Do you have a desire to build a trading business that will generate consistent income for you and your family?

If you answered yes then I have something to share with you…

Selling options is one of the fastest ways you can generate tremendous returns on your stock portfolio.

There are several reasons why, here are just a few:

- Odds of winning over 60%+

- Return on Investments of up to 100%

- Defined risk on every trade

- Paid upfront to take the trade

Of course, without the right game plan, even a great strategy can turn out to be a loser. That’s why I want to take the time and walk you through the mechanics of the covered call strategy.

These simple, easy to follow rules will help you avoid disaster, and even put you on the path to consistent profits.

The Covered Call Strategy

A covered call is an options strategy that allows a trader to collect additional income on a stock that is in their portfolio.

This strategy is considered a mildly bullish strategy because the upside of the trade is capped from further gains. This is unlike a long call option or long stock position which have unlimited upside potential.

When establishing a covered call position you would want to target a stock you own or plan to own in your portfolio.

Next, you want to select a strike price of a call option that is either at-the-money (ATM) or out-of-the-money (OTM).

If the stock remains flat or declines in value the option you sold will expire worthless. This means that you will get to keep the premium you received when they were sold.

For example,

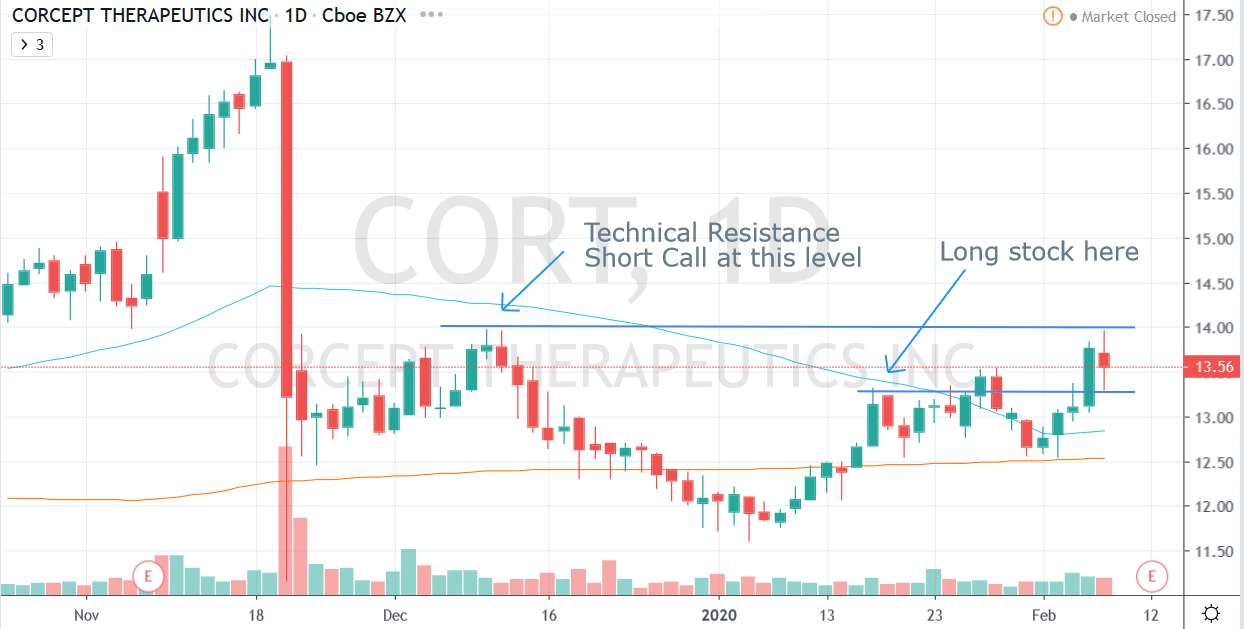

The Trade: CORT – Buy 100 shares at $13.30

Source: www.tradingview.com

I use a custom-built technical analysis scanner to find trades like these every week.

Selling the calls for the Covered Call position can be done for many reasons.

A few examples are:

- Expecting a slightly bullish, if not bearish to neutral in the upcoming weeks or months

- Technical level expected to suppress stock price in near term

Since $14.00 on the chart is a decent technical level to expect the stock to decline from, it’s a great candidate for a covered call strike price.

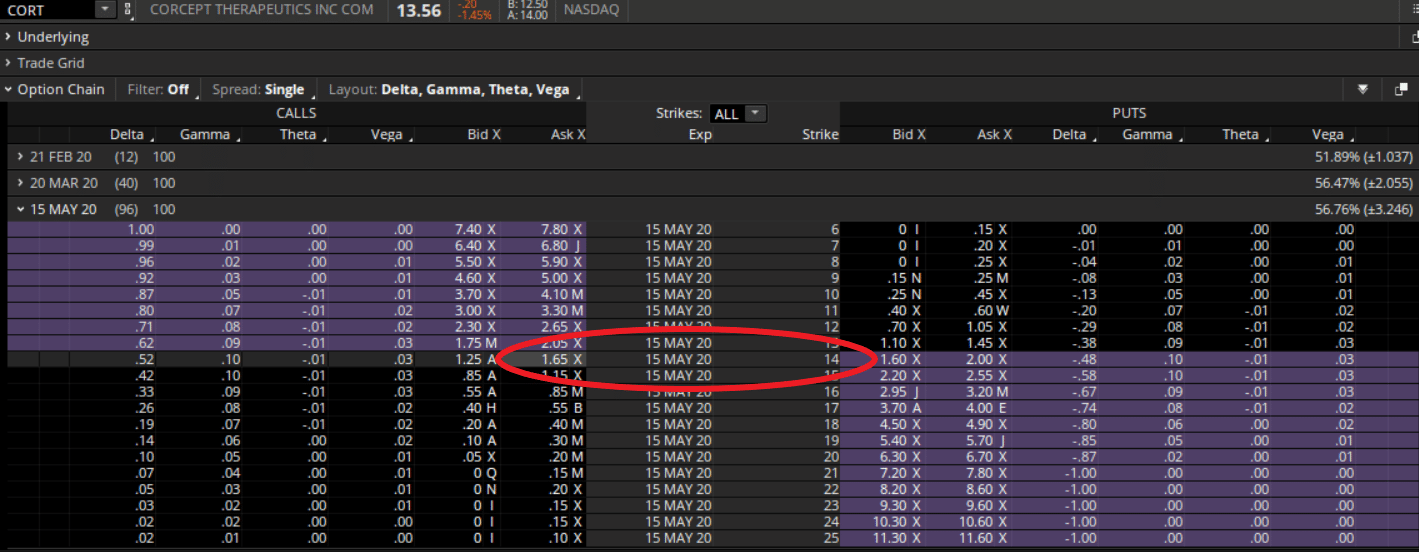

Source: think-or-swim

Taking a look at the option chain, the ATM calls are the best choice for this trade.

Therefore…

The trade: Sold the May ’20 $14 covered call for $1.65

Let’s take a look at how this works:

Breakout Of The Trade

First, I always like to know what returns I can see from my trade.

To find this, you want to divide the premium collected by the value of the stock position.

For CORT: 165/1330 = 12.41% return of investment

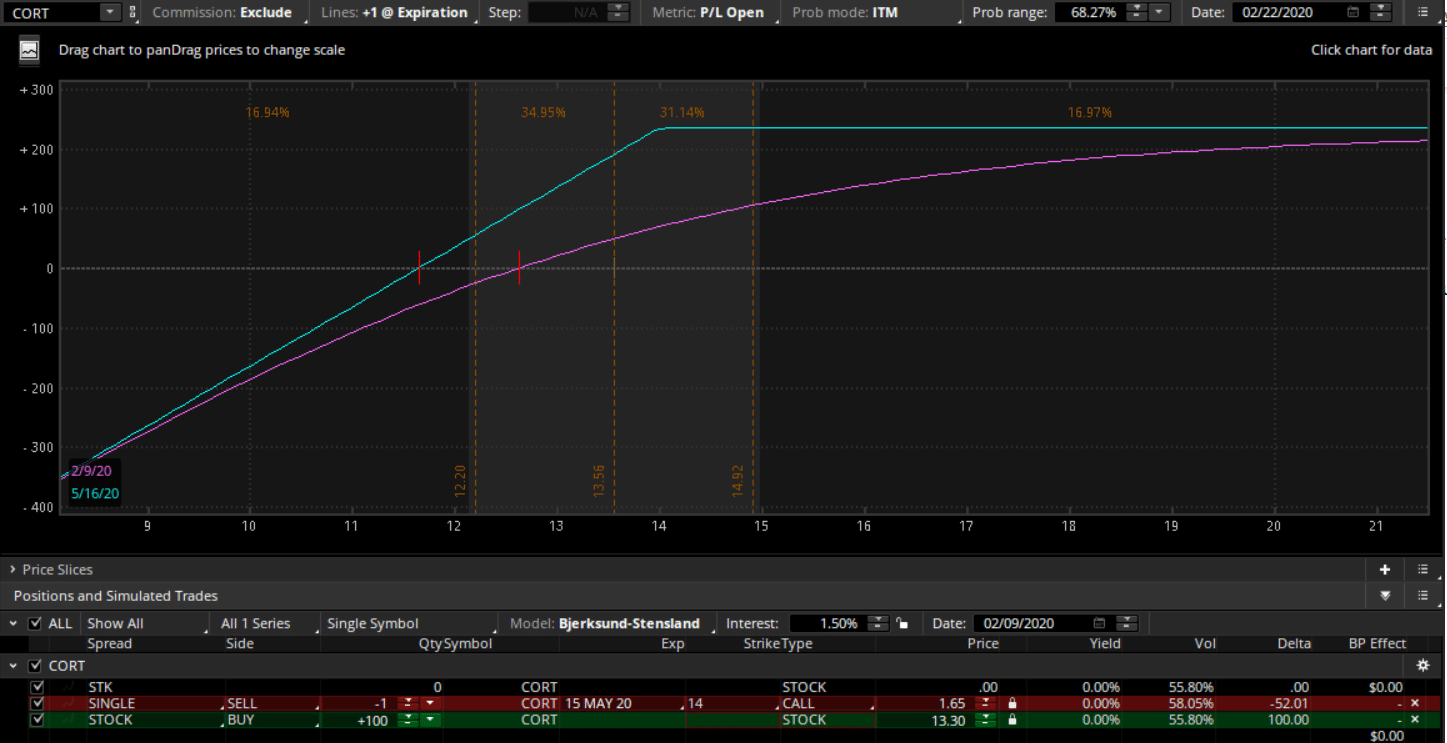

Here is a sample of the risk diagram for the trade:

Source: think-or-swim

The covered call has two calculations, the max profit a trader can receive and the breakeven on their trade.

Like a long stock position, the loss to the downside is the same.

Max Profit: Premium received + (Strike – Stock Price) = 1.65 + 0.70 =2.35

Breakeven: Stock price – premium received = 13.30 – 1.65 = 11.65

Now that you understand those two numbers…

How do you get to keep the entire premium?

The stock closes at or above $14 at the expiration date.

In this case, you will collect the premium received plus the increase in the underlying stock price.

This is the Max Profit calculated above, and will be $2.35 / contract

In other words, the max profit potential from this trade is 235/1330 = 17.69% profit!

As you can see, this strategy has the potential to significantly increase your returns on the stock position you currently have on.

Additionally, by selling calls against your long position, you are essentially hedging your bets on the trade.

If a stock was to sell off and go against you – the short calls will offset some of the losses on the initial stock trade.

Ways The Covered Calls Make Money

There are 2 ways the Covered Call strategy makes money:

- Stock stays flat or declines

- Stock trades higher

As you can see, this strategy has more than one shot at winning and that is extremely appealing to many traders.

And if you are a new options trader, you have only had the luxury of having a single way to win trading stocks.

Additionally, the worst fear many stock traders have is actually the loss of potential profits instead of risk to the downside.

That is where a Covered Call strategy is not an ideal trade. If you are extremely bullish on your stock, it is not recommended that you trade this strategy.

Why?

Well, the short call above your market price is going to limit your profit potential and cap your returns until the options expire or you exit your calls early.

That’s one of the biggest risks to a Covered Call trader.

Hold on… but what about the downside risk?

It’s essentially the same as owning the stock itself!

There is no added risk to trading the covered call to the downside versus owning stock.

Next… let’s talk about what stocks you would want to select for this strategy.

Stock Selection For A Covered Call

This is definitely not a stock you would want to trade on Bitcoin, Tesla, or any high-flyer names.

You will restrict all of the profit potential on those trades, essentially stepping over dollars to pick up pennies.

Instead, the covered call strategy works well with blue-chip stocks and other slow growth sectors and companies.

Since most blue-chip stocks have relatively low volatility, trading a covered call can go a long way in helping boost your returns on these otherwise sleepy names.

This is also where a stock screener tool can help make your stock selection easier.

There are many other ways you can trade a covered call. One of them is using LEAPS instead of using the underlying stock to help with capital outlay for traders with smaller accounts.

The “Poor Man’s” Covered Call is extremely useful for trading a stock that is expensive and otherwise unable for a small investor to be involved in, such as Google or Apple.

Great – now that you know how to select stocks… let’s talk about how to manage your position and unwind your options.

Trade Management

Trade management is difficult, even for the most experienced traders…and is even completely overlooked!

That’s why I put together the 7 rules in trade management that are available to you when trading a covered call and find yourself in a spot where you need to make a quick decision.

The 7 rules in Covered Calls trade management:

- Expiration: Do nothing and let your options expire worthless.

- Assignment: Do nothing and let your stock be called away at or before expiration.

- Close-out: Buy back the covered calls (at a gain or loss) and retain your stock.

- Unwind: Buy back the covered calls (at a gain or loss) and simultaneously sell your stock.

- Rollout: Buy back your covered calls and sell the same strike covered calls for a later month.

- Rollout and up: Buy back your covered calls and sell higher strike covered calls for a later month.

- Rollout and down: Buy back your covered calls and sell lower strike covered calls for a later month.

There you have it…those are my 7 rules in trade management for the Covered Call strategy.

Wrapping Up

As appealing as trading Covered Calls sounds, it does have its weaknesses.

It’s best to remember:

- Covered Calls do not work for extremely bullish positions as it will limit your profit potential

- Covered Calls do not prevent your account from having major losses like a Protective Put strategy would have

What are some other strategies other than a covered call?

Maybe you would prefer looking for a risk-defined strategy that is mildly bullish? If yes, consider the income generating strategy called a credit put spread.

The bottom line is this… as with most options strategies, there are many pros and cons to consider before placing a trade.

And it is best if you take the time and understand exactly what risks you are potentially placing yourself in when trading this strategy before hitting that send button.

Now, if you are ready to jump into options trading with covered calls or need guidance when making your first step, click here to learn more details about the Options Profit Planner!

0 Comments