Have you ever been in a position where you bought puts on a stock thinking it was heading lower, just to watch it trade sideways?

And then you are stuck watching your premium evaporate?

Well, if you haven’t, you will at some point in your trading career.

Then once it trades sideways, this premium is “sucked out” of the options price as quick as it went in.

And if you were buying into this price action, chances are you are stuck holding the bag on a losing options trade.

But it doesn’t have to be this way!

You see, by trading a credit spread, instead of buying options, you can be the one selling those options to a trader looking to take a bet on the stock falling further.

If you get your timing right, you can be looking at 50% or more returns in just a snap of your finger.

Now, let’s take a deeper dive at how I use credit strategies and how they have changed my trading forever.

Credit Spreads

The market has moved a fair amount higher since it’s big drop due to the virus.

But we are not sure what the future brings, but premiums are elevated due to people speculating on the direction the markets are going to take during the election period combined with corporate earnings that are starting to heat up.

So with that in mind, a credit spread could prove to be a useful trading strategy to take advantage of both the sideways markets plus the elevated volatility.

There are two main types of credit spreads I like to trade:

- Credit Put Spread

- Credit Call Spread

Credit Put Spread

The credit put spread, or sometimes called, “bull put spread” can be an effective way to profit when an option trader expects the stock to stay at or above a certain area.

Many times, this area is potential support in the form of a pivot level or maybe a moving average that is approaching from below.

Let’s take a look at how this trading strategy can be implemented.

Creating A Credit Put Spread

A credit put spread is created by selling a put option and buying a lower strike put with the same expiration.

Maximum profits is the credit received (the credit collected – the debit paid) and it would be earned if the options expire worthless. This would occur at or above the short strike at expiration.

Let’s take a look at an example of this.

Source : Thinkorswim

As you can see, the credit put spread is going to allow you to generate income if a stock was to trade at, above, or even slightly lower than its current trading price.

And it’s this built in wiggle room that makes credit spreads so important to my trading.

Now let’s take a look at a credit call spread.

Credit Call Spread

The credit call spread, or sometimes called, “bear put spread” can be an effective way to profit when an option trader expects the stock to stay at or below a certain area.

Many times, this area is potential resistance in the form of a pivot level or maybe a moving average that is approaching from above .

Let’s take a look at how this trading strategy can be implemented.

Creating A Credit Put Spread

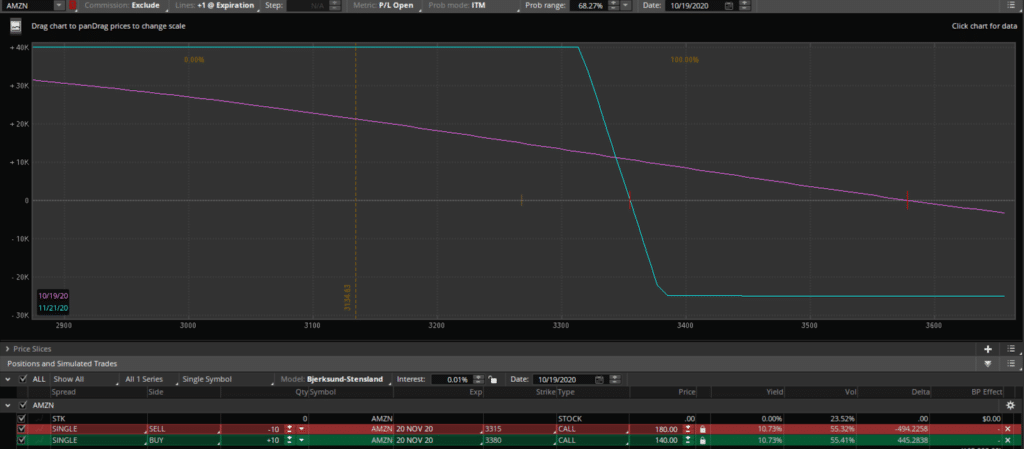

A credit call spread is created by selling a call option and buying a higher strike call with the same expiration.

Maximum profits is the credit received (the credit collected – the debit paid) and it would be earned if the options expire worthless. This would occur at or below the short strike at expiration.

Let’s take a look at an example of this.

Source: Thinkorswim

As you can see, the credit call spread is going to allow you to generate income if a stock was to trade at, lower, or even slightly higher than its current trading price.

And it’s this built in wiggle room that makes the credit call spreads so important to my trading.

Wrapping Up

When trading a stock and I want to take a short position, trading a bear call spread is a must if you anticipate lower prices in the future.

And when trading a stock that I feel comfortable owning, either a credit put spread or even a short put is a great way to go long a stock if you anticipate higher prices in the future.

But it is the built in security that I know I won’t be risking unlimited losses if a stock was to trade to an unknown price is a huge benefit of this strategy.

Unlike a credit put spread where you are safer selling a put since the downside is limited to both zero, or ownership of a stock, a short call has unlimited losses on both the options and the short stock position.

And when you trade credit spreads – profits are something that can be achieved like a casino collecting its revenue from traders betting on games.

Ready to learn more about how I trade credit spreads for monthly income?

Sign up to Options Profit Planner here

0 Comments