Believe it or not…

When it comes to options strategy…

You should be mixing it up…

What I mean is… there’s a time when being a buyer of premium works…

And others…where being a seller of options premium makes sense.

Most retail traders can’t tell the difference between high implied volatility vs. low.

They wouldn’t know if options are historically rich or cheap…

But you know what?

You don’t have to be an expert if you trade spreads.

Why?

Because it reduces risk and limits exposure to volatility and time decay.

Its primarily what I trade, and which has led me to a nearly flawless track record in 2020.

Options Profit Planner

Before a trader can sell options, they need a reason to actually enter a trade.

And the indicator used at Options Profit Planner is shared with some of the most powerful mathematical models throughout nature and science.

What are Fractals anyways?

Fractals are a never-ending pattern found throughout nature. Fractals are infinitely complex patterns that are self-similar across different scales. They are created by repeating a simple process over and over in an ongoing loop.

When searching for ways to tap into the inner workings of the stock market, I knew right away Fractal Energy would do the job!

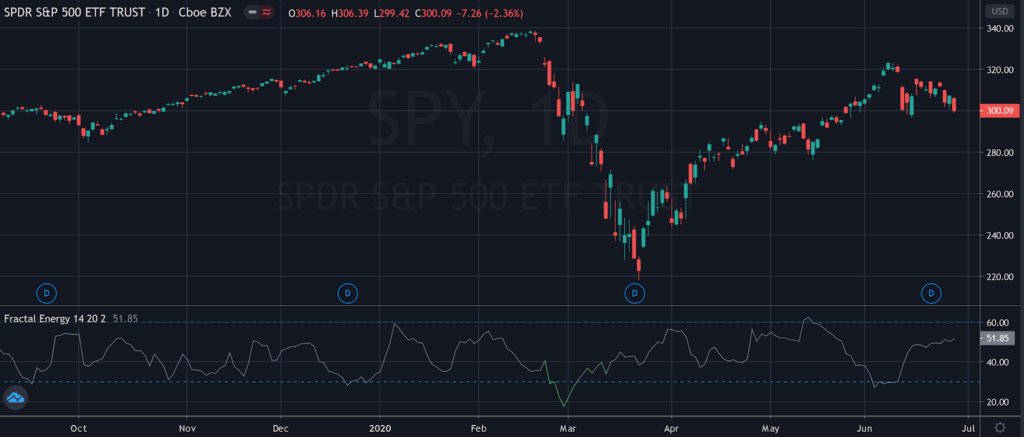

Fractal Energy Indicator

The power of fractals allows me to determine the strength of trends and how much “life” is remaining in a stock’s movement.

And I must say, there are some ominous signs coming out of the fractal indicator.

But first, there are 2 main components of Fractal Energy that you need to know.

Two components:

- Markets Fractal Pattern

- The Internal Energy

Fractals are found throughout everything in nature, from plants to shorelines… and even the financial markets!

Energy is the term used to describe the stored or potential energy a stock has built up. Like a spring that is compressed, it stores potential energy and erupts when you release the force that is keeping it held together.

And by combining those two different components you create a single indicator that is able to successfully determine the strength or weakness of a trend on any stock.

Fractals tap into the inner strength of every stock across every time frame giving you the most comprehensive understanding of what a stock is going to do in the future.

Source: TradingView

How should I trade this?

Let’s take a look at a way you could do this safely without trading naked calls or buying puts!

But first… let’s review the classic long put.

Classic Puts

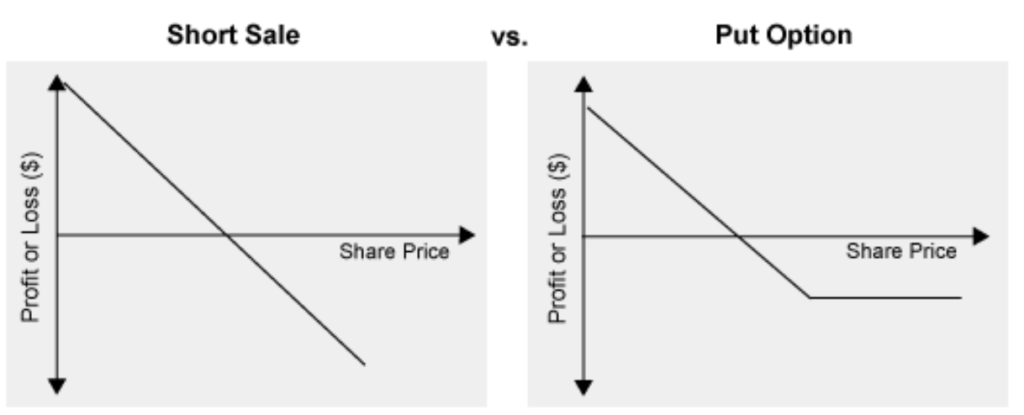

Typically if a trader is interested in going short and using the options markets, the first thing that comes to mind is to purchase a Put.

A purchase of a put option does two main things for a trader. It allows a trader to benefit from the decrease in the price of the asset and it limits or decreases the amount of loss they may incur.

This is much less risky than shorting the underlying asset and the trader can use the leverage of options to increase their gains as well.

Here is a payout diagram for both a short stock and put option.

The diagram on the left shows a traditional short sale of a stock and on the right is a classic long put.

By using either strategy, there is an unlimited loss as the share price increases!

Unfortunately, there is something I must remind you of. If you are wrong on the timing, your options may expire and you will still lose the trade.

That’s the pain I feel all the time, and I don’t want you to go through this.

It really sucks to be right, just to be wrong.

But I have a solution that you will like, and it may surprise you.

It’s called a Call Spread.

I know that you may be confused, and it’s ok if you are.

Because I just told you to trade a Call when I think the markets are going to go lower. And that might be strange.

Selling Options and Credit Spreads

An alternative to buying a put is to sell a call.

This is usually described as a naked call and is one of the most terrifying trades anyone could place. Just ask one of the many hedge funds that blew up from this trade.

It works… until it doesn’t.

And what I mean by that is, you could end up bankrupting your trading account with one bad trade.

I know I don’t like those types of landmines in my portfolio that can go off at any random time.

So how do you take advantage of a short call but keep yourself safe?

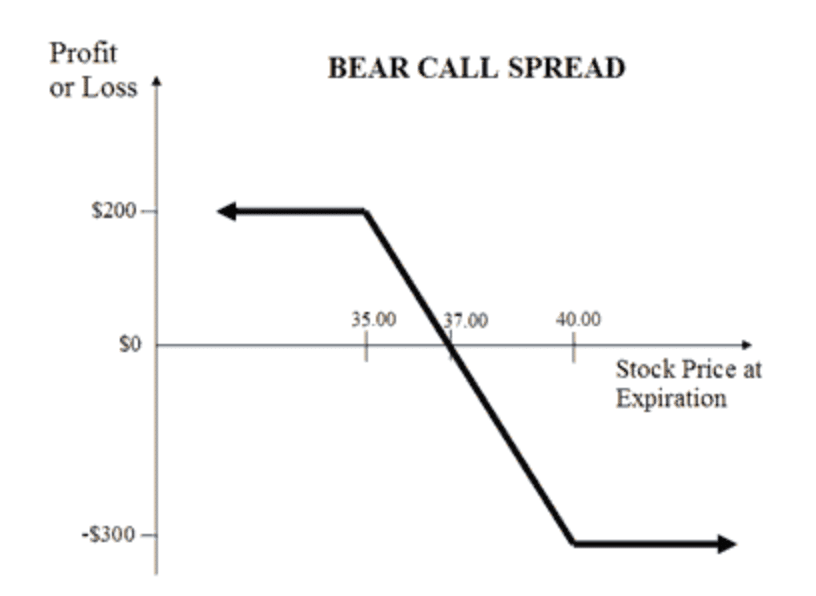

The Credit Call Spread

The Credit Call Spread (or Bear Call Spread) is a bearish to neutral options trading strategy.

It aims to capitalize on both downward price movement of the asset and theta decay.

Credit call spreads work extremely well in both directional and sideways markets as the options will expire worthless at the end of the trade, leaving the premium for the trader to collect on.

What does that mean exactly?

It means that you receive the cash upfront …

That’s right, you get paid to take that trade!

Another huge benefit of this trade is that it has a lower max loss compared to selling calls and even purchasing put options.

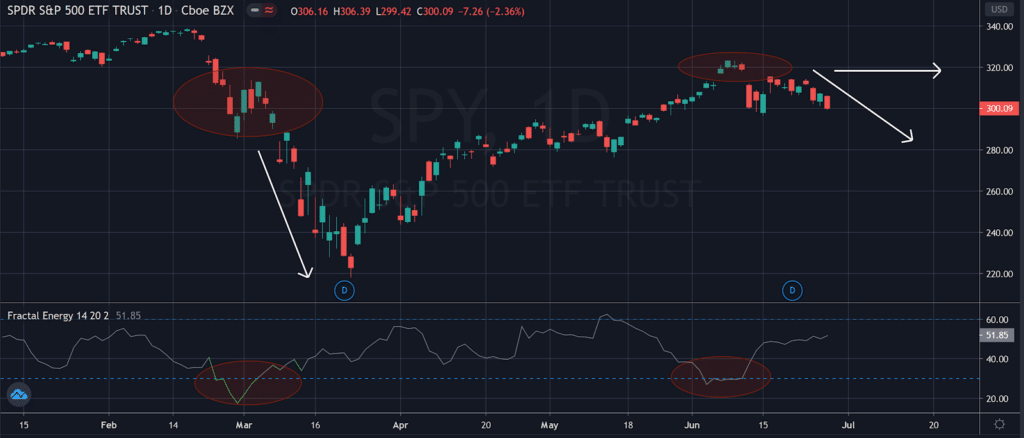

Which leads me to this trade in the SPY’s.

Here is a trade coming up in the SPY’s with the help of Fractal Energy signaling the markets would go sideways to down for a few weeks.

Source: Tradingview

Would you rather be long a put or short a call spread?

I hope your choice is short a Call Spread! Because if you were to have traded the long puts, you actually would have lost money with the sideways market action!

So why do you want to sell call spreads?

As a seller of options, we can still make money even in a sideways market!

This is such a great strategy since it allows me to trade a short call and have a max loss on the trade.

This is a must to capitalize on premium decay and also market direction on the trade.

Or more simply… to put the odds in your favor!

The Odds Are Stacked In Our Favor

Option sellers take maximum advantage of the option time decay theory, commonly known as Theta Decay.

OTM options lose value quickly and become worthless at expiration. This allows traders to not have to worry about correctly predicting the market direction or timing the market perfectly to generate income.

We can take advantage and be the house with odds in our favor on every trade

Don’t forget that an option buyer needs to be right about direction and time!

Remember traders, there are many ways to make money in this market and selling options is one of my absolute favorite go-to strategies.

Key Points:

- Credit Call Spreads profit if the stock goes down, stays the same, or goes up

- Limited risk vs naked calls

- Puts the house odds in your favor

- Allows you to get paid to take risk

So if you’re looking to get short the SPY’s… next time you might want to consider using short call spreads instead of going long puts for your directional trades!

Click here to sign up for Options Profit Planner today!

0 Comments