When you hear of someone making 1000% on a trade, they are usually talking about a recent win on trading options.

But that is the farthest thing from what really happens when you’re using options

According to the CBOE, 80% of all options expire worthlessly.

This means that 80% of the time, Options traders make no money on those positions if they are held until expiration.

Now I am not sure about you, but I don’t want to be trading where I’m guaranteed to lose 80% of the time!

Instead, I would much rather go to a casino where I could at least get close to 50% on Black Jack

So what did I do?

Rather than BUYING options, I am going to focus on SELLING them!

That’s right, I am then able to get the odds of profits up to 80% and huge returns that can be 100% or more!

Ready to learn more and have the truths revealed about this feared options strategy?

Now that’s exactly what I did on a recent trade where I was able to leverage a typically feared nuance of options and turn this into a powerhouse strategy where I can make over 100% ROI on my trades.

Let’s take a look at how I combined technical and fundamental with a killer option strategy for huge gains in this stock.

A Strategy For Generating Income

No matter the direction I think the stock is going to head, there is always a strategy that I can choose from to trade.

Either up, down, or sideways, there is always a strategy that you can use when trading credit spreads.

Some of my favorite strategies are :

- Credit Put Spreads

- Credit Call Spreads

- Credit Puts

- Covered Calls

And for me, I found that I need to be selling credit spreads that generate income for my trading business*.

I knew that casinos and successful traders have a well-defined edge in the markets, and I knew that I needed to find the same thing for myself.

How Short Credit Strategies Puts Me Ahead Of The Competition

My edge comes from reading Fractal Energy and the technical indicators that comprise Options Profit Planners trading system.

And this allows me to have win streaks that are nearly perfect since last year with only a handful of losses*

The thing is… many strategies require traders to be at their screens all day tracking their positions.

But instead, this strategy is developed to allow for me to only spend a few hours per week managing the trades I put on my account

And in order to generate income and put the odds of the casinos to work for me, I focus specifically on selling calls and puts.

But of course, I am willing to own every stock I trade so I will occasionally let positions exercise in order to get even larger profits on my trades over a longer period of time.

Let me explain why this happened in a recent trade of mine, and how I used this opportunity to generate extra returns for my trade.

Moving on…

Why I Took The BOIL Trade

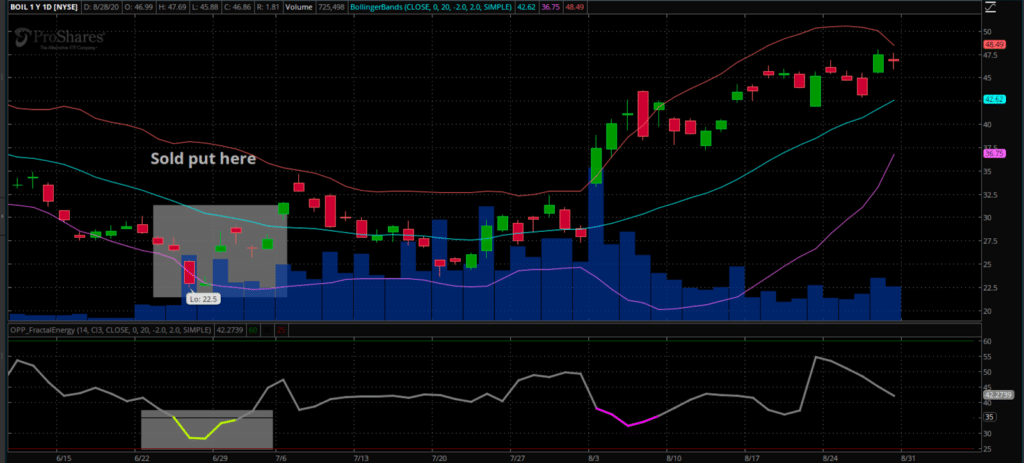

At a technical level, BOIL appears to be a great setup for me to trade.

It checkmarks my 3 technical boxes that I need to enter a trade

- It’s trading below its lower Bollinger Bands

- The Fractal Energy is depleted, meaning it can’t sustain its current trend

- It had a strong rebound, and I can use the recent low as my hard stop exit.

And that’s exactly what I did with my trade and started selling Puts when the chart was reading $30.

Now you see, when trading naked puts, I always know that I carry some extra risk with my trades

And that’s ok with me since I am taking stocks that I feel comfortable with investing in.

Now I knew this stock had a split that was coming up soon and I felt comfortable when the stock started trading down near my short put level.

Source: Thinkorswim

How I Took Ownership Of BOIL

But then a short put traders worst fear happened next before I took the trade-off.

For many traders who don’t use fundamentals to select stock this might be a nightmare, but not for me!

You see, I carefully select all stock based on strict fundamental criteria in order to make sure I am trading and investing in the best possible stock out there for me.

And when I was assigned ownership in the stock and then the split occurred, I felt totally confident knowing that I was owning a quality stock both fundamentally and technically.

So what happened?

At this point, the split and adjustments caused my breakeven to move to $36.23.

And I was ok with holding this position until my target price was hit.

Now… this is when a trader can even get more aggressive in their position and do a few different adjustments to their trade.

They could:

- Sell another put, and collect more income

- Sell a call, and create a covered-call to collect more income

- Buy a Put, to protect from further downside risk

But my plan is to simply sell my shares when it gets into the upper $40 to low $50.

So what happened?

Source: Thinkorswim

As you can see, the stock rallied a massive 30% from where I was assigned.

And since I was selling a naked put, I was able to generate income on top of extra returns on the stock after I owned the stock.

What exactly happened?

- I collected 100% of my sale on those puts

- I generated an additional 30% on the equity of my stock

Combining the ownership of both options and the stock position, I was able to return a fantastic 130% ROI on this investment in just a few months!

Now, I know you are wondering… Can this even work for me?

Well, I think it works for me and it could be a complete game-changer for your trading!

Just check out some of these wins, a strategy that puts the odds of the casino in your favor, and one of the highest-conviction trade idea service produced

So let me ask you these three questions:

- Do you like to generate income instead of gambling on every trade?

- Do you want to trade with the odds of success the same as the casinos?

- Do you need to only trade part-time but still earn full-time returns?

If you’ve said yes to any of these questions, then trading credit strategies is what you need to take your trading to the next level.

Now if you are ready, take Options Profit Planner for a spin… and if you join now, you’ll receive my next best trade ideas tomorrow!

*Results presented are not typical and may vary from person to person. Please review our full disclaimer located at ragingbull.com/disclaimer.

0 Comments