When the markets run higher there’s one thing you do… hold on for the ride

But when the markets go flat to sideways, a trader needs to be more strategic

And that’s where everything starts to break down

Place the wrong trade at a breakout level and you’re getting stopped out

Many times new traders watch the market go back lower in a “ M “ or higher in a “ W “ pattern trying to anticipate the move.

And this will usually spell losses on your positions

But… it’s not game over that quickly!

By using this trading strategy you can have profits if the stock goes up, down, or sideways which means you remove the risk of picking the wrong direction!

Ready to learn more about this trading strategy?

Options Profit Planner

Options Profit Planner is focused on the use of technical analysis and Fractal Energy but there’s a handful of trading strategies that still need to be studied.

Typically if a trader is interested in going short and using the options markets, the first thing that comes to mind is to purchase a Put.

A purchase of a put option does two main things for a trader. It allows a trader to benefit from the decrease in the price of the asset and it limits or decreases the amount of loss they may incur.

This is much less risky than shorting the underlying asset and the trader can use the leverage of options to increase their gains as well.

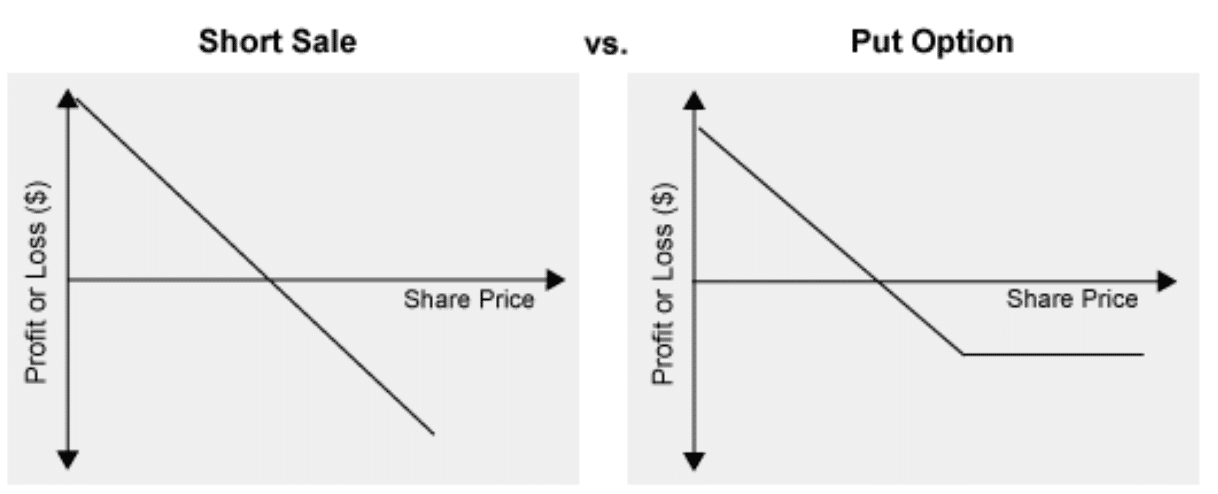

Here is a payout diagram for both a short stock and put option.

The diagram on the left shows a traditional short sale of a stock. With this, there is an unlimited loss as the share price increases!

The diagram on the right shows the purchase of a put option. With this, there are limited losses as the share price increases!

Pro Tip: If you want to short a stock and you are aggressive with the direction, buying at the money puts gives you the most bang for your buck.

So what’s the benefit of using this strategy?

- There is limited risk if you get the trade wrong

- There is unlimited upside gains if you get the trade right

Now… there is something I must remind you of…

If you are wrong on the timing, your options may expire and you will still lose the trade.

And a solution is a strategy called a Credit Call Spread.

The Credit Call Spread

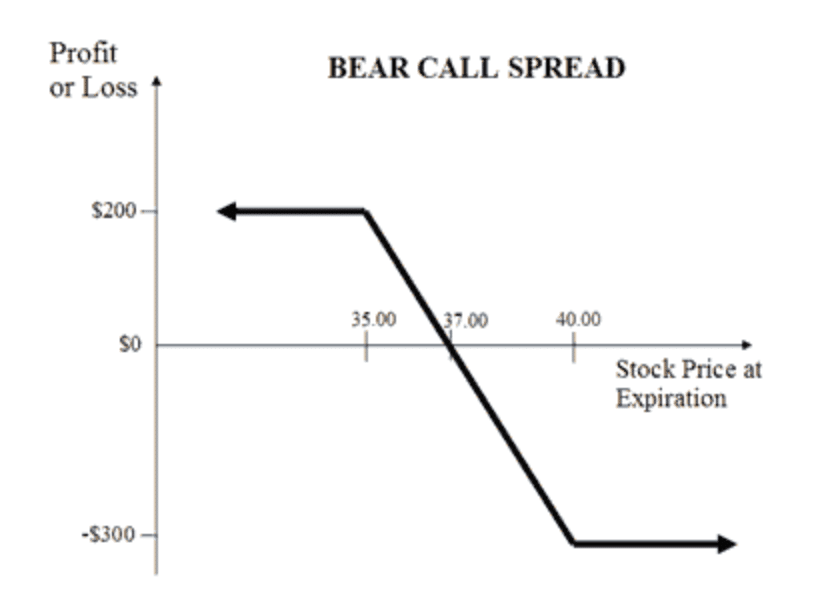

The Credit Call Spread (or Bear Call Spread) is a bearish to neutral options trading strategy.

It aims to capitalize on both downward price movement of the asset and theta decay.

Credit call spreads work extremely well in both directional and sideways markets as the options will expire worthless at the end of the trade, leaving the premium for the trader to collect on.

What does that mean exactly?

It means that you receive the cash upfront …

That’s right, you get paid to take that trade!

Another huge benefit of this trade is that it has a lower max loss compared to selling calls and even purchasing put options.

As a seller of options, we can still make money even in a sideways market!

This is such a great strategy since it allows me to trade a short call and have a max loss on the trade. This is a must to capitalize on premium decay and also market direction on the trade.

Now let’s take a closer look at the details of using this strategy and what to expect from it.

Credit Call Spreads – The Details

Remember , the goal is to profit from a neutral to bearish price action in the underlying stock while minimizing the impact of volatility and time decay.

What is this made up of?

This strategy consists of one short call with a lower strike and one long call with a higher strike.

Max Profit

The bear call spread is a net credit received, and you will get paid up front to take this trade. If the stock closes below your lower strike, you will be able to keep your entire credit received.

The potential profit is limited to the net premium received from placing the trade.

Max Profit = Net credit received

Max Risk

The maximum risk on this trade is limited, unlike naked calls, or short stock.

The maximum risk is calculated as the difference between strike price minus the net credit received.

Max Risk = strike higher – strike lower – net credit received

The maximum risk is realized if the stock price expires at or above the long call at expiration.

Breakeven

Like trading most trading strategies, there’s a breakeven that a trader needs to consider on this trade.

Dreakeven = strike price -the short call + net credit received

Now that you know these three basic calculations, let’s take a look at some of the factors that impact this strategy.

Additional Factors of Credit Call Spreads

As a reminder…

The bear call spreads is a strategy that collects option premium and limits risk at the same time. They profit from both time decay and falling stock prices. A bear call spread is the strategy of choice when the forecast is for neutral to falling prices and there is a desire to limit risk.

Impact of stock change

Bear call spreads benefits when the underlying price falls and is hurt when it rises.

This means that the position has a net negative delta for the trader.

Delta estimates how much an option price will change as the stock price changes, and the change in option price is generally less than dollar-for-dollar with the change in stock price.

Also, because a bear call spread consists of one short call and one long call, the net delta changes very little as the stock price changes and time to expiration is unchanged.

In the language of options, this is a “near-zero gamma.”

Gamma estimates how much the delta of a position changes as the stock price changes.

Impact of volatility change

Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices.

As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant.

Since a bear call spread consists of one short call and one long call, the price of a bear call spread changes very little when volatility changes and other factors remain constant.

In the language of options, this is a “near-zero vega.”

Vega estimates how much an option price changes as the level of volatility changes and other factors are unchanged.

Impact of time change

The time value portion of an option’s total price decreases as expiration approaches. This is known as time erosion.

Since a bear call spread consists of one short call and one long call, the sensitivity to time erosion depends on the relationship of the stock price to the strike prices of the spread.

If the stock price is “close to” or below the strike price of the short call (lower strike price), then the price of the bear call spread decreases (and makes money) with passing of time.

This happens because the short call is closest to the money and erodes faster than the long call.

But… if the stock price is “close to” or above the strike price of the long call (higher strike price), then the price of the bear call spread increases (and loses money) with passing time.

This happens because the long call is now closer to the money and erodes faster than the short call.

If the stock price is half-way between the strike prices, then time erosion has little effect on the price of a bear call spread, because both the short call and the long call erode at approximately the same rate.

Wrapping Up

Option sellers take maximum advantage of the option time decay theory, commonly known as Theta Decay.

OTM options lose value quickly and become worthless at expiration. This allows traders to not have to worry about correctly predicting the market direction or timing the market perfectly to generate income.

We can take advantage and be the house with odds in our favor on every trade

Don’t forget that an option buyer needs to be right about direction and time!

There are many ways to make money in this market and selling options is one of my absolute favorite go-to strategies.

Key Points:

- Credit Call Spreads profit if the stock goes down, stays the same, or goes up

- Limited risk vs naked calls

- Puts the house odds in your favor

- Allows you to get paid to take risk

Click here to sign up for Options Profit Planner today

0 Comments