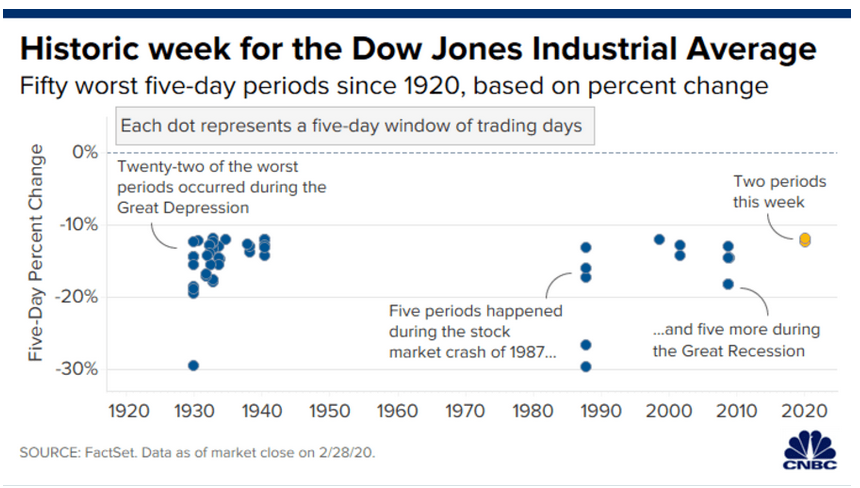

Last week’s market declined marked the largest on record in over a decade.

And unfortunately, there are no signs of it coming to an end anytime soon.

Check out the chart below for some perspective:

Source: CNBC.com

The coronavirus threat has led several companies to issue earnings and revenue warnings.

But here’s the thing…

I’m carving out ways for myself to profit off this incredible market volatility.

And you know what it feels like?

It’s like buying something that is cheap and at a discount!

But I’m not buying anything.

In fact, I’m selling options at this level. A strategy that I believe will pay off handsomely in the coming weeks.

Today, I’m going to walk you through one of my favorite options selling strategies—selling naked puts.

Selling Put Options

Selling put options is a great way to put the power of the markets in your favor.

And they check off a lot of boxes when it comes to ease of use and added cash flows to your trading account.

One of my most favorite perks of selling options is to be paid upfront for the opportunity to buy stock at a significant discount.

How does that work?

First let’s take a look at some options basics.

All options come with two main parts:

- A price obligation (the strike price)

- A time obligation (the expiration date)

The Strike Price

It’s important to understand that all options come with a price that is associated with them, and this is referred to as the strike price.

The strike price (also known as the contract price) is the price at which a put buyer will deliver shares and a put seller will accept shares.

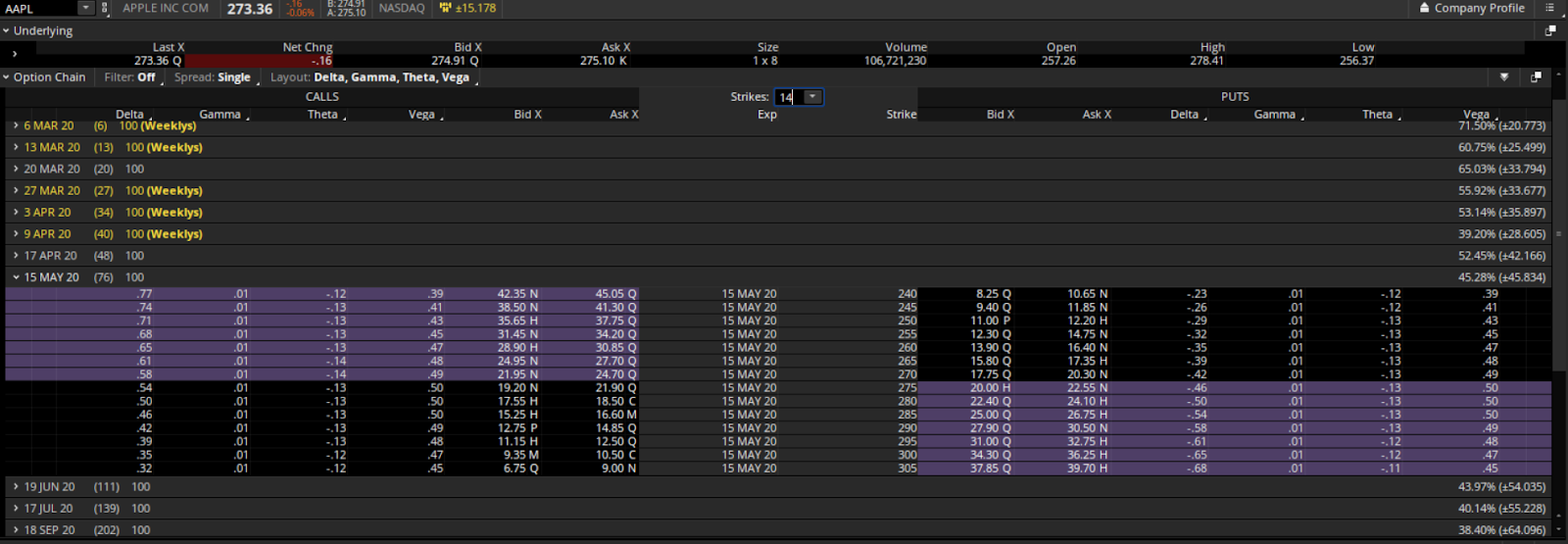

Here’s an example of a stocks options contract.

The options available to trade AAPL 15 May 20 are listed here.

It’s standard practice to list options with calls in the left column and puts in the right column of the grip.

With AAPL trading 272.36, a trader could sell the 240 puts for approximately $10.

This means that you have the opportunity to own AAPL shares at $240, and get paid to own 100 shares at that strike price. This is approximately a 12% discount with a ROI of 3.66% on this trade in 2 months, or approximately 18% per year ROI if you were able to sell this every 2 months.

Options Expiration

Options expiration is the date of the contract in which the the options contracts are settled and become invalid. In other words, the date options are active, or alive until.

Here is a sample option chain on AAPL.

It’s key to notice the different types that are listed.

In the options chain, the weekly options are labeled “Weeklys” and the regular contracts are in gray. LEAPS are considered anything beyond 1 year until expiration.

As example: 27 MAR 20 (27) 100 Weeklys means that those contracts listed for AAPL will expire on March 27th, 2020 and have 27 days left until expiration.

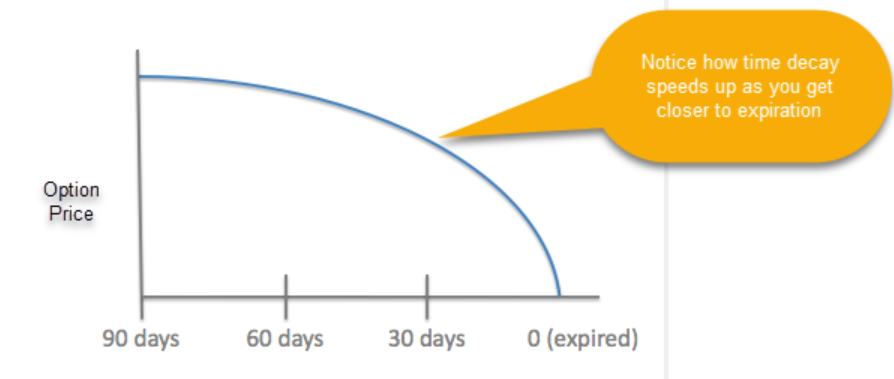

Why does the time until expiration matter? Well the time until expiration is important to traders because once inside 30 days options begin to expire extremely quickly.

And a trader is trying to have enough premium on their options, they need to make sure they go out far enough to not have an impact from time decay on the contracts.

Pro tip: It’s a must to go out 90+ days before expiration in order to make sure time is not decaying options and removing premium while you are trying to sell them.

It’s important to remember that when selling a put option, you have the obligation to buy a stock at the specific strike price before expiration (if exercised by the option holder). And auto exercise of options occurs at expiration to every option that is 0.01 in the money or greater.

So.. how does this work…

The Trade

When selling options it’s important to follow 2 main rules:

- Sell options with more than 90 days until expiration

- Sell monthly options only

And that’s it!

So let’s take a look at a recent trade on RIG where we made a ROI of over 85% on the trade

How did I find RIG to begin with? It all started with a proprietary filter from FinViz.

Why use a filter?

A trader needs a way to narrow down his list of stocks from nearly 10,000 traded stocks in the stock markets!

So what did I do once I found RIG as a trade?

I sold the Feb 20 $4 put for $0.70 and collected $70 per contract.

What do I expect to happen?

- The market rally and I keep my premium

- The market continues to sell off, and I own a great stock at market value and paid to place the trade.

Here is a chart of RIG and how the trade played out.

This trade on RIG turned out being a 85% return on investment and only lasted a few months. Once the revenue was collected for this trade, we were able to go and invest in the next trade just like it!

Talk about putting the house odds in your favor with the chance of winning well over 50%! This are much higher odds compared to being an options buyer or stockholder.

Wrapping up

What does this all mean?

Options Profit Planner is a trading strategy at which aims to generate high probability and high ROI income to the traders.

And it all starts as a simple trading strategy that tries to buy stock at a discount all while being paid up front to do so!

The best part of this strategy is that if you do not end up owning the stock, you still get to keep your premium and place another trade again and again!

And these trades can happen every single day… Especially in market conditions like these!

Do you want to get updates on each new trade and get 100% return on your investment in just a few months?

0 Comments