Are you stuck in the mud with your trading, going nowhere but sideways or negative in your account?

Whatever your struggle may be, any experienced trader has been there at one point in their career.

So after struggling to catch a breath of fresh air I realized after almost drowning that I needed to change what I was doing.

You see, trading is a lot like lifting weights as a bodybuilder

There is no way to just hit the gym and look like Arnie without putting in some serious time and effort to build the muscles and strength needed.

And to get that into that kind of shape, you need to follow a strict regime of eating healthy, working out, and embracing the lifestyle of a professional athlete… and that definitely means you can’t have those wings and beers during football Sunday!

Which is what I did with trading, I’ve put the time, energy, and dedication into my trading strategy to make it what it is today.

And credit strategies are my secret weapon

This strategy is what allows me to trade with less stress and accuracy compared to a normal stock or option buyer.

And this all has to do with the way time decay works in your favor when you sell options.

I know you are ready to learn how to utilize these strategies and put the odds of winning in your favor.

What Is A Credit Spread

Before getting started, I think it’s best that you understand what exactly a Credit Spread is and how they are structured to generate steady income for your account.

Credit Spreads involve two options to be executed

- selling a high-premium option

- purchasing a low-premium option

This is usually done in the same class of the same security ( calls or puts ), resulting in a credit to the trader’s account.

While most options traders are focused on debit spreads, credit spreads give traders a unique advantage when trading credit spreads.

The bottom line is this…

I want to be a trader that collects money when selling credit spreads instead of a trader that spends money when buying debit spreads.

Now think of this as a business owner.

Wouldn’t you rather be collecting money for your business instead of only paying out all of the time?

Another way to think about this is like the Lottery systems

Where you buy lottery tickets (or options) for the chance of a huge future payout. Even though the states pay out large sums of money every now and then, they actually make far more money than what they dish out.

And since I am in the business of making money through both real estates and businesses, I felt my trading should operate in the same capacity.

Let’s take a look at a recent trade I made and how I generated nearly 100% returns when the underlying stock only moved factions of that amount.

The Credit Put Spread In VRTX

The Credit Put Spread and Credit Put are my two all-stars…

No matter what type of market condition I am facing, I know these two strategies will just get in there and get the job done rightSure, I might have to make adjustments to my trade, but that’s nothing other than calling in a pitcher from the bullpen.

Then it’s up to me to manage my business and turn that trade back into a winner.

And with credit spreads and put spreads, I have the confidence to get the job done!

Now let’s take at a recent VRTX trade

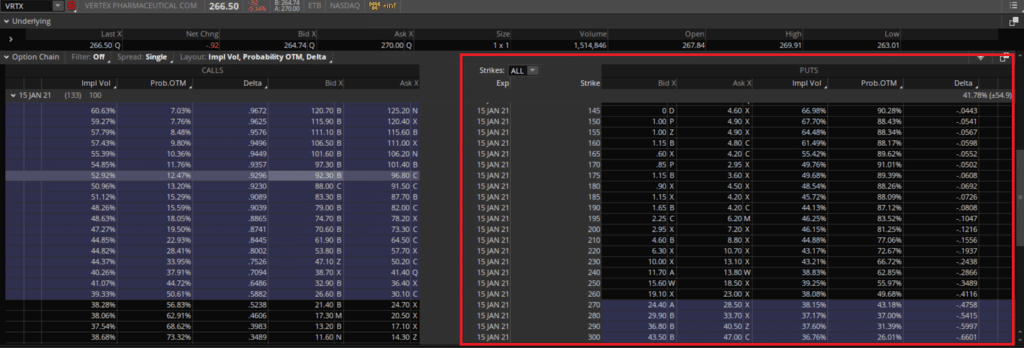

VRTX: I sold the Jan ’21 $200/190 put spread for $1.25.

Source: Thinkorswim

Next…the right side of the options chain is where the put contracts are listed in this option chain.

And to complete a short put spread, you would look to simultaneously sell a higher priced strike and sell a lower priced strike

The Trade – Credit Put Spread

The trade breakdown

- Buy 15 Jan 21 195 @ 2.25

- Sell 15 Jan 21 200 @ 3.50

Net Credit : $1.25

Max Profit : $1.25

Max Loss : $3.75

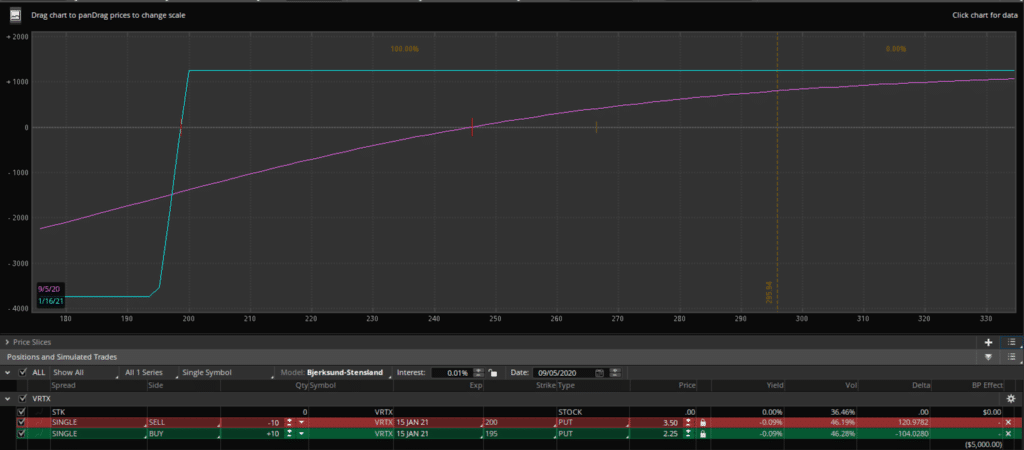

And here is the risk profile on the credit put spread

Source: Thinkorswim

From the chart above, you can see that the breakeven is just under 200 which is about 25% away from the current market price.

But I didn’t select that breakeven randomly.

Instead, I saw an area of technical support that I believe the stock will bounce at, and felt like it is a strong area of support for the trade.

Here’s what I see

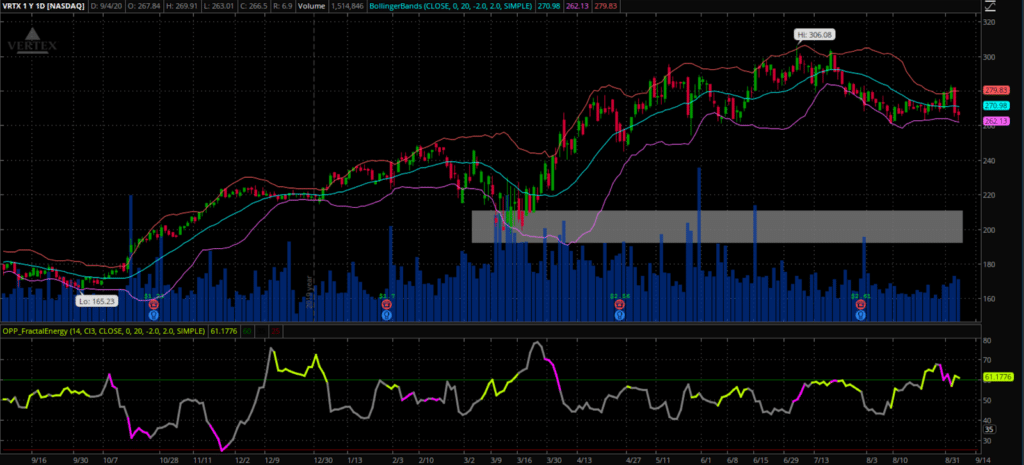

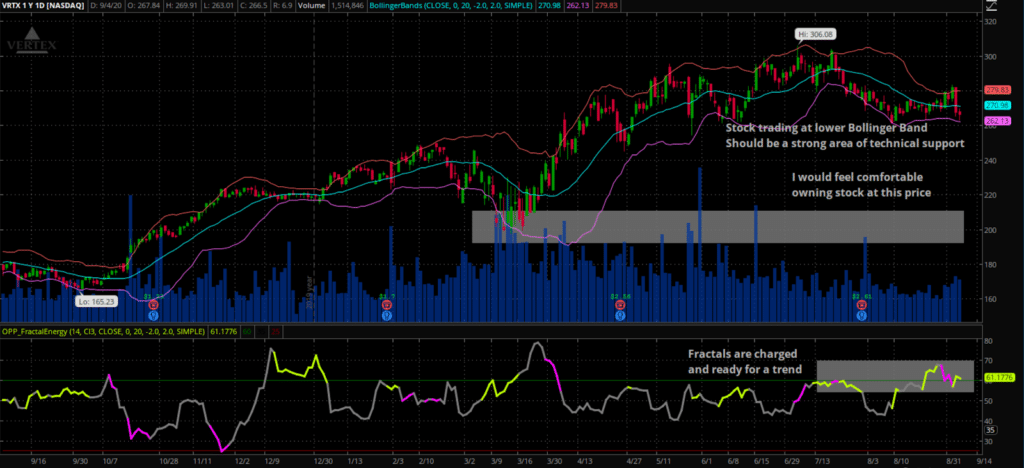

Source: Thinkorswim

Now let’s break this down a little further

Why Did I Take This Trade

I choose to use credit spreads over debit spreads because I get paid upfront to execute the trade.

What does this look like on a chart?

Source: Thinkorswim

As a technical trader, I make sure to structure my trades around patterns, support and resistance levels, and fractal energy of a stock.

Reviewing the trade:

- This stock is trading at support created from the prior week

- Stock is trading at technical support from the bollinger bands

- My proprietary fractal energy indicator is signaling that the stock is getting ready to trend

Where I Am Now

At this time, everything is trading according to plan!

The stock has been going sideways since execution, causing the time value of the options to continue to bleed out every day.

And when trading this trading strategy, I focus around selling credit spreads in order to generate business for my income

With VRTX this is no different, each day that passes the stock continues to pay me for the trade.

It’s important to remember that credit spreads give unique advantages to traders when trading credit spreads, with the most important being that you are paid upfront to place a trade!

And if the stock ever gets down to my breakeven point, I will take ownership of the shares directly, while keeping my profits on the credit spread!

And as a business owner, I want to make sure I know how much money I have coming in and out each and every month.

Since running a trading account is actually a business and not a trip to the casino!

To learn the process I use day in and day out to lock in consistent profits, click here to sign up today!

0 Comments