Many traders feel frustrated and left out because they missed this recent move higher.

However, it’s not a market-wide surge higher like last time — you can’t just randomly hit the buy button and assume the stock you’re in goes up right now.

This move is far more surgical…more precise…

And with the way the markets have been acting lately, I’ve made sure to stay nimble and wait for opportunities to come to me.

I mean, many of the major indices were at key levels earlier in the month, and I want to teach you how to take advantage of these moves.

Earlier in the month, I pointed out to my Options Profit Planner subscribers that I was interested in the Russell 2000 (RUT) stock index as a potential long trade

Listen, I have been following Fractal Energy trades for a long time, and I understand the way a stock moves when specific setups occur.

Now, let me walk you through this trade idea and the chart pattern that let me know RUT was ready to rumble…

And how I took advantage of this opportunity for nearly a 100% win*

CREDIT STRATEGY FOR INCOME

Selling put options is a great way to put the power of the casino in your favor.

This means you’ll be selling options to the gamblers, and collecting income as you go.

Pretty sweet, huh?

This strategy checks off a lot of boxes when it comes to ease of use plus the extra income you can generate

And one of my most favorite parts of this strategy is that I am paid upfront for taking this trade.

All options come with two main parts:

- A price obligation (the strike price)

- A time obligation (the expiration date)

How I Uncovered The Direction Of RUT

On Nov 23rd at 8am…

The S&P and RUT daily charts are still in the exhaustion zone and we’ve barely begun to release the weekly energy. I think we will see another week like last week this week with some chop, especially with the holiday mid-week and then black Friday to end the week. It is not uncommon to see big swings in weeks like this because they are low volume weeks and a lot of traders are out. So, I would not be surprised to see big swings up and down but really go nowhere in the end. The daily charts just need a few days to get charged back up and there is no way around it.

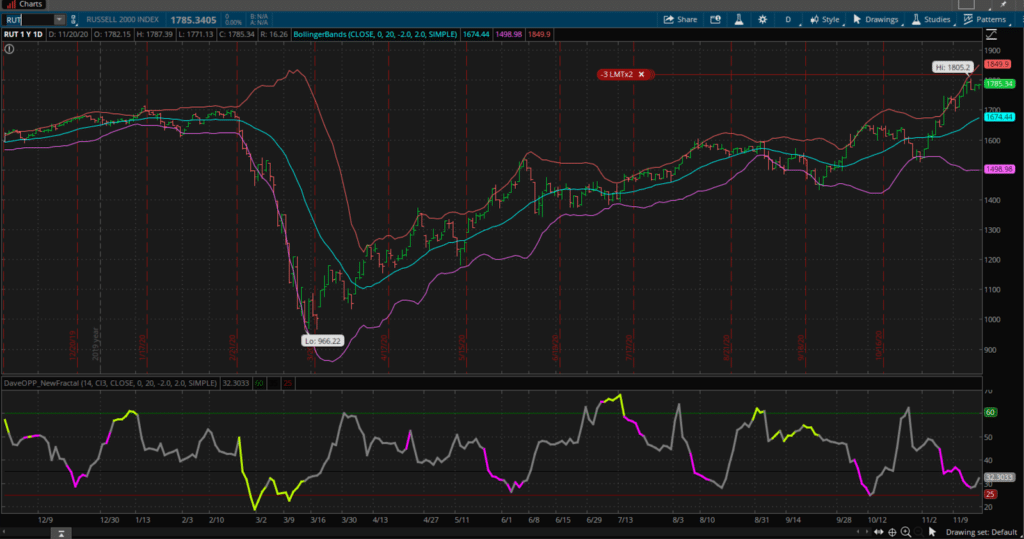

This is a great environment for an Iron Condor on the RUT like we did last week. Even with the market opening higher today, it will be hard to sustain. You can see the RUT daily chart is still in exhaustion with its energy at 37 on the chart below and will take some sideways chop or downward movement to recharge it.

Source: Thinkorswim

And if you look at these indicators, the Fractal Energy of the RUT was completely exhausted on the daily chart, with a value near its yearly lows.

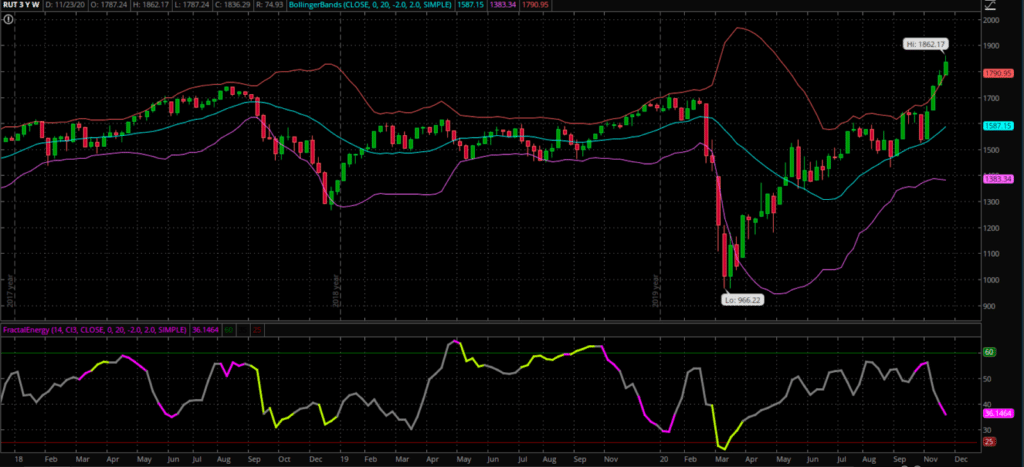

On the weekly chart, we were starting to see a similar setup occurring

Source: Thinkorswim

Now, I said the markets were starting to show signs of exhaustion… not to go short!

Which is why I ultimately decided to trade a Credit Put Spread strategy

You see, I needed a defined risk strategy while being able to maximize my potential returns

On Nov 23, at 10:38am I sent to my subscribers…

Hey Everyone!

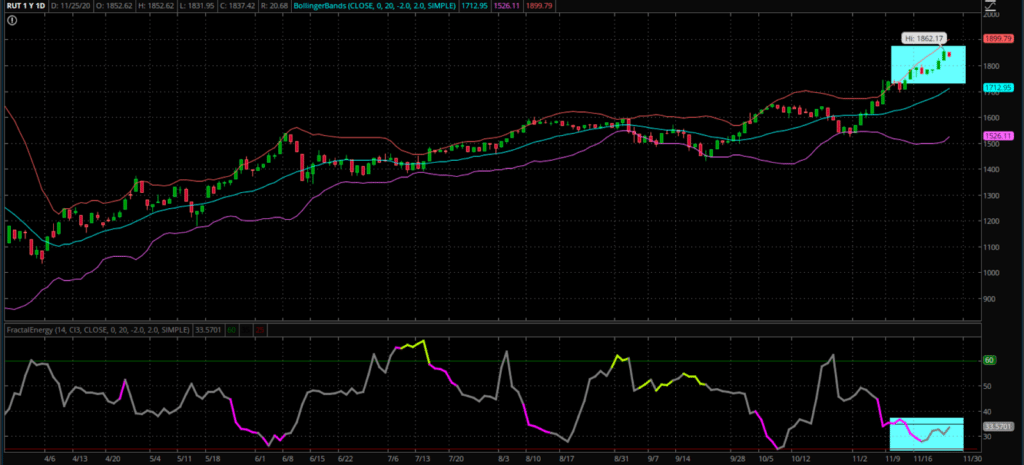

Just a quick note to let you know the RUT Energy Trade filled at $.85 for me this morning. And now with the RUT climbing even higher, I’ll be able to close out my position or roll it into a Iron Condor strategy if the fractals continue to become further exhausted

Source: Thinkorswim

So, what am I looking for?

As the RUT continues to climb, I am looking for a rounding out at the top where it can start to come back down.

And this will be signaled by the Fractal Energy at the bottom becoming exhausted, on both the daily and the weekly time frames.

Now, using a put spread allowed me to define my risk, and the price action signals to me that this should be a very high conviction trade idea that will set up for the week or two.

Listen, if you want my best trade ideas every week, then there is only one place where you will get it… Energy Trader!

Join now and be on the lookout for my next trade idea

*Results presented are not typical and may vary from person to person. Please see our full disclaimer here: ragingbull.com/disclaimer

0 Comments