To me buying options feels like a gamble, and statistically, it can be depending on how you decide to play them.

However, I had to learn the hard way by actually attempting these trades and failing on them.

So I decided to do what any sane person would…

Instead Of Buying Options

I Decided To Sell Them

Unlike buying options, this strategy is designed to provide a steady stream of income

And you don’t even spend a single dollar to place this trade

What happens is you collect your revenue up front for selling the option and you can generate income each and every week!

You know…the kind of consistent cash that lets you easily pay down debts. Obliterate most money worries. Even secure yourself an early retirement.

It’s almost unfair once you know how to use this strategy

Ready to learn how this strategy works?

Options Profit Planner

Buying options is always a betting-mans strategy… and not one that I feel comfortable with when it comes to maintaining a steady income to provide for my family.

These credit strategies are specifically designed to target the moment of a stock based off of its Fractal Energy and technical indicators.

So what are these strategies?

- Credit Put Spreads

- Credit Call Spreads

- Credit Puts

- Covered Calls

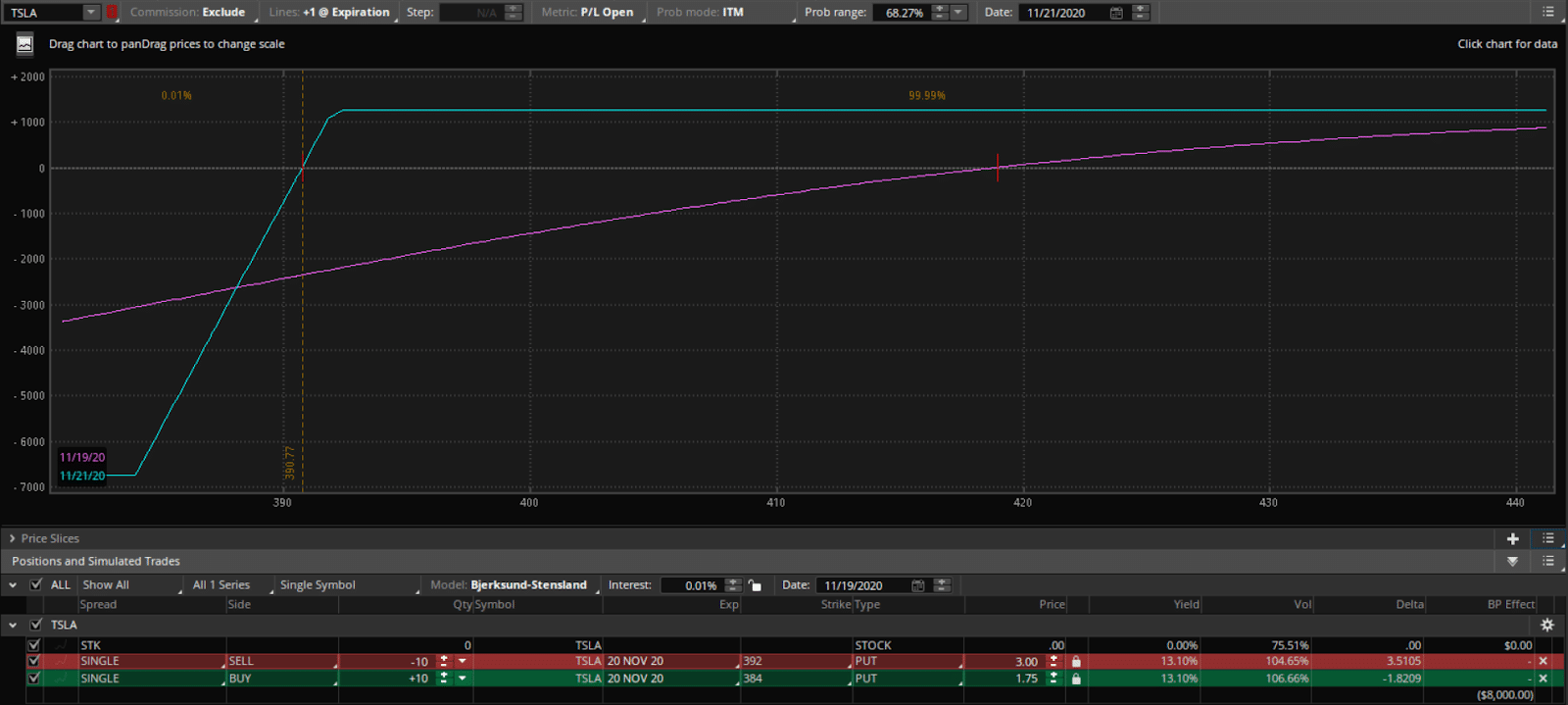

And I recently traded a credit put spread in TSLA that landed me nearly 100% returns in a short amount of time.*

For those who missed my email I sent to the members of Energy Trader

I am selling the TSLA $392/384 put spread

This strategy is a tri-directional strategy and allows me to profit if the stock drops, rises, or goes sideways

Why would I want to trade a strategy like this?

Only Fools Try To Bet On The Market Direction

Well, it allows me to generate income instead of betting in the markets… plus it means I don’t have to be right about going long options

When a trader buys an option, they have a 33% chance of being right in the trade, whereas a seller has approximately a 66% chance of winning

This means I don’t have to be 100% accurate with my timing or direction

And TSLA can drop all the way down to $390 (or about a 20% drop in market price) before I end up taking a loss on this trade

Of course I save the best for last…

If TSLA stays above the breakeven price of $390, I will return 100% on this trade, compared to only 20% profits for shorting the stock.

So even if I was bearish, I can return more money by trading a bullish strategy instead of shorting the stock directly.

How Do I Find Stocks To Trade

Now, don’t go and start to sell put spreads on every stock you come across.

You need to have a true edge as to where you believe the stock is going to head.

And I use Fractal Energy and technical analysis to give me a heads up to the direction it might head

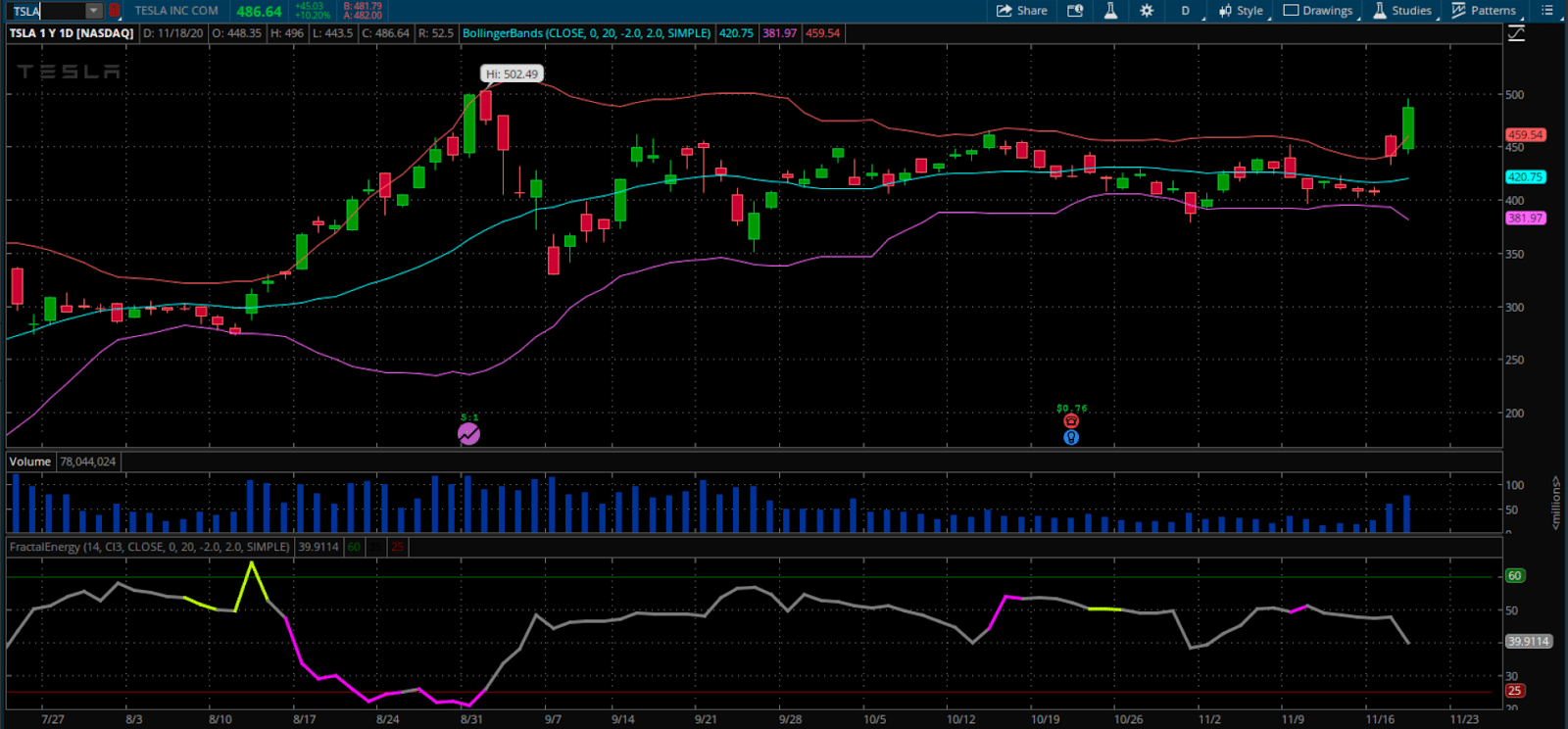

You see… this chart spelled M-O-N-E-Y to me and I knew I had to trade this stock

There were two things that started to play out last week…

What I saw in TSLA:

- TSLA was starting to head sideways when it traded along its lower Bollinger Band.

- Growing level of support near $380 as the stock bounced against this level multiple times

- Fractals were charged meant two things

- TSLA could trade sideways as the energy continued to charge

- TSLA could start to release its energy and trade higher

Trading Options And Collecting A Credit Is Key

Now do you see the power of trading a credit spread instead of a debit spread?

I hope so!

There are many benefits of trading this type of strategy… like the ability to generate steady income, trading with the odds like a casino in your favor, and making money if the markets go up, down or sideways.

Personally, I find this strategy so liberating and stress-free to not have to constantly worry about the direction of the markets every time I want to trade.

And when trading credit spreads, you often can build a strategy where you can only lose in the case of a drastic or extremely large move in the underlying stock price.

So, are you ready to take the leap and start generating a second income for yourself in as little as 1 week*?

Click here to join the Options Profit Planner today

*Results presented are not typical and may vary from person to person. Please see our Testimonials Disclaimer here: https://ragingbull.com/disclaimer

0 Comments