TSLA is one of the most loved and hated stocks in the stock market.

And recently, TSLA was approved to join the S&P 500 and the stock has exploded.

But as the stock is climbing, the bears are starting to pile in more and more each day…

Now, I don’t want to be one of those bears that are shorting the stock or buying puts into huge levels of implied volatility.

No way, not for me… that’s just a pure gamble in my eyes.

Instead, I want to do what has been working for me, and that is selling credit spreads and leveraging the power of options to safely short TSLA.

And shorting the stock is not a trade I want to gamble on.

So, let me show you how to safely get short TSLA in two alternative ways than shorting the stock.

Just by trading options, it’s possible to be in a position to land 10x the amount of returns as a stock trader would.* Of course, I’m not saying every trade will be a 10X… there are no performance guarantees in the market.

Don’t take my word for it, find out how to return up to 100% ROI on a credit strategy in as little as a few days.*

Two Alternative Ways To Short TSLA

Recently, there has been awesome news for TSLA stock buyers… TSLA joined the lucrative S&P500!

And the news is driving excitement in TSLA every day, and traders are flocking to the name.

Traders are buzzing around this stock and it’s like a feeding frenzy.

So, how do you keep yourself safe when trading this out of control stock?

Let me teach you two of my go-to strategies that you can use to get on the right side of the trade and generate triple-digit returns.

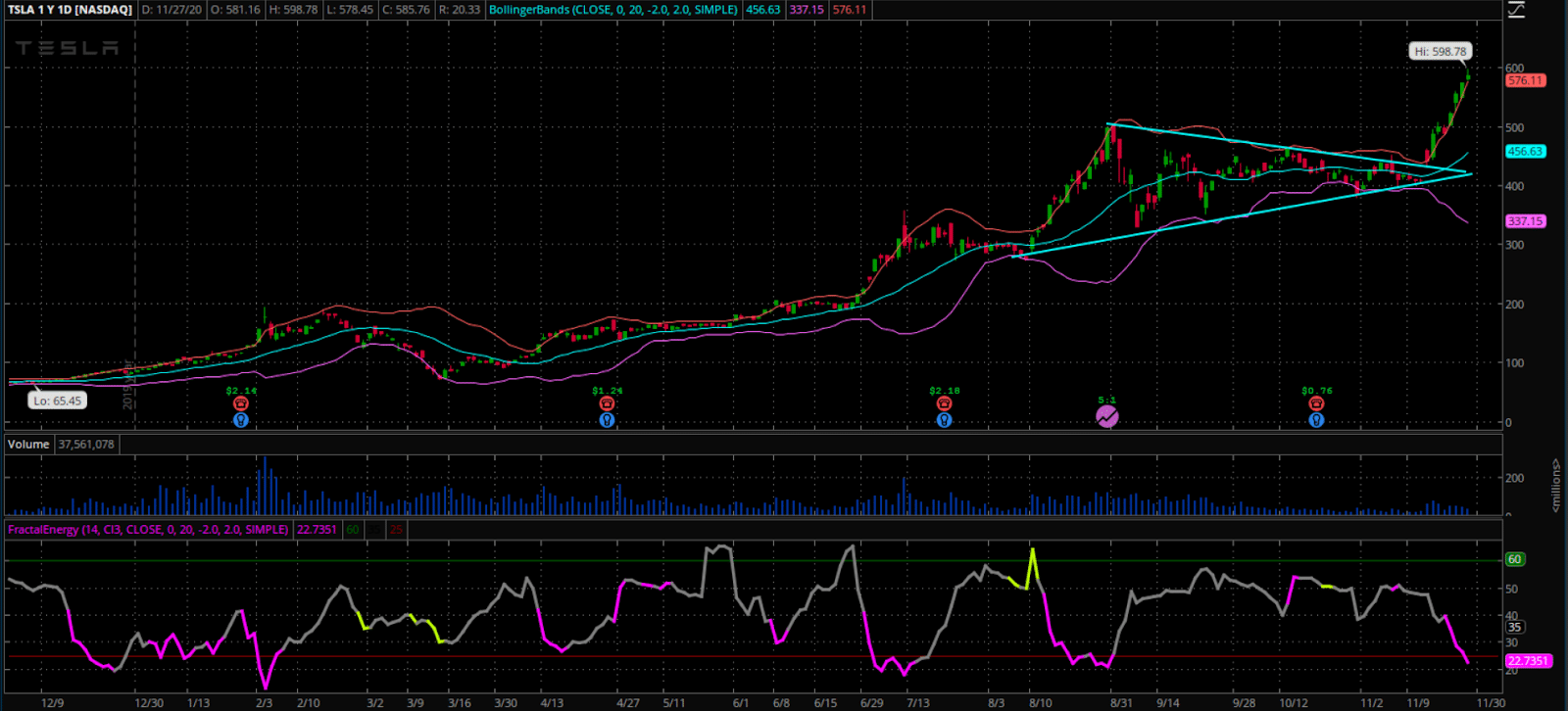

Look how crazy this stock has been over the last week or two from it’s breakout pattern.

Two Bearish Option Spreads

The two bearish option spreads I would trade would be:

- Credit Call Spread

- Covered Call

With the increase of volatility, it’s usually not a great idea to purchase options when looking to take a bearish trade in a stock.

This is because the levels of implied volatility has increased past the point of being able to return a profit.

Why?

This is caused by traders looking to go short the stock in the options market and are driving the prices higher.

And from my experience, I would rather trade a credit spread to generate income instead of gambling on a stock.

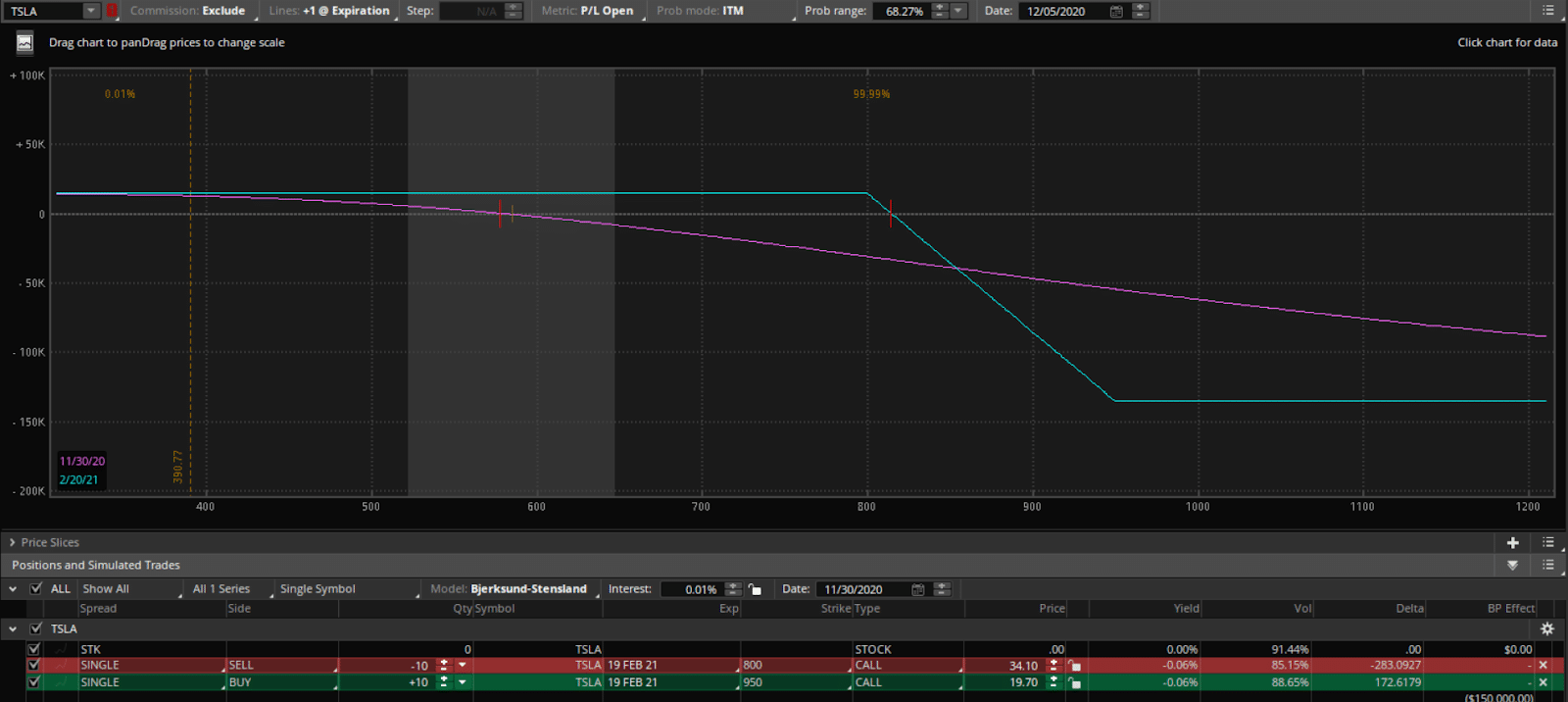

First, let’s take a look at the Credit Call Spreads and how I can use these to generate income.

One huge benefit is that trading a Credit Call Spread is that I can safely sell call options to take advantage of the overpricing of call options as the stock is running higher.

And when you are selling calls or shorting the stock, you expose yourself to unlimited losses.

So I want to stick to what I’ve been trading consistently and look for a safe way to generate income and short TSLA.

As you can tell, if the stock goes up, down, or sideways – I can make profits on my trade! Plus, the best part about this strategy is that the higher the stock trades, the longer I can wait to sell my calls to take advantage of these greedy buyers!

And I won’t even begin to lose money until the stock runs another 40% higher!

So what I will want to keep an eye on is the Fractal Energy of TSLA.

From my experience, if this indicator continues to drop and TSLA stays above its upper Bollinger Band… then TSLA will have almost no choice but to come down and rest before it can take its next leg higher.

But what if I already have a position for TSLA and want to get short?

Well, you can do that too with options!

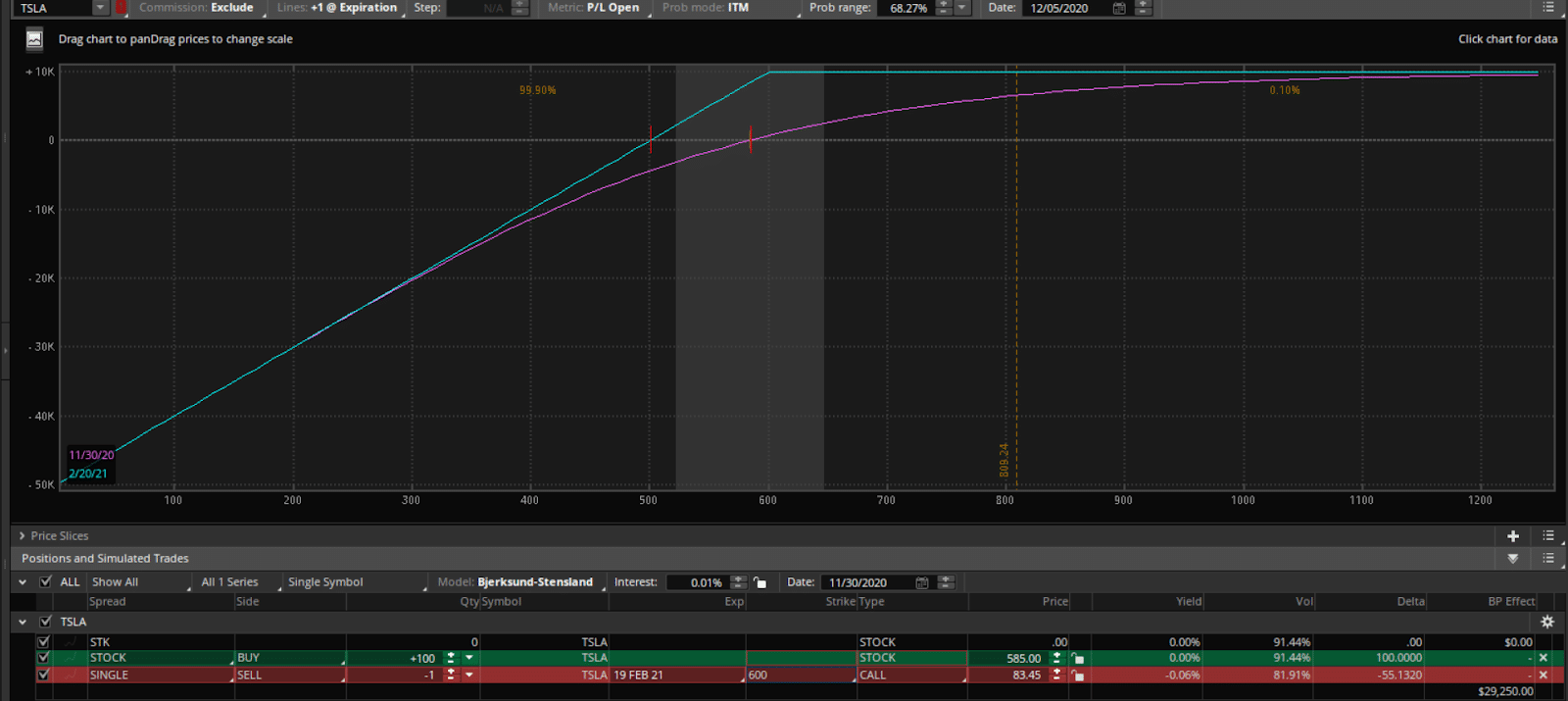

This strategy is called the Covered Call, and is a neutral to bearish strategy where a stockholder can sell calls against the position he currently has.

You see, many times people who own stocks actually want to bet against the stocks they own…

It’s actually very common in stock ownership and is a way to essentially create a dividend stream of revenue in a stock.

This works when you purchase a stock, and then sell OTM calls against this position, and as long as the stock doesn’t climb too high, you get to keep your credit and continue to hold onto the stock.

As you can tell, if you were to buy the 100 shares of TSLA and sell 1 call option, you would be able to make money if the stock went up, down, or sideways from here.

And the stock could fall as far as 15% before you’d even see a loss on your account.

Talk about a great way to generate extra income or betting on a stock trading lower without breaking a sweat.

Now… don’t get me wrong…these strategies take time to master and learn, which is why I’ve created my two services, Options profit planner and Energy Trader

These services are geared around teaching you how I use Fractal Energy and Bollinger Bands to identify key levels in a stock and how to generate weekly and monthly profits just by selling options.

Don’t miss out on my next credit trade, so be sure to sign up now so you can trade along with me.

Time is running out…take action now and receive your next trade as soon as tomorrow

0 Comments