We’re often betting on whether or not stocks are going to go up or down…

But very rarely do you hear about the trader who plays for ranges.

Now it might sound crazy to you…

Sideways markets are one of my favorites to trade

And in sideways markets I can get the most profits as long as I execute correctly.

Allow me to walk you through how it works, and then decide for yourself if its something worth adding to your traders toolbox.

What are options

Options are an extremely popular way to place a trade in a stock without having to dish out a lot of capital.

One major benefit of options is that it allows the trader to gain tremendous leverage by trading large amounts of stock cheaply. This leverage is built into every option contract available on the market.

Another reason options are popular is the ability for a trader to receive a steady stream of income if designed to do so.

This type of trading style is called credit trading, and it is considered to be one of the most steady and consistent ways for an options trader to make money.

So… if you are trading options, it is a must to learn how to trade credit spreads to generate income.

But one of my favorites (besides credit trading) is that a trader can adjust their risk parameters to meet their needs for trading the markets.

Two examples would be limiting losses to the downside, and being able to capitalize in a sideways market. Both are not achievable by trading stocks themselves.

Next… let’s take a look at this in more detail.

The 2 Primary Trades

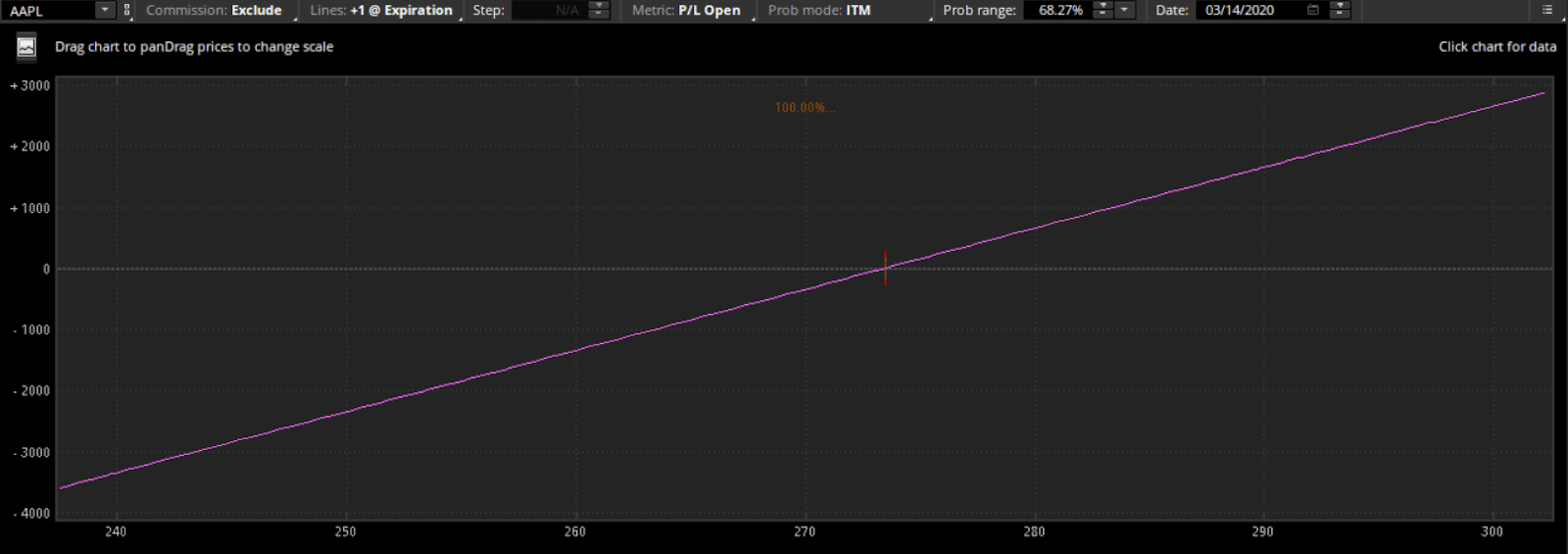

First, let’s review the risks associated with trading a stock…

Remember, if you are long a stock, this is assumed to have unlimited gains and unlimited losses associated with it.

Here is a stock risk diagram for your reference.

Source: Thinkorswim

So, as you can see above, there are significant risks associated with trading long stocks directly.

And with the markets moving 10% each day, I doubt anyone would want to buy a stock and watch their account flip that quickly on them.

The solution?

Well there are a few choices for a trader to make when seeking an alternative for a long stock.

These choices are:

- Trade a Covered Call

- Trade a Credit Put Spread

Let’s take a look at how each one of these trades can offset losses when trying to get long a stock in these types of markets.

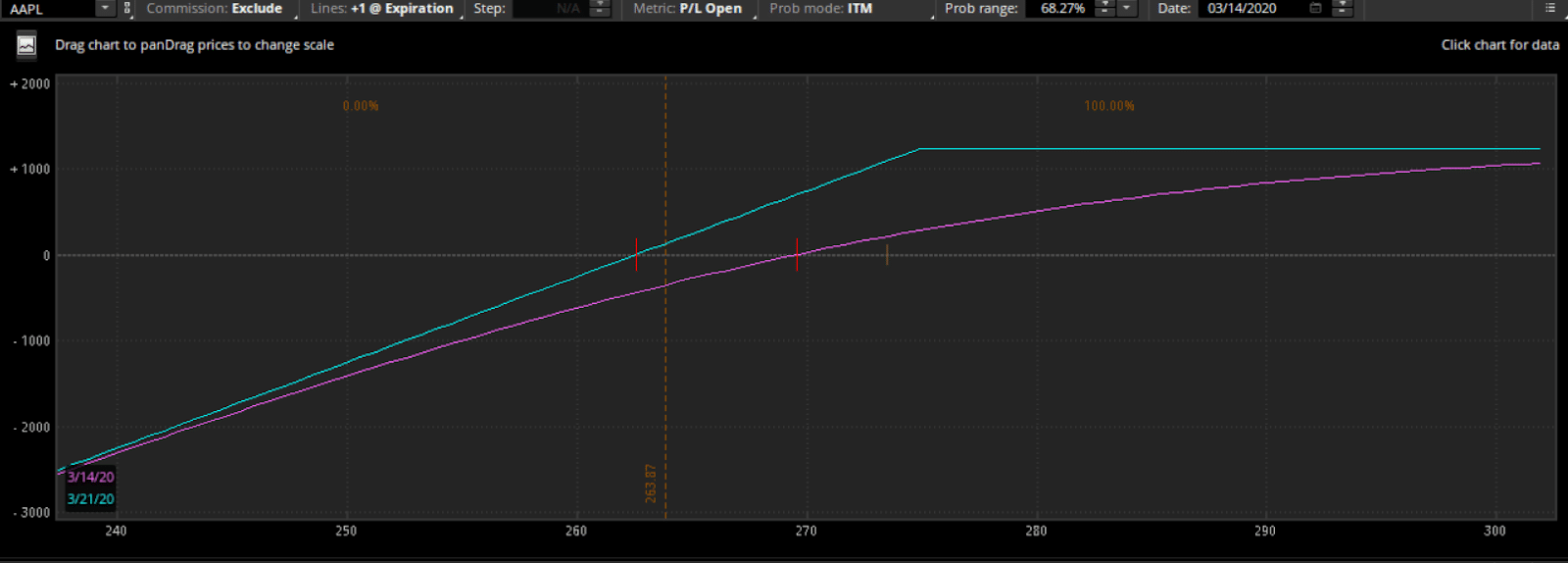

The Covered Call

A Covered Call can be a great way for an options trader to help offset losses and collect premium all while they hold the underlying asset.

For a Covered Call to be effective, a trader would typically sell a call that is out-of-the-money (OTM) which allows for profit to be made on both the options contract and the stock.

Additionally, if you believe the stock price is going to drop, but you want to remain your stock position, you can sell an even further in-the-money (ITM) call option.

How to create a covered call:

- Purchase 100 shares of AAPL

- Sell 1 OTM call option contract

Here is an example of the risk diagram for this trade.

Source: Thinkorswim

At this point there are a few things that stand out on this chart, such as the unlimited downside risk (like the stock) and the capped profit potential if the stock price was to rise.

But what you might not realize is that if the stock stayed still, or even fell slightly, you would actually make money!

This is far better of an outcome instead of losing money or breaking even when faced with trading the stock itself.

But we can take this one step further… and we can place a trade that limits our downside risk as well.

This trade is called a Credit Put Spread

Next…

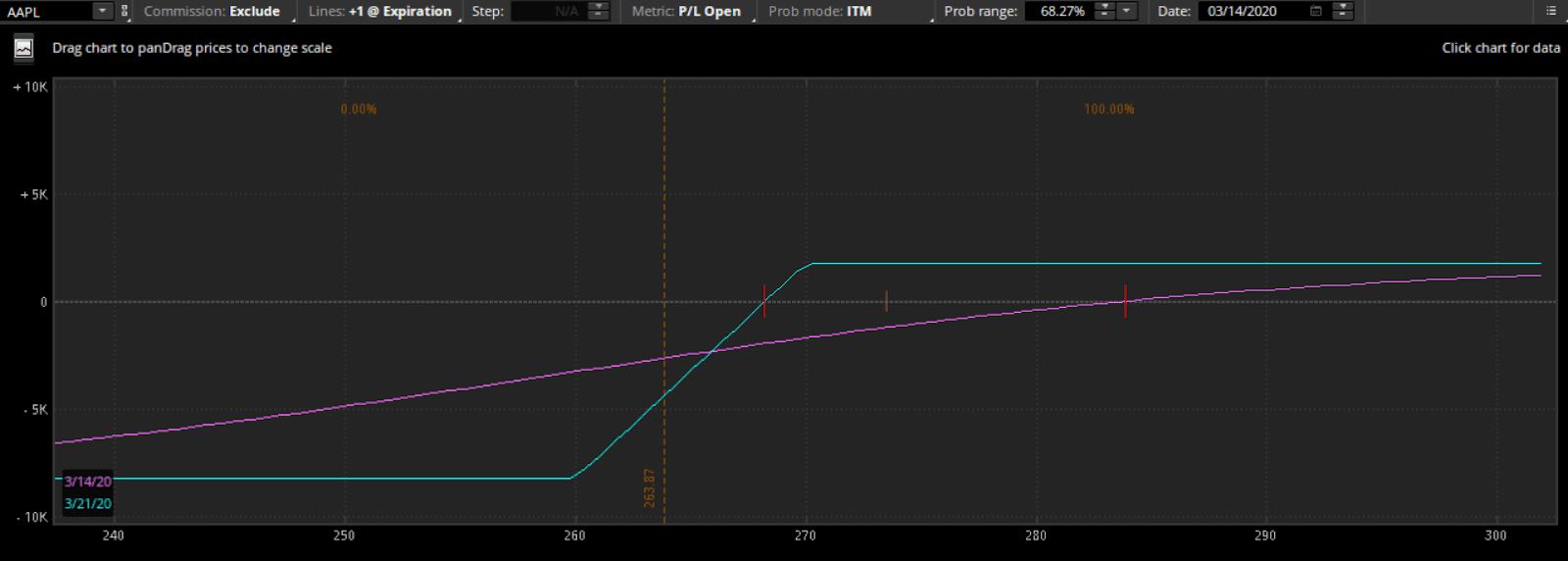

The Credit Put Spread

A credit spread is a directional strategy that requires a trader to buy an option that is at a nearby strike and sell an option that is at a further strike. Both in the same month and on the same stock.

This can be a highly advantageous choice instead of going long the stock directly….especially during extreme periods of high volatility like we are in now.

The credit put spread is a fantastic trading strategy that allows traders to take advantage of a sideways, bullish, or slightly bearish market environment. With proper strike selection you can vary how much income you will receive for the trade.

Here is an example of a credit put spread on AAPL for your comparison.

Source: Thinkorswim

As you can notice, this strategy offsets all of the downside risk a trader will face. This strategy is known as a collar and is created by owning stock and trading a short call and long put.

And to achieve the same position, a trader can sell a put spread on the name and not trade the underlying stock. This is known as a credit put spread.

Personally, I would rather trade the credit put spread over a collar due to the capital requirements on the long stock position.

So…Why is this such a favorite trade of mine?

Well for three reasons:

- Trade without the capital required of owning stock

- Limits loss to an unfavorable downside move

- Collect income for the trade if it moves downward, upward, or even stays the same price.

Putting It All Together

Trading credit spreads is a great way to generate income and eliminate many risks associated with trading a long stock position.

Let’s take a look at some pros and cons to trading credit spreads and covered calls.

Pros:

- House odds in favor of seller (60% or more)

- Limited downside risk

- Can win in up, down, and sideways markets

- Lower capital requirements vs owning stocks

Cons:

- Limited upside gains

It’s easy to see how the pros of trading this strategy significantly out-weight the cons!

Click Here To Join Options Profit Planner Today!

0 Comments