I need to say one thing…losing on a trade stinks!

Which is why I never like to just accept a loss on my options trade

Typically, traders will use a technique called hedging to help offset their losses… but that’s not for me

But don’t get me wrong, there are times when it is an absolute necessity to protect your profits and your account

Instead, I prefer a more proactive approach – called a “Roll-Out“, and in my opinion, it can be an alpha-adding strategy

Which is why every trader needs to understand the value of how to roll a spread and when it’s appropriate to do this.

Want to see how I just did it last week?

The Setup

Last week, I found myself in this exact situation.

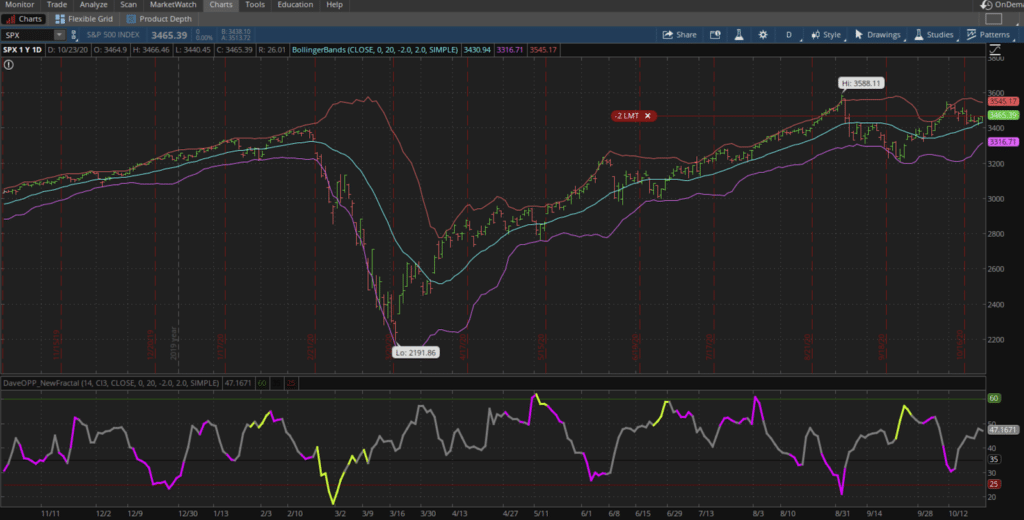

The market was doing exactly what I wanted when I was trading the SPX (The index) …but I just needed a little more time to watch it play out.

And unlike a Superbowl game, I’m able to add time to the play clock and turn around this trade for a profit!

And in this case, I was noticing that my put spread needed a little guiding hand to profits.

In case you don’t know, here’s a quick overview of how to profit when it comes to trading a short put spread.

- For max profits, you need the stock to stay above the breakeven point

- Short put spreads generally work well when the markets have run up, slightly down or even a little bit sideways from your current market price.

Need more information on put spreads and how they work?

Now, I find myself in this exact situation.

I know the SPX will need to turn around and let the Fractal Energy start to release itself…

but now I had one thing was working against me… and that is time decay

So I knew this was a problem and had to step in and fix it…

This is what I did

Adding Time To The Clock

Now, let’s talk about the choices you have in front of you

The main choices an options trader has:

- Take the trade off, and try to capture as little loss as possible

- Adding new positions (spreading your position) to take risk off the table

- Turn it into a new position to change your spread

- Adding new positions to create a new trade, adding risk to your trade, but adding profits

- Adding time to your position, typically adding both risks and profits to your trade

I want to focus on the last point, adding time to your trade and increasing your profits

In my recent trade, I was running into a problem with my Iron Condor, and I knew I had to take action and add time to my trade.

In case you missed it, earlier in the month…I alerted my members

I sold the 30 Oct ’20 $3280/3275/3540/3545 Iron Condor for $.70 or better.

The reason: To take advantage of the Fractal Energy and sideways markets ahead of the election.

And everything was going as planned… until it wasn’t!

Then I found myself in a situation where the SPX was trading below the lower put spread and I was going to lose on this trade.

Well…ladies and gents… I’m not here to lose on my trading

Put Your Plan Into Action

Traders, it’s time to take action…

And I added time to the clock and rolled out my SPX Iron Condor to give me both more time and additional profits

Here’s the play-by-play…

- I rolled the spread down… this means giving me additional room to the downside past the bollinger bands for more wiggle room

- I added some room to the top, or widened the spread. This means I have a larger range to keep the SPX inside, and allows me to capture profits at the top in case we run higher due to election news

- I needed to generate more profits for my trade for taking additional risk, so I targeted to increase the spreads value by $0.40 or more.

What did I do?

I rolled the SPX 30 Oct ’20 $3280/3275 put spread to the 6 Nov ’20 $3235/3225

Pro Tip: Try to target the single side of the Iron Condor that is not “working” as planned. In this case, I chose to roll out the lower put side first, and hold off on rolling the higher side. This will let me generate profits on my other trade if we continue lower since that spread is not high-risk at the moment.

[ Check out my full, in-depth SPX Trade Management Video, right here ]

The outcome?

Before I knew it, I was watching my Iron Condor expire from the roll I made for full profits!

That’s right, a cool and smooth 100% profits landing in the books.

And while I was at it, I closed out my AMZN Iron Condor as well for a huge profit as well when it hit my target price.

Now, I know you’re scratching your head about how this all works, and I know I would be too if it was my first complex trading strategy that I was trading

Which is why I created a complete and in-depth and comprehensive options training course.

This will get you up to speed and comfortable with trading options at a higher level in as little time as possible

But if you’re already comfortable with these types of strategies…

Don’t miss out on my next options trade that I am setting up this weekend to generate more income

And if you hurry and sign up now, members will be receiving a detailed guide to selling options next week on Sunday evening.

So what are you waiting for, sign up here to see my next trade

Don’t miss your chance to generate additional income week-over-week and month-over-month by using credit spreads

Click here to sign up now and join my team in Options Profit Planner

0 Comments