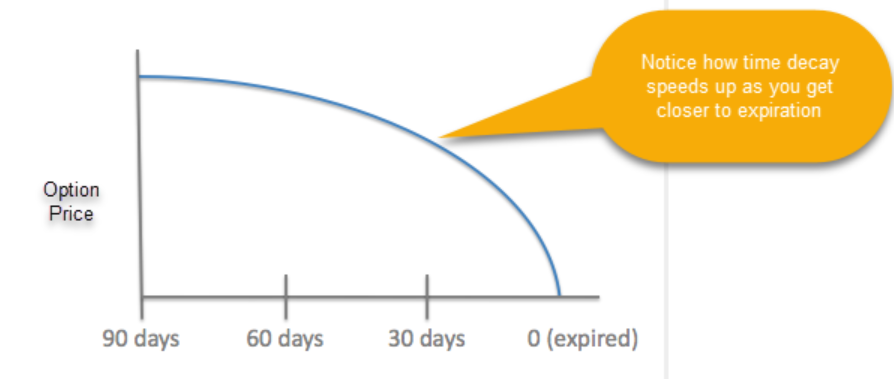

Decrease in option value and time until the expiration of options is the theta and expiration for options…

The closer you get to expiration, the faster options decay in value.

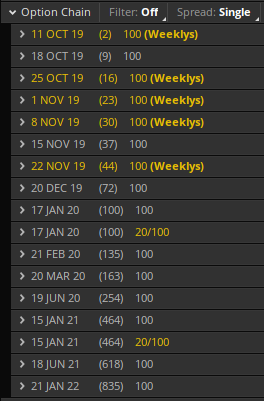

A time limit is how long the options are “alive” for. On many stocks, they have weekly and monthly options.

An example:

18 OCT 19 (9) shows there are 9 days left until those options expire on that branch.

Theta will speed up the closer you get to expiration and you will lose profits quickly if you are long options.

In the chart below you can see how rapidly the option price drops with less than 30 days until expiration.

Pro tip: It’s a must to trade 90 days (or more) before expiration making sure to work with the flat-ish part of the curve.

I know… this might look confusing with math and charts at first… but it’s actually very simple.

2 simple rules

Rule 1 : Only trade Monthly contracts

Rule 2 : Look to SELL options only!

That’s it!

What does a real trade look like?

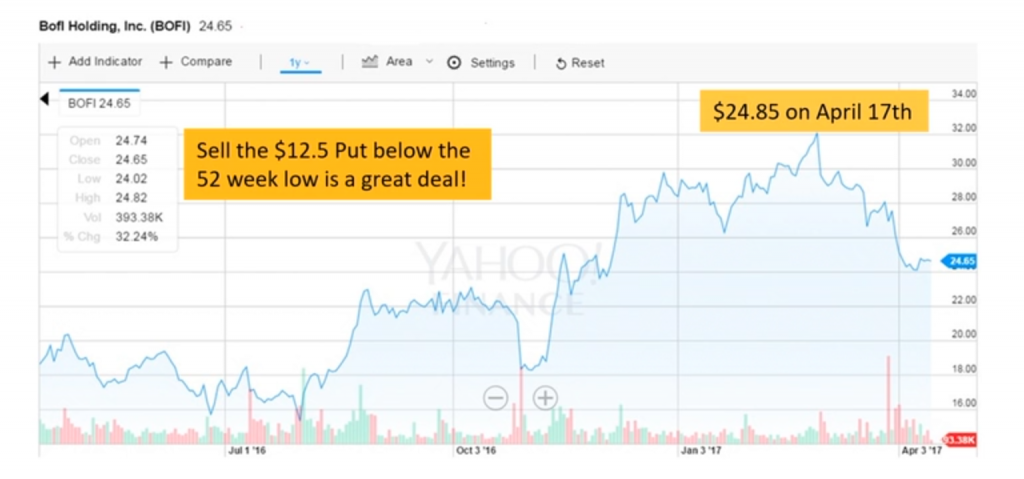

Let’s check out this trade on BOFI I had on for a huge win.

I want to own the stock at $12.50 that’s BELOW the 52-week low!

So what did I do?

I sold the $12.50 put options and collected my rent!

What do I want to happen?

- The market to rally and keep my rent money

- The market to continue to sell off and I own a great property under market value AND I was paid to own the property

What does this mean?

That’s like putting an offer on a house to buy it well below market value and requesting to be paid up front to purchase the property only at that price!

At this point I bet you are thinking… how many trades like this are available to us that we can sell puts on?

The good news is that they happen every single day!

Trades like these put those house-odds of 67% in your favor!

Wouldn’t you like to increase your wealth by over 50% annualized returns per year in only 10 trades?

You can produce huge yearly returns and grow your wealth like the pros do!

P.S. Wouldn’t it be even better if I told you it takes 15 minutes a week to do?

0 Comments