I’ve never been a fan of hearing about a 15% winner

I mean, if I’m a business owner, I want to know how to make at least 50% of my invested money before I even consider accepting the deal.

So why would my trading be any different?

After all, trading and owning a business are very similar to one another. It’s all about that cash flow in and out of your trading account (or business account).

And the more money in and less money out means you’re a profitable business owner… and the same goes for trading.

Which is why I want to share with you three of my favorite trades that can put the odds of winning in your favor and get you those 100% winners on a consistent basis.

Let’s get going

Options Profit Planner

The trading strategy that is deployed at Options Profit Planner is a credit trading strategy on the options markets.

This strategy is designed to generate income instead of gambling with options for the trading account.

By leveraging an options credit strategy like this you are able to achieve higher ROI than a standard trading strategy, such as debit spreads, buying stock, or buying calls.

After all, 90% or more of all options traded in the markets expire worthless which means that selling options is more successful than gambling on buying options.

Credit Spreads involve selling a high-premium option while purchasing a low-premium option in the same class or of the same security, resulting in a credit to the trader’s account.

While most options traders are focused on debit spreads, this gives traders a unique advantage when trading credit spreads.

Credit Spreads

Credit spread strategies make you money while debit spread strategies cost you money.

And when you are a business owner, you want money coming in and not going out.

But that’s not the only thing that separates the two types of spreads.

Credit spread: Selling a high-premium option while purchasing a low-premium option in the same stock and option type.

Debit spread: Purchasing a high-premium option while selling a low-premium option in the same stock and option type.

The 3 credit spreads we are going to dig deeper into are:

- Credit Put Spread

- Credit Call Spread

- Naked Puts

Credit Put Spread

One of the main strategies at Options Profit Planner is the credit put spread.

This strategy is a spread trade where a trader would place an order to simultaneously sell a higher priced strike and buy a lower priced strike.

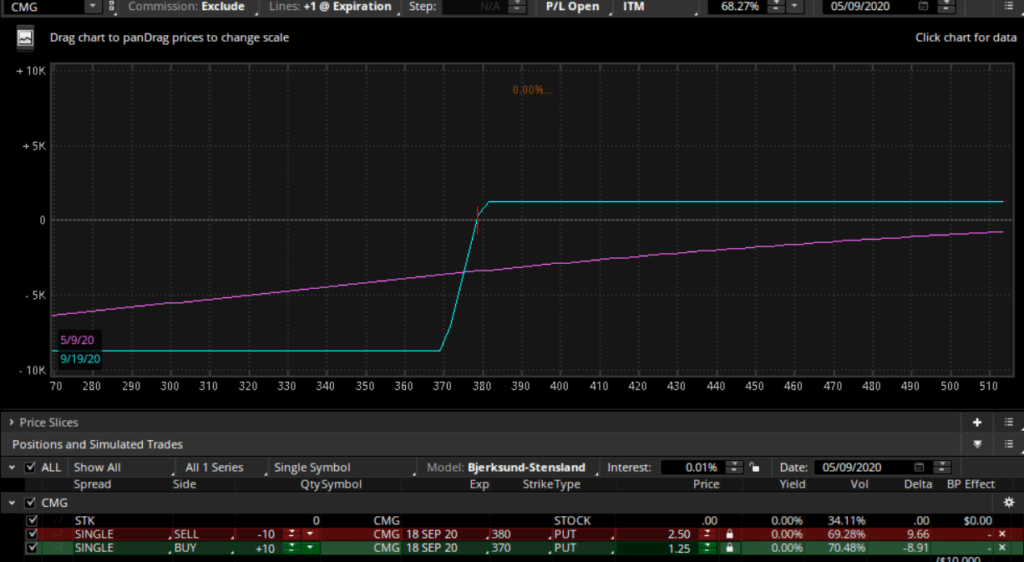

For example, let’s take a look at the CMG credit put spread that was traded.

CMG Put spread :

- Sept ’20 $380/370 for $1.25

Total Risk : 380-370 -1.25 = $8.75

Total Profit: $1.25

Here is a risk profile for this trade.

Source: Thinkorswim

And from the chart you can see that if the stock stays above its breakeven of 378.50 it will be max profits.

This week the stock closed at $929, so that is a 100% winning trade on the books in under a couple months!

Credit Call Spread

One of the main strategies at Options Profit Planner is the credit call spread.

This strategy is a spread trade where a trader would place an order to simultaneously sell a lower priced strike and buy a higher priced strike.

For example, let’s take a look at the AMZN credit call spread that was traded.

AMZN credit call spread:

- Oct ’20 $3600/3700 @ $14.70

Total Profit : $14.70 or 100%

Here is a sample risk diagram of this trade.

Source: Thinkorswim

Buy 16 OCT 20 3600 @ $78.70

Sell 16 OCT 20 3700 @ $64.00

Net credit of $14.70 or your max profit at expiration!

So in order for us to make 100% ROI on this trade, the stock needs to settle above the breakeven price and we will collect the full net credit of $14.70!

The Naked Put

Another frequently used strategy at Options Profit Planner is the Short (Naked) Put.

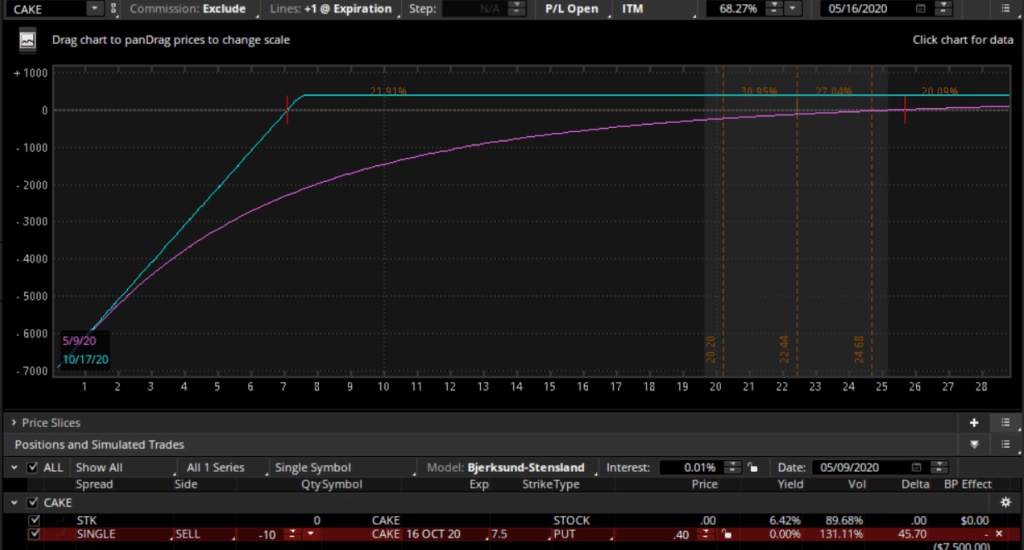

Let’s take a look at

The Short Put:

- Oct’20 $7.5 @ $1.30

Here’s the risk diagram for this short put.

Source: Thinkorswim

Remember, I am willing to hold this stock for the long term so the downside risk doesn’t bother me as much as it would on a short call.

And if the stock stays above the breakeven price, I will see 100% ROI on this trade.

Wrapping up

The good news is that there are many trades you can place every day based on any market conditions.

No matter if the markets continue to sell off, or buy the dippers are back in control, more of these trades become available every day for you to take advantage of.

One benefit of trading the credit spreads like the three outlined above is that you are able to generate steady and consistent income and up to 100% ROI on your trades.

This credit trading strategy lets you place the house-odds in your favor compared to going long an option. And unlike long options, you actually have a high chance to win instead of “getting lucky”.

So here is a quick breakdown of the pros and cons of trading Credit Spreads

Pros:

- Selling options inherently puts the house odds in your favor of over 60%

- Potentially earn 100% ROI on every trade

- If trading a short put you have the ability to purchase stock at a significant discount

- Credit spreads allow you to return profits in an up, down, or sideways market

Cons:

- The most can make is 100%, credit spreads have limited upside gains

0 Comments