What if I told you that I make most of my trading returns from stock that nobody has on their radar?

Unlike many traders who get into the hot new stock when they hear about it on TV… I focus on stocks that appeal to me.

You see, many times when traders get into those stocks that are the hot pick of the day, it will fade against them and they will lose money.

But you know what?

Chart patterns and technical analysis let traders know when it may be the best time to enter and exit a position.

And it seems like many traders actually just ignore these key levels and enter wherever they feel like it.

So what pattern am I referring to?

Use This Indicator Before You Chase Stocks

Here’s what I sent out not long ago:

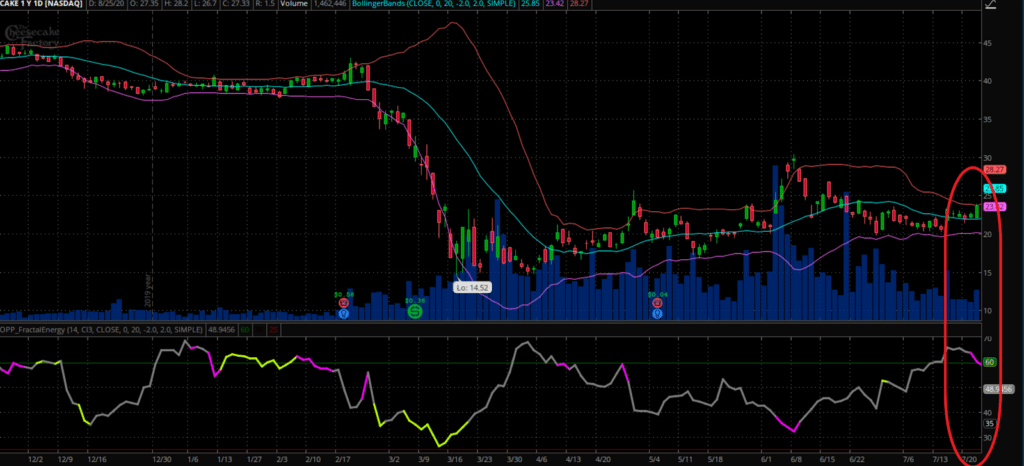

And here is what the chart looked like:

Source: Thinkorswim

The stock is appearing to be trading at it’s upper Bollinger Band after a strong rally from its middle average.

Now just because the stock is trading at the upper Bollinger Bands, this doesn’t mean a stock is going to fall or continue higher.

Which is why there’s actually one tool that lets me know when’s the right time to get into a stock.

It’s known as Fractal Energy.

This lets me know when all of the internal energy is either stored up or depleted and where the demand will pick up for a stock.

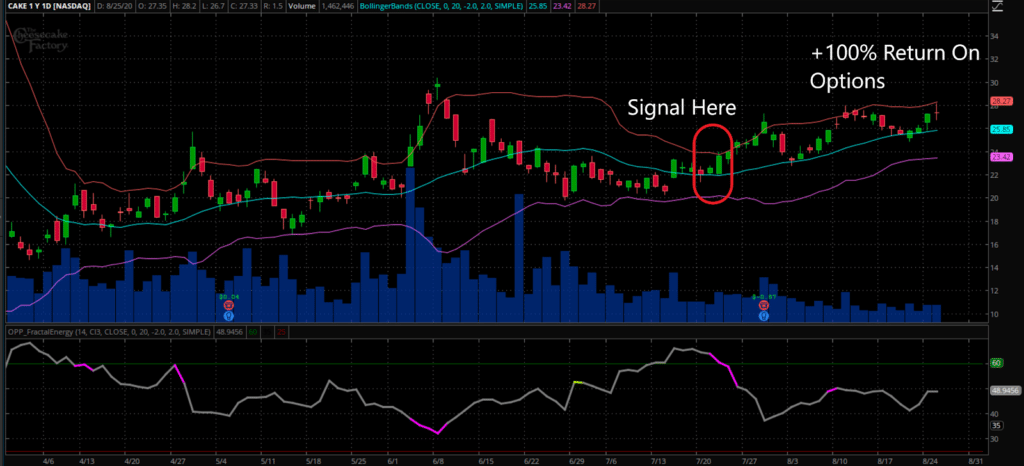

Source: Thinkorswim

With CAKE, the stock started to begin it’s runup right after the Fractal Energy signaled it was fully charged and ready to release its energy into the new trend.

And even though the stock moved 25%, the options I sold returned nearly a 100% winner from this trade.*

This is exactly why I trade credit strategies instead of buying stocks or options!

I can return 100% from selling options and is a much better strategy when it comes to trading odds to be like the casinos.

This pattern is especially powerful when a stock is rallying and you are looking to either get short or exit your positions.

The thing is, you don’t need to chase stocks or trade high flying biotech stocks to make 100% winners steadily and consistently.*

If you want to learn more about the techniques I use to uncover these huge trends and reversals from exhausted internal energy…

Then make sure you sign up here to Options Profit Planner.

What you’ll learn may shock you…

You don’t need to be the fastest trader to have success with this simple strategy.

It’s the slow and steady approach to trading, where all trades are placed once a week and exits are achieved in as little as a few days.

Make sure you get your access to Options Profit Planner today and start receiving trades like these!

0 Comments